What to know:

- Franklin Templeton CEO Jenny Johnson called bitcoin a “fear currency” and said it’s a distraction from blockchain’s real potential.

- Johnson believes the best crypto investments lie in infrastructure — including blockchain “rails,” consumer apps and node validators.

- She expects mutual funds and ETFs to eventually run on blockchains but says regulatory risk is slowing that transition.

In this article

BTCBTC$113,519.49◢2.46%

BTCBTC$113,519.49◢2.46%Bitcoin

aside, the best investment in crypto is its “picks and shovels,” according to the CEO of $1.6 trillion asset manager Franklin Templeton.

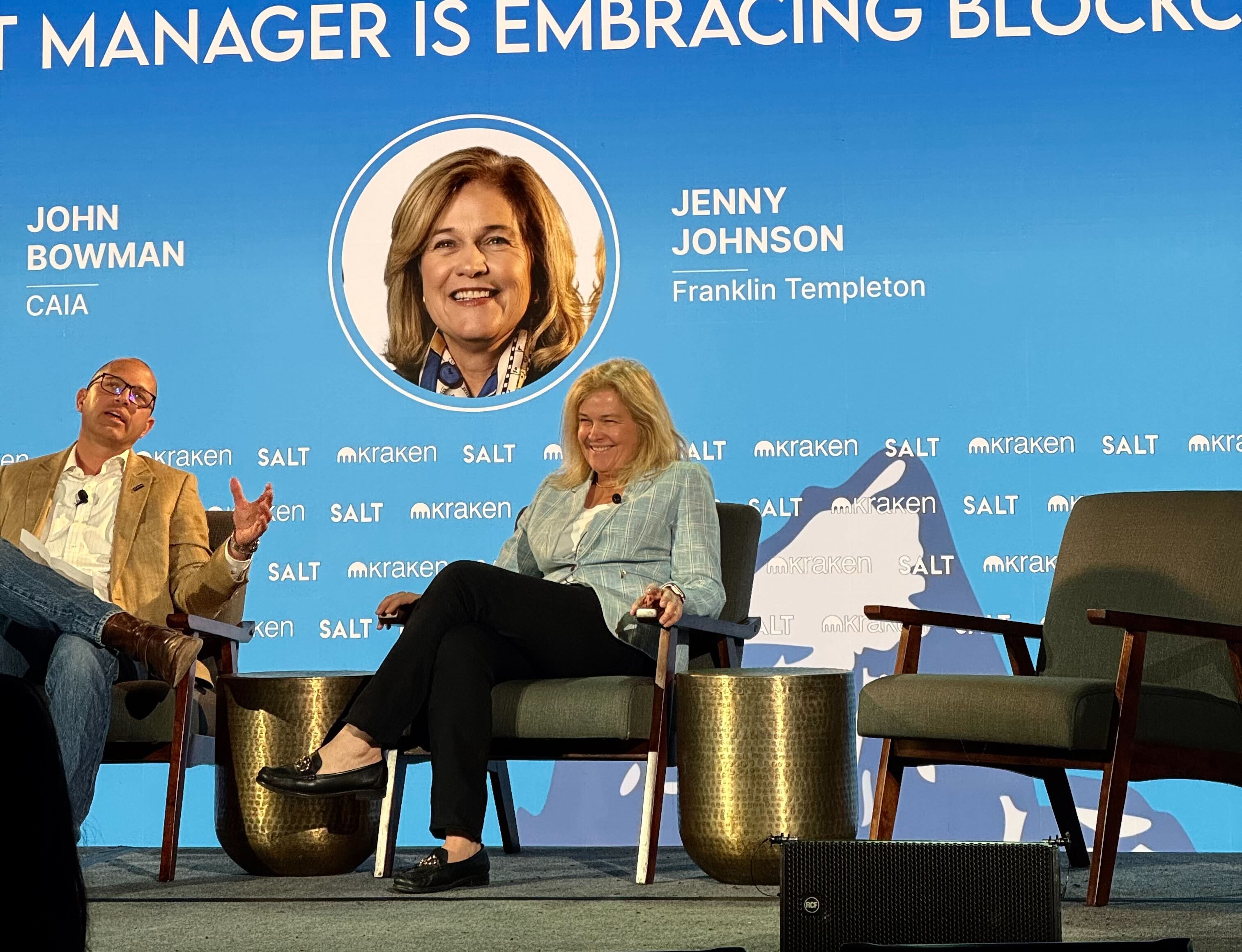

At the SALT conference in Jackson Hole, Wyoming on Tuesday, Jenny Johnson, a third-generation manager, voiced her views and emphasized her convictions about the most impactful applications of blockchain technology and where investments should be made, according to her perspective.

From her perspective, Bitcoin serves as a “safe haven currency” – a financial sanctuary for individuals residing in nations with government-imposed restrictions on funds or deteriorating national currencies. However, she regards it more as a diversion than a viable solution, despite its attractiveness under such circumstances.

In her opinion, Bitcoin serves as a significant diversion from the immense upheaval that’s on its way to the financial services sector.

She indicated that the root cause of disruptions isn’t found within the digital assets themselves, but rather in the supporting systems. This is where she advises investment should be directed.

Johnson stated that fundamental components, similar to picks and shovels, form the foundation of robust, multi-layered applications. She further expressed her preference for blockchain networks as a starting point. Additionally, she mentioned an upcoming wave of consumer-friendly apps that she finds particularly thrilling.

Additionally, she finds potential in the function of validators, those responsible for upholding blockchain network integrity. For active investment managers, they might provide an additional level of transparency, serving as a significant “disruptor” or game-changer.

Think about it, if you could view all the financial movements coming into and leaving a publicly traded company, the amount of insightful data that would be available to you,” she explained.

After assuming control of the asset management business that had been in her family since 2020, Johnson steered it towards digital assets. Under her guidance, numerous cryptocurrency exchange-traded products were launched, and the introduction of the OnChain U.S. Government Market Fund – a tokenized investment tool – was also made.

She anticipates that investments such as mutual funds and exchange-traded funds (ETFs) might transition to blockchain technology in the future, potentially improving their efficiency and reducing costs significantly. However, at present, regulatory hurdles seem to be the primary barrier preventing this change, according to her statement.

In my studies, I’ve noticed a certain apprehension stemming from the high probability of digital assets potentially failing. This level of risk seems beyond what current regulators are equipped to handle effectively at the moment.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Silver Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- USD HKD PREDICTION

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-19 23:35