AI Prophets Pick 2026’s Meme Coin King 🐸💥: Spoiler Alert!

meme coins thrive on chaos.

meme coins thrive on chaos.

San Francisco-based The Clearing Company is a startup led by Toni Gemayel, who’s basically the Elon Musk of “I once sold lemonade as a kid.” Terms undisclosed? Of course-they’re too busy counting zeros to tell us what the deal is worth. 💸

The stage is set, and the spotlight falls upon the infamous $0.21 mark. This level, oh how it doth torment thee, Pi Coin! Like a stubborn fool in a comedy, thou canst neither escape nor embrace it fully. Whether thou shalt break free from this shackle or remain ensnared shall determine thy next grand act. 🎭⚖️

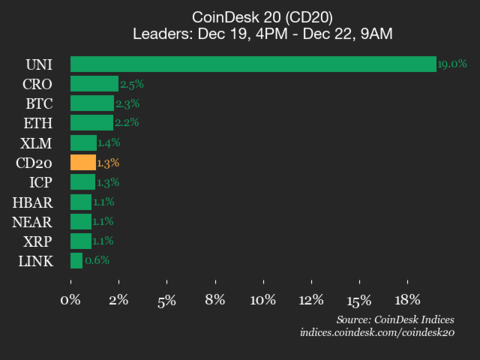

Ah, the daily spectacle of the CoinDesk Indices, where fortunes are made and lost faster than you can say “cryptocurrency.” Today’s performance report is brought to you by the letter “C” for Chaos!

Lo! The Defi Development Corporation, that oracle of decentralized fortunes, proclaims: SOL’s coffers swell with $1.4 billion, while ETH’s hollow echo dwindles to $522 million. A “regime shift,” they cry! As if revenue alone could birth a new world order. 🌍💸

Crypto exchange-traded products (ETPs) bled $952 million, with Ether (ETH) losing $555 million and Bitcoin (BTC) shedding $460 million. That’s more red ink than a schoolmarm’s grading pen! 📉 According to some highfalutin CoinShares report, the culprit is the Clarity Act, or as I like to call it, the “Maybe Next Year” Act, which has folks fretting over “regulatory uncertainty” and “whale selling.” 🐳💨

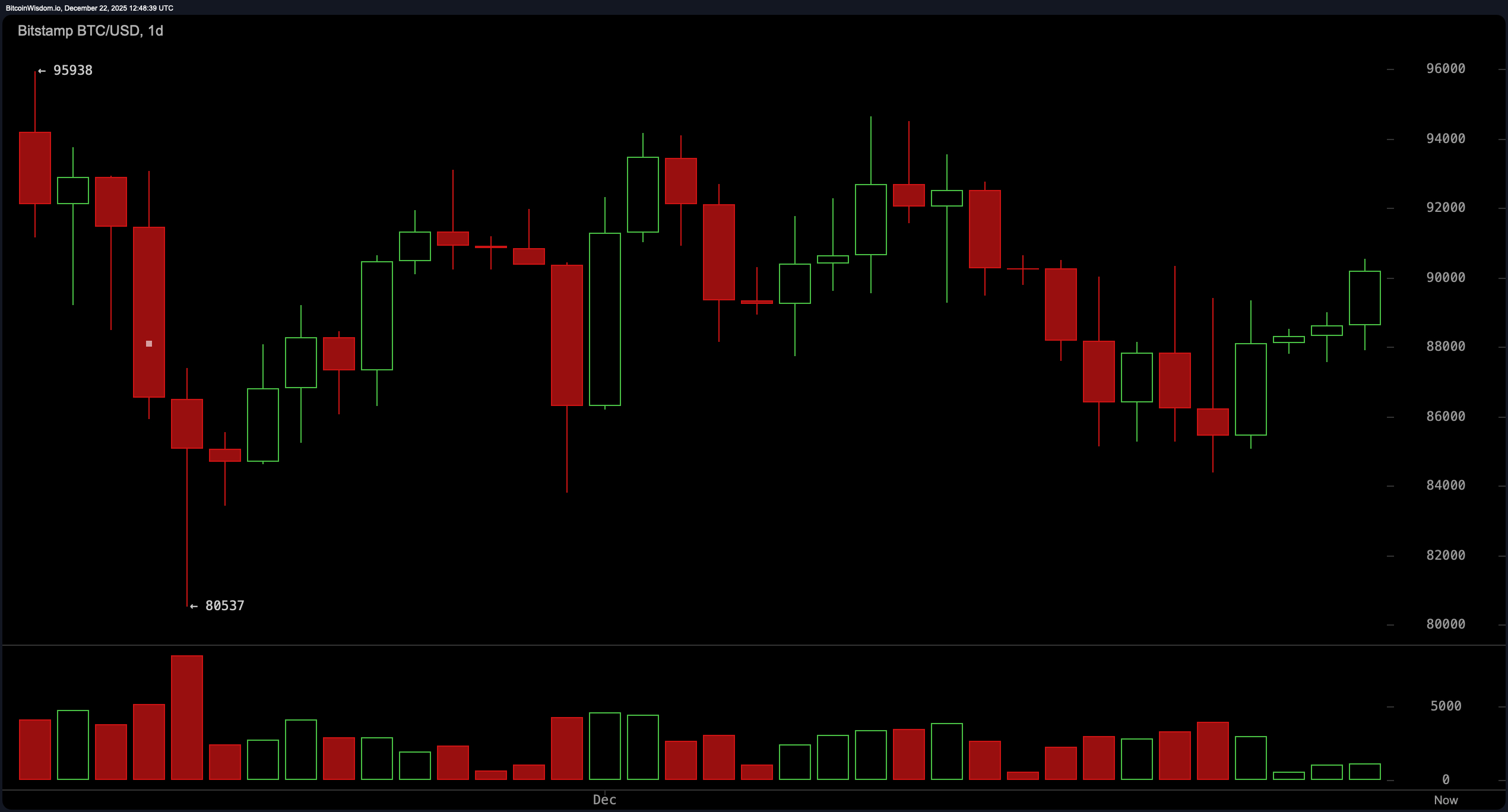

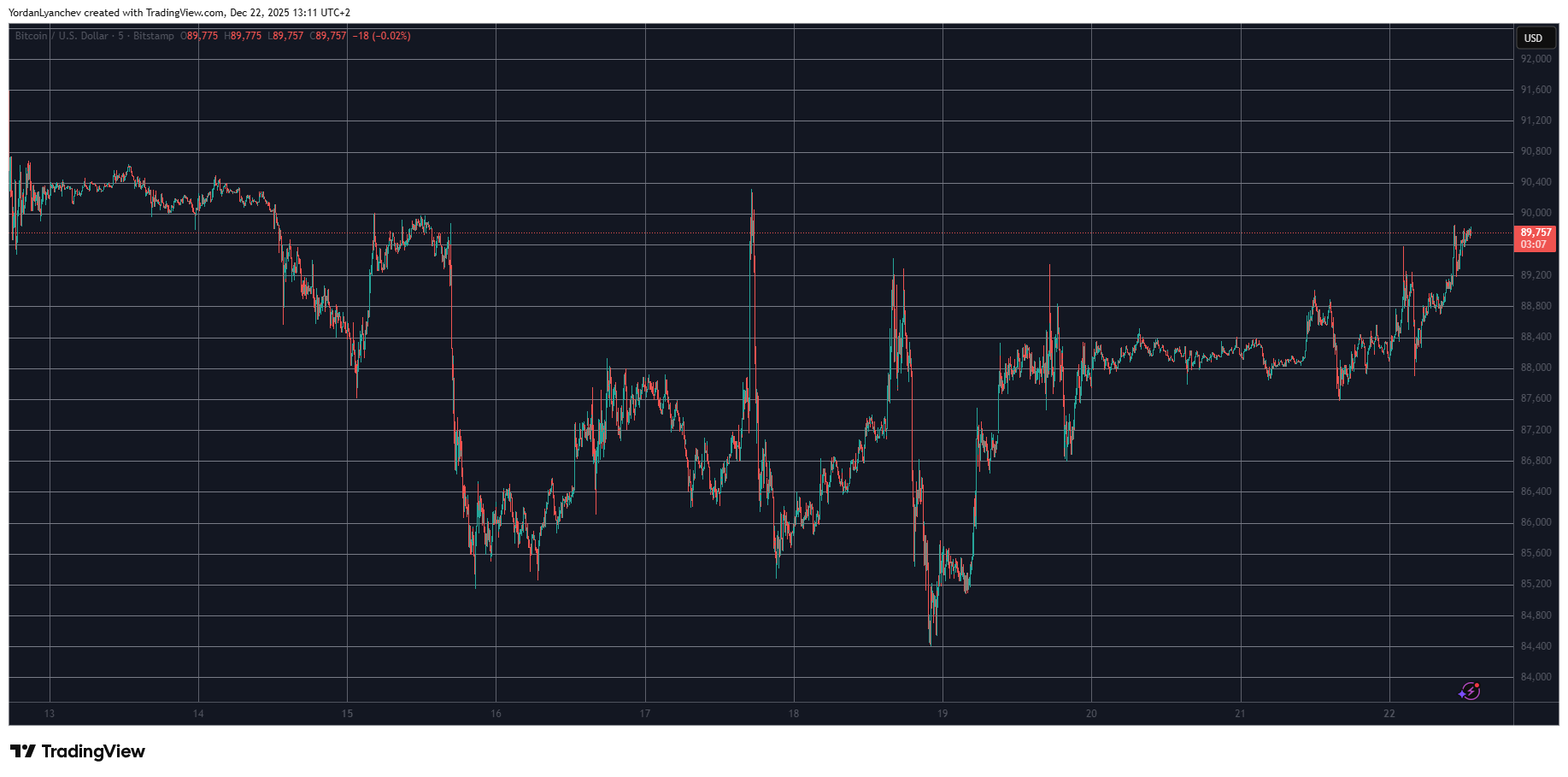

The daily chart paints a picture of calculated optimism. After shaking off a nosedive to the $80,537 low, bitcoin is now consolidating in a comeback arc. A succession of green candlesticks with upper wicks reflects buyers showing up-but with just enough hesitation to keep the $91,000 resistance intact. 🧠📈

But let us not overlook the role of HTX (formerly known as Huobi), which has graciously welcomed Kaspa to its platform. Such listings can often be the fairy godmother that transforms pumpkins into carriages, or in this case, steady altcoins into soaring investments. 🥳

The Virtual Asset Service Providers (VASP) Bill, 2025-what a mouthful! 😣-is here to save the day. Or, you know, at least make sure nobody’s getting scammed while they’re trading their digital fortunes. 🕵️♂️ The exchanges are now under the watchful eye of the law. Big Brother’s watching, folks! 👀

Meanwhile, Ethereum, ever the stubborn fellow, sneered at the doubters and stormed back over the $3,000 line, making everyone wonder if it’s achieved some secret magic trick. BNB, that steady old champ, kept its chin above $860, looking as proud as a cat with a newly discovered fish. 🐟