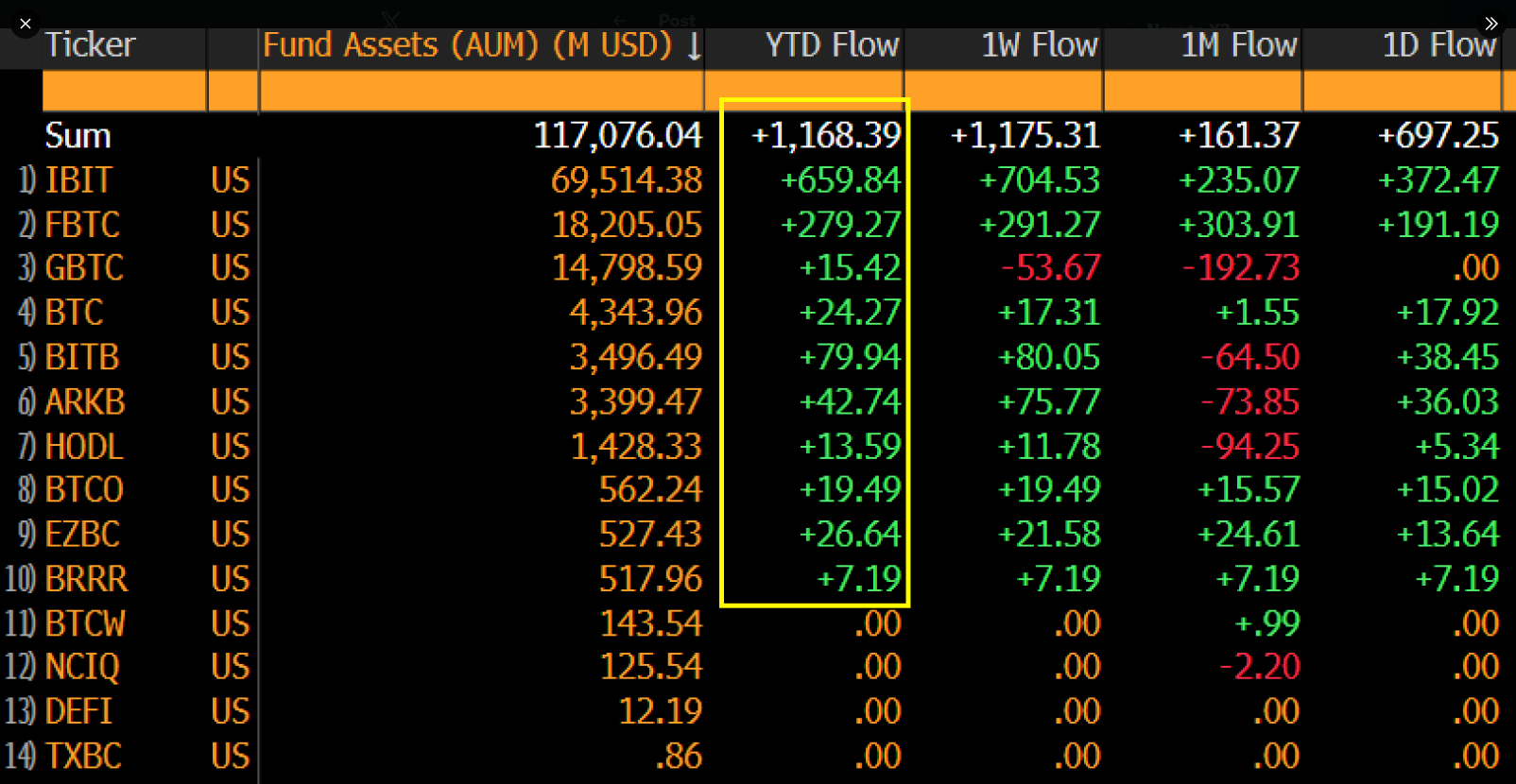

ETFs Go Full Lion in 2026: $1.2B Inflows & Bitcoin’s Wild Ride 🐅💸

Bloomberg’s Eric Balchunas, that wizard of ETFs, dropped the numbers like a hot mic: $1.2 billion in two days. If this keeps up, he reckons we’re looking at $150 billion annually. “That’s 600% more than 2025,” he said, “which, if you’re keeping track, is like going from a toddler’s allowance to a kleptocrat’s bank balance.”