Bitcoin’s Big Move? Or Just a Red Herring? 🚨

Bitcoin’s Coinbase Premium turned negative after a 62-day buying streak. Talk about a mood swing! 😱

Bitcoin’s Coinbase Premium turned negative after a 62-day buying streak. Talk about a mood swing! 😱

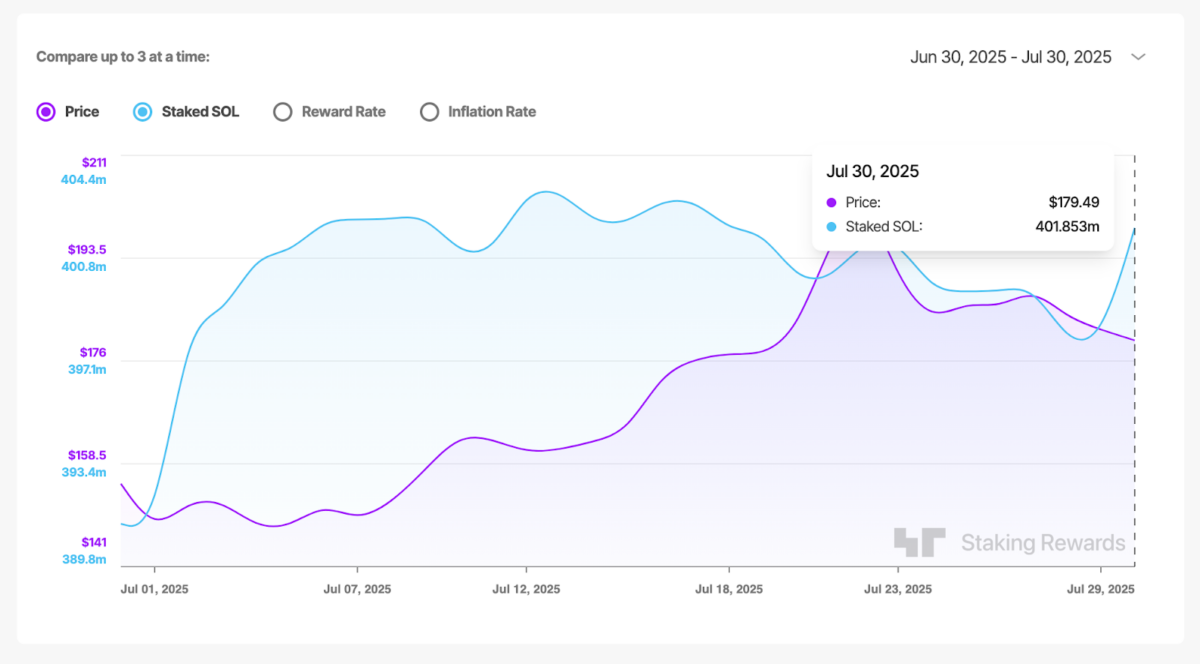

Now, while the broader cryptocurrency bazaar displayed all the enthusiasm of a damp sock, our beloved Solana managed to hold its head above water, buoyed by the delightful streams of institutional investment and the blossoming optimism surrounding regulatory clarity—very encouraging indeed!

The magnitude of the transaction, akin to a sudden downpour in a drought-stricken land, left many traders scrambling to find shelter. While Galaxy Digital maintained a composed facade, the market was a different story, with prices fluctuating wildly as participants tried to gauge the impact. It was as if the entire financial ecosystem had been turned into a grand stage, with Bitcoin playing the lead role in a drama of epic proportions.

Dogecoin (DOGE) tanked to $0.2200. That’s its lowest since July 18, which is… well, not exactly a highlight reel. But don’t worry, the experts have THREE (not two, not four—THREE) reasons why it might bounce back:

On the daily chart, XRP sways in a modest waltz—a confined range, as it were—not falling below its treasured support zones. The analysts, those charming clairvoyants of the financial opera, see this as a promising sign that the buyers are still playing the brave defenders of the fortress. As long as it stays above $2.65 (a rather decent safety blanket), there’s a flutter of hope that it might sprout wings and soar upward again.

MEXC, with its AI-led surveillance—a digital Cerberus guarding the gates of integrity—and region-specific strategies, hath boasted of its prowess. “Risk control is not punishment; it’s protection,” proclaimed Tracy Jin, the COO, with a gravitas that would make Raskolnikov blush. Yet, the irony drips like molasses: South Asia, once the epicenter of deceit, saw a 41% decline, only to have fraud attempts rise by 11% elsewhere. Indonesia and Vietnam, those twin sirens of Southeast Asia, lured 73% and 16% of cases, respectively. The CIS region, meanwhile, surged by 83%, a slow burn compared to its previous inferno. 🔥🤡

BlackRock’s just been handed the keys to the kingdom—or at least, the SEC thinks so. As that chap Çağrı Yaşar chirped on X, this isn’t some trivial nod; it’s like the SEC tossing institutions a juicy bone, straight into the heart of ETH’s engine room. But staking isn’t about chasing price bubbles, oh no. It’s about locking arms with the network, playing validator and earning yield, all while pretending to be oh-so-helpful. Ha! With this approval, Wall Street can now cozy up to ETH not just as a speculative toy, but as a proper income stream from the protocol’s guts. If staking becomes as common as morning coffee in ETF land, investing in ETH might mean you’re not just holding digital gold, but actively oiling the machine. Sneaky, isn’t it? The SEC’s basically stamped ETH’s consensus model with a big, shiny “Approved for Fun and Profit,” dragging traditional finance into the crypto fold without so much as a by-your-leave. And remember, empires don’t crumble with fanfare; they tiptoe in through the back door, courtesy of some overlooked regulatory tweak. 😏

This range, however, is no ordinary boundary; it’s more like a cosmic threshold. A decisive breakout above $125,000 could launch Bitcoin toward the fabled $141K milestone—a level whispered about with the reverence usually reserved for ancient prophecies or overly ambitious New Year’s resolutions.

According to CoinMarketCap (because who doesn’t love a good data dump?), SHIB’s trading at $0.00001298. That’s a 4.82% dip in 24 hours. Ouch. 😬 And get this—it’s been on a steady decline this past week, losing up to 15%. But Marks? He’s sticking to his guns, saying it’ll hit $0.000081. Because why not? It’s not like the crypto market is predictable or anything. 🙄

//bitcoinist.com/wp-content/uploads/2025/07/Screenshot-2025-07-30-172615.jpg?w=640&resize=700%2C428″/>