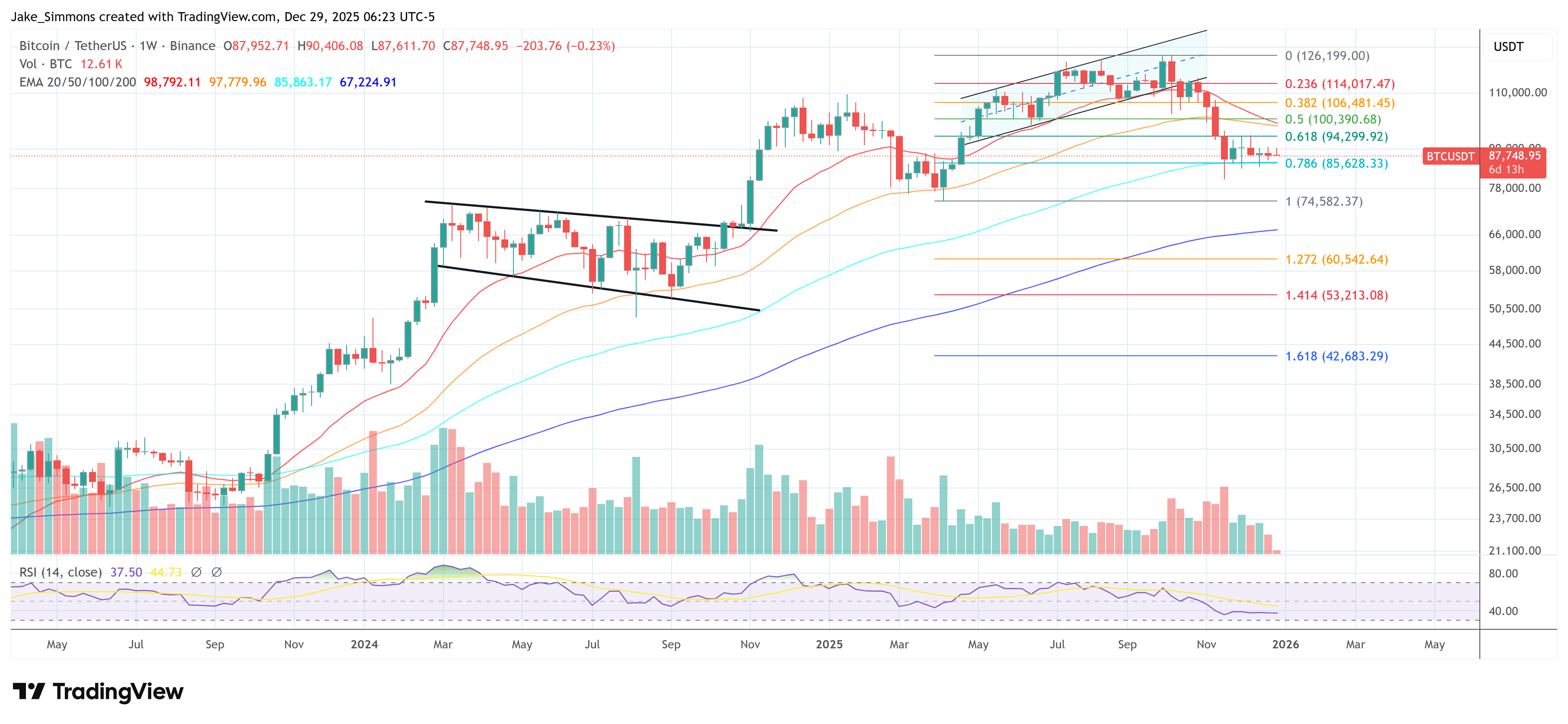

Bitcoin’s $90k Wall: Will It Collapse to $80k? 💸

//media.crypto.news/2025/12/610-2.webp”/>

//media.crypto.news/2025/12/610-2.webp”/>

Now, this means Ripple can’t go about unlocking XRP willy-nilly, like a chap raiding the biscuit tin mid-afternoon. The whole shebang is designed to keep the circulation as tidy as a well-pressed trouser, avoiding those pesky price dips caused by an overabundance of assets. Claver assures us there’s “no emergency releases possible,” even if the demand for XRP spikes like a fever in flu season. No soup for you, market floods! 🌊🚫

Armstrong, with a voice that could make a mime speak, announced on X, “Bitcoin is good for USD.” Naturally, he argued that this cryptocurrency, often mistaken for a rogue shiny object, actually fosters a virtuous competition-sort of like a high-stakes fitness contest-helping Uncle Sam keep inflation and deficits in check. Because nothing says “stability” like a currency that can disappear faster than your last diet resolution. 🍔🙃

Meanwhile, across the vast wilds of the crypto jungle, Bitcoin (BTC) decided to throw a tantrum, briefly peaking over the $90,000 cliff-perhaps trying to outdo the crown prince of coins. It’s up 3% in 24 hours, showing that even in chaos, there’s some order-sort of like a dog chasing its tail. Ethereum (ETH), Ripple (XRP), and Solana (SOL) are all happily trading in the green, humming a tune of speculative harmony, because why not? It’s all fun and games until someone loses a digital wallet.

The late-year mood? A soft Q4 tape, which is to say, a gentle nudge from the market’s collective elbow. Thorn noted BTC dipped 36% below its October 6, 2025 high of $125,296, even as bullish headlines rained down like confetti at a party no one invited. 🎉

Voilà! The entire continent can now get their hands on the U.S. Dollar faster, cheaper, and easier than a monkey steals bananas. RLUSD allows businesses and individuals to clasp onto digital dollars as securely as a burrito on a spinning plate. Once you’ve wrapped your assets in this shiny tokenization, African users won’t just get a peek – they have front-row seats to the U.S. market assets. So, brace yourself for simplified payments, slashed costs, and a buffet of cross-border trade opportunities. Delicious!

This daring move, akin to a magician pulling a rabbit from a hat, seeks to elevate the digital yuan above its more flamboyant rivals-Alipay and WeChat Pay-who have dominated the landscape like two overzealous directors vying for the lead role.

How’s that for a rogue wave? As we peer suspiciously at the dramatics involving Bitcoin [BTC] and other frightened coins jostling in the crypto tumult, isn’t it delightful to fancy an ounce of optimism?

What does this artful handoff from exit to entry mean for ETH’s price? We seek guidance from the oracle-like analysts who, as one might expect, are neck-deep in charts and jottings, each with a magnifying glass to their eyes, trying to decipher the tea leaves and crypto leaves alike.

Crypto markets are basically a bunch of squirrels on espresso right now – darting from one shiny token launch to another. Bitcoin? Oh, it’s just sitting there, being all stable and boring. Meanwhile, altcoins are having their moment, like that one guy at a party who won’t stop talking about his “revolutionary” startup. 🙄