TIA, the token that’s been as predictable as my morning coffee, managed to stage a 14% rally today. It’s like finding a $20 bill in an old pair of jeans—exciting, but you can’t help but wonder if it’s a fluke.

According to crypto.news, Celestia (TIA) hit an intraday high of $1.68 on July 7, settling at $1.65 by the time I finished my second cup of coffee. With a market cap of $1.15 billion, it’s like a small country with a big dream.

This rally comes right after TIA broke out of a descending channel pattern, which is crypto-speak for “it was going down, and now it’s not.” A descending channel, characterized by lower highs and lower lows, is usually a sign that the bears are in control. But today, the bulls decided to throw a surprise party, and TIA’s price shot up like a kid on a sugar high.

The technical analysts are calling this a trend reversal, which is their way of saying, “Hey, maybe this thing isn’t dead yet.” This technical confirmation likely contributed to increased buying activity, and the token’s sharp intraday appreciation. It’s like when you finally get that promotion you’ve been waiting for, but you’re not sure if it’s real or just a dream.

Adding to the excitement is the upcoming Lotus upgrade, the fourth major version of the Celestia protocol. This upgrade is supposed to reduce token inflation, introduce revised staking mechanics, and enhance network interoperability. It’s like a software update that promises to fix all your problems, but you know deep down it’s probably just going to create new ones.

These developments are widely viewed as positive catalysts for long-term network utility and user growth. As of now, the Lotus upgrade is live on Celestia’s Mocha testnet, with deployment to Mainnet Beta expected in the coming weeks. It’s like a beta version of a video game—exciting, but you’re not sure if it’s going to crash the moment you start playing.

Bearish Overhang Persists Despite Today’s Rally

But let’s not get too excited. On-chain data for Celestia presents a more cautious picture. According to DeFiLlama, the total value locked in Celestia’s DeFi protocols has declined by over 95%, falling from a peak of $64.28 million in March 2024 to just $2.31 million at present. It’s like a party where everyone left early, and you’re left wondering if it was even worth it.

Similarly, daily chain fees, often a proxy for user engagement, have dropped from $3,400 in March to a current average of around $200, reflecting reduced on-chain activity. It’s like a gym membership you never use—sure, you’re still paying for it, but you’re not getting much out of it.

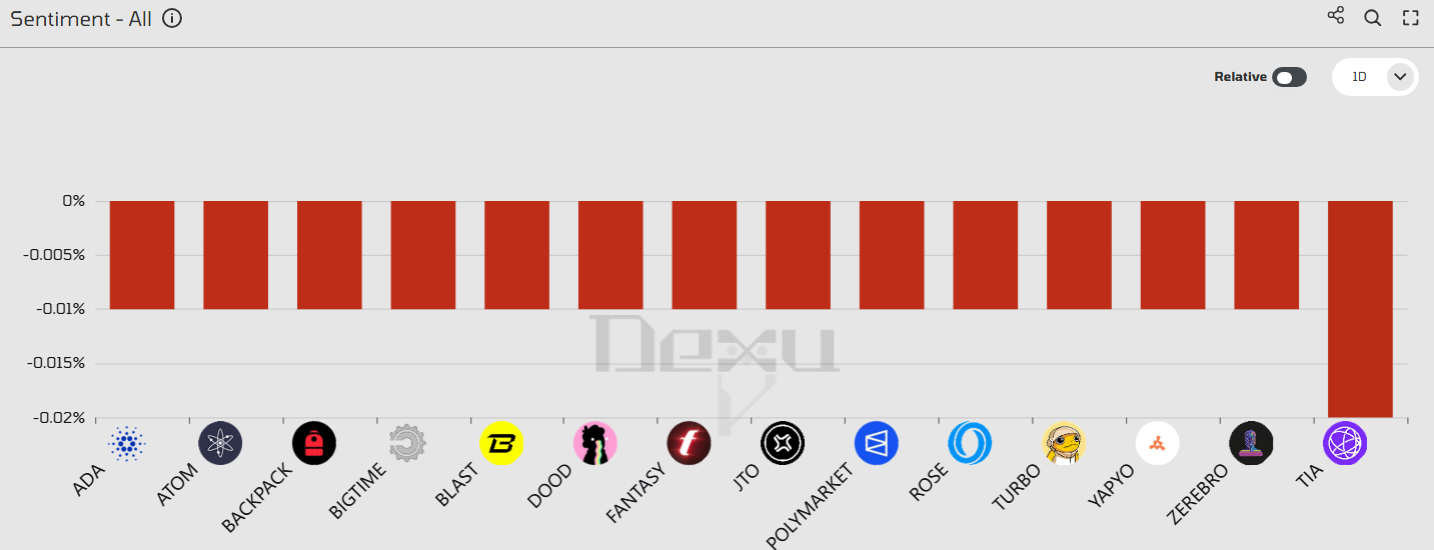

Sentiment indicators also remain subdued. According to data from social analytics platform Dexu AI, TIA ranks among the lowest in social sentiment across major crypto assets, suggesting a lack of positive engagement from the broader retail community. It’s like being the only one at a party who’s not having fun.

This contrast with the price rally raises questions about the sustainability of the current uptrend in the absence of stronger fundamental or community-driven support. It’s like a relationship that’s only surviving on the excitement of a new haircut.

Investor concerns are further exacerbated by continued sell pressure from early backers. Notably, Polychain Capital, one of Celestia’s earliest institutional investors, has reportedly sold over $242 million worth of TIA tokens since the project’s TGE. While the firm still holds around 44.7 million TIA, valued at approximately $63.9 million, any further liquidation from this wallet could negatively impact the price through increased circulating supply. It’s like when your best friend decides to move away, and you’re left wondering if the party is over.

Despite today’s rebound, TIA remains down approximately 92% from its all-time high, meaning the vast majority of holders are currently underwater. Such a dynamic raises the risk of profit-taking pressure should the token continue to recover. Many investors may opt to exit positions near breakeven, further limiting upside momentum in the short term. It’s like trying to sell a lemon at a fruit stand—nobody wants it, but you’re desperate to get rid of it.

TIA Price Analysis

On the 1-day USDT chart, the MACD line has crossed above the signal line, signaling an initial recovery in trend momentum. However, for a full bullish confirmation, both the MACD and the signal line would need to rise above the zero axis, indicating a transition from negative to positive momentum on a broader scale. It’s like when you finally get a date, but you’re not sure if it’s going to lead to anything serious.

Meanwhile, the Relative Strength Index currently stands at 49, hovering just below the neutral 50 mark. The reading suggests that while bearish pressure has weakened, buyers have yet to assert full control. A decisive move above 50 would strengthen the case for a continued bullish reversal. It’s like being on the edge of a cliff, not sure if you’re going to jump or step back.

Given these mixed momentum signals, the short-term outlook hinges on whether the current bullish sentiment among investors remains sustained. If so, a daily close above $1.68, which marks today’s intraday high, could act as a technical trigger for further upside. The next key resistance levels to monitor include the June 5 swing low at $1.93, followed by the psychological round number of $2.00. It’s like setting your sights on a distant mountain, hoping you have the stamina to reach it.

Conversely, if buying momentum weakens and price fails to hold above immediate support, a pullback toward the $1.31 level remains a plausible scenario. This would place TIA back within its recent consolidation range, delaying any meaningful trend reversal and keeping the token in a broader sideways structure. It’s like being stuck in a rut, not sure if you’ll ever get out.

Read More

- Gold Rate Forecast

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Ark Invest Splurges $21.2M on Bullish Shares and $16.2M on Robinhood – Crypto, Anyone?

- Solana’s $200 Gambit: Will This Blockchain Darling Finally Deliver? 🚀

2025-07-07 13:22