Why 2025 Made Crypto Trading a Comedy of Errors 😂

What unfolded across centralized and decentralized derivatives venues was not a single black swan event, but a slow-motion structural unwind.

What unfolded across centralized and decentralized derivatives venues was not a single black swan event, but a slow-motion structural unwind.

Iran’s Ministry of Defense, now rebranded as “Mindex: Where Dreams of Profit Meet Missiles,” has boldly stated they’ll accept crypto, barter, or even Iranian rials (if you can find any). Their inventory? Emad missiles, Shahed drones, Soleimani-class warships… and let’s not forget the air defense systems that could probably shoot down a pigeon if it sneezes too loudly. 🕊️💣 “Sanctions? Pfft. We’ve got contingency plans involving pigeons and Morse code,” they reassure.

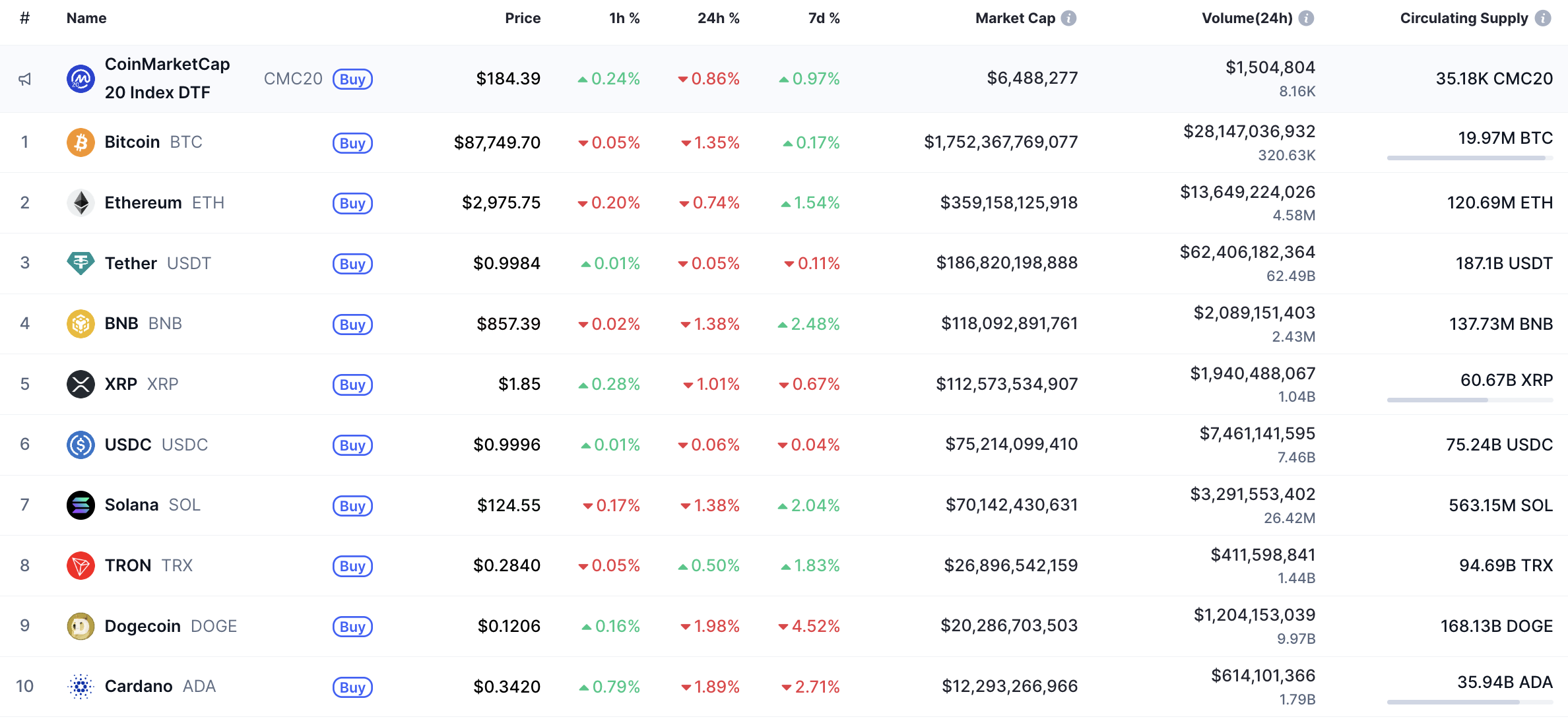

Darling XRP, you’ve lost your luster by dipping a measly 1% over the past 24 hours. It’s like watching a toddler climb down from the refrigerator with stoic determination-boring, but undeniably happening. 🧒

Somewhere, in the shadows of Binance, which is perhaps just a fancy digital tavern for the world’s money, whispers spread that all was not well-an attack, a breach, a hacking plot-so dramatic it’s the sort of thing a Russian novel could be built upon. But fear not, dear reader! Binance, in its wisdom, assured everyone that no sinister malware had invaded their systems, just the usual chaos of a slightly mad digital marketplace. Ah, the joys of randomness and bad ideas, intertwined like lovers in an epic saga of greed and folly.

Investors, once jubilant, now pace like caffeinated hamsters, gnashing their teeth over whispers of secret sales. Transparency? More like a game of hide-and-seek with a blindfolded toddler! 🤡

The money sits there, gathering dust and existential dread, while Berkshire sells stocks like a nervous widow auctioning her late husband’s cufflinks. The markets whisper: “Are they preparing for disaster, or just terribly indecisive?” And somewhere, a crypto enthusiast mutters, “Surely they’ll buy Bitcoin now… right?” 🥴

BREAKING: #BITCOIN JUST RECORDED ITS 1st RED CANDLE AFTER A HALVING IN HISTORY

4-YEAR CYCLE BROKEN. BUCKLE UP 🚀

“Each ultimate beneficial owner will be eligible to receive one of the new digital tokens per whole share,” crooned the company in a Wednesday announcement, likely composed by a robot that had once dreamt of writing poetry. 📄🤖

Essential revelations:

The numbers, cold and unfeeling as a Bolshevik bureaucrat’s stare, do not lie: SUI processed more DEX volume than a televangelist processes prayers during tax season. In just one day, it ranked among the most active Layer 1 chains-rubbing digital shoulders with the big dogs, the OGs, the ones who still believe in “decentralization” between sips of artisanal kefir.