Shiba Inu’s Grand Ball: 167 Billion Tokens Exit, But Who’s Dancing? 💃🐕

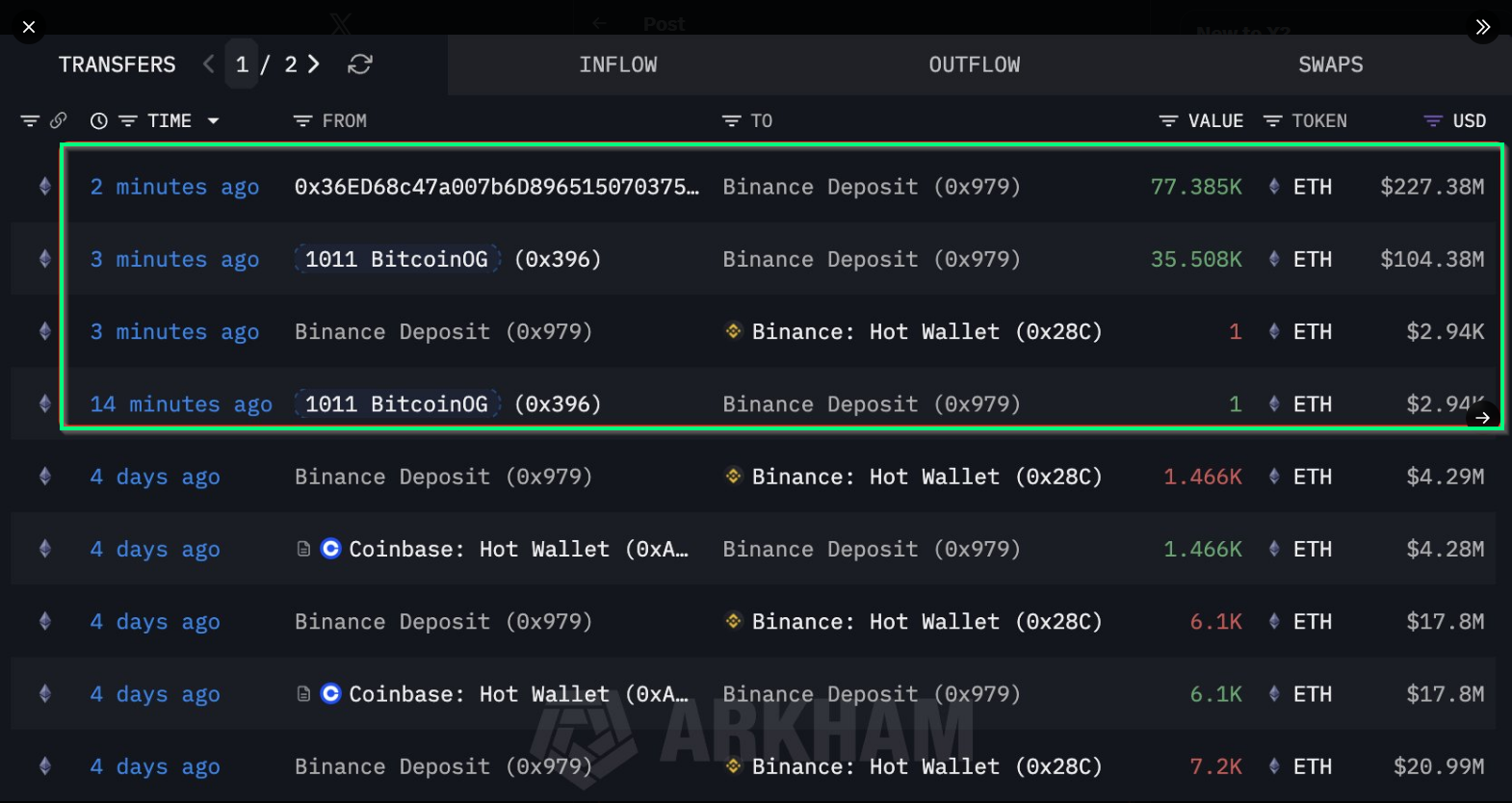

Though the Shiba Inu has experienced a mild deceleration in its price, one cannot help but observe that it is merely gathering itself for a grand gesture in the near term. The exchange movements, as revealed by the ever-watchful CryptoQuant, suggest a rising demand among investors, who seem quite determined to secure their place in this peculiar dance. 🕺