Markets: A Comedy of Errors and Tiny Bites

Ah, the things we chase:

- Pentoshi, that clever pseudonymous oracle, has purchased a modest sliver of HYPE, below the cursed threshold of $34-roughly one-fifth of his brave goal.

- He’s not interested in the fireworks – no sir. Instead, he’ll wait patiently near $30-$28, avoiding the temptation to jump on every bounce like a cat after a laser pointer.

- With the market tumbling-because what else is new-and the unstaking supply hanging like an uninvited guest, he’s playing it small and leaving his bids lower than his ego.

Pentoshi, the stock market’s equivalent of a tea leaf reader, announced on a crisp October day that he had “nibbled” at HYPE – yes, tiny, cautious bites, not feasts. Think of it as dipping a toe in the icy pool, just enough to shiver but not to drown. The spot purchase was plain: he bought the actual token, free from the chains of leverage, because who loves a good liquidation? His grand plan involves adding more only if prices drift down to a sadder, lonelier place near $28 and below $30, spreading his buys like breadcrumbs for starving birds, instead of throwing all his bread into one basket.

He points out-oh, what a sage-that this setup exists within a “broader downtrend,” which sounds more like a bad soap opera than investment advice. Lower highs, he calls it, each bounce weaker than the last, a classic “dance of the doomed.” When he mentions “broken market structure,” he’s referring to the support zones that have been battered into submission and order books so thin they’re practically transparent-volatility’s way of saying “look at me!” The takeaway, dear reader: sip cautiously, don’t try to catch the elusive bottom, and remember, dips often oversell their welcome.

Now, about that unstaking supply-imagine a crowd of tokens standing in line, waiting for their turn to be sold. If many decide to exit stage left, short-term pressure will mount. Our analyst doesn’t know how many tokens will make a run for the exit, so he’s waiting patiently, leaving bids below the current price-like a polite host, letting the market come to him, instead of chasing it into the abyss.

He confesses that a recent ether trade-a misstep, perhaps-cost him some dignity, even if the bounce was nice. Updates include smaller positions, predefined bids, and a near-micromanagement blackout-because sometimes, the best move is to do less, not more.

Hyperliquid, the decentralized wild west of perpetual futures, is where HYPE lives. Think of it as a speakeasy for derivatives, where tokens hold the key to voting, rewards, and maybe even winning at poker-if only they played. HYPE, the token in question, is like a share of the entire crazy carnival, linking user activity and fee revenues in a tangled web of dreams and dashed hopes.

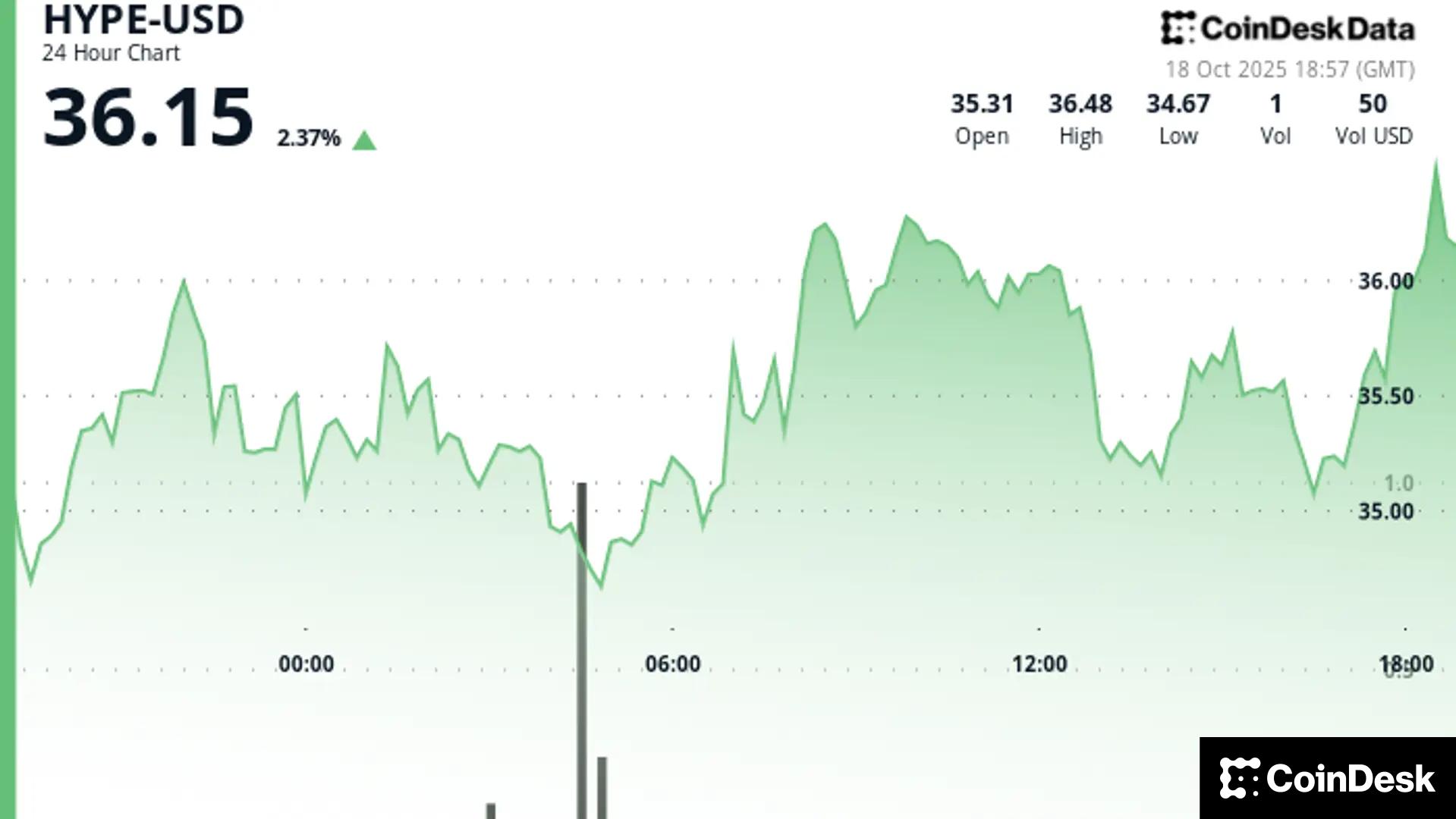

As the day ends, CoinDesk reports HYPE at around $36.32, up a modest 2.1% over the last 24 hours-proof that even in chaos, some things are resilient, or maybe just stubborn.

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Cardano’s Rollercoaster Ride: From $1 to $1.54 (And Possibly Back Again)

- Solana’s $200 Gambit: Will This Blockchain Darling Finally Deliver? 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

2025-10-18 22:15