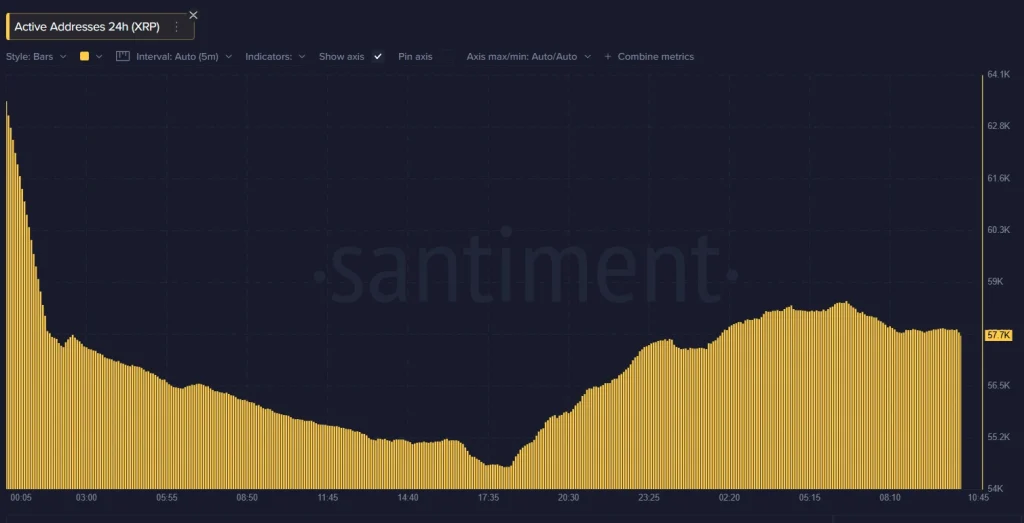

Discover How $130M Was Tokenized with a Dash of Brazilian Agribusiness Charm!

It is with no small degree of astonishment that I present to you the remarkable news that the XRP Ledger, a veritable marvel of modern innovation, has audaciously engaged in the tokenization of no less than $130 million worth of Credit Rights Agreements (CRA). These, as you may well know, are absolutely pivotal financial instruments within the vast and bounteous realms of Brazil’s agricultural sector. 🌾🍇