Is Bitcoin in a Bear Market? You Won’t Believe What the Numbers Say! 🐻💰

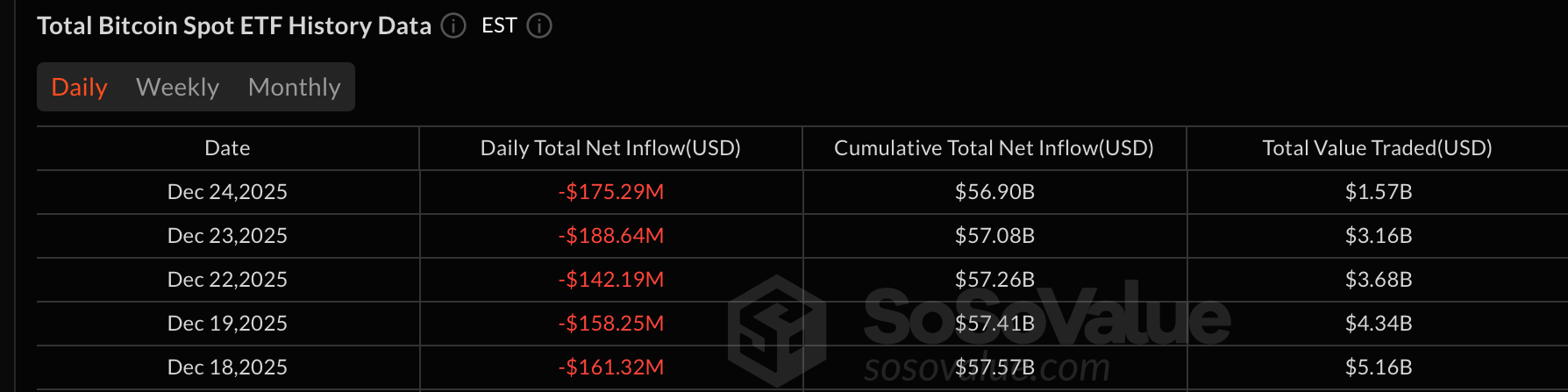

Now, you might think that price alone could spark a debate over whether we’re in bear territory or simply taking a leisurely stroll through a market correction. But fear not! Our friends over at CryptoQuant have crunched some numbers that make it all clearer than my neighbor’s Christmas lights-completely overwhelming and a little tacky.