Oh, the drama! Bitcoin ETFs exited stage left with a $105 million outflow, while Ether ETFs twirled into the spotlight with $49 million in fresh cash. Solana? The quiet wallflower with a secret admirer. XRP? Still waiting for its cue.

A Tale of Two Cryptos: High Drama in ETF Land

Tuesday’s crypto ETF session was less “blockchain revolution” and more “awkward family reunion.” Bitcoin ETFs, darling, were positively melodramatic about their losses, while Ether ETFs sipped champagne in the corner, quietly accumulating admirers.

Spot Bitcoin ETFs hemorrhaged $104.87 million-a veritable yard sale of panic. Blackrock’s IBIT led the fire sale with a $119.68 million exodus, joined by Bitwise’s BITB ($10.29M), Grayscale’s GBTC ($8.45M), and ARK’s ARKB ($8.31M). Truly, a parade of despair.

Yet hope flickered! Grayscale’s Bitcoin Mini Trust scooped up $35.97 million like a bargain hunter at Harrods, while Fidelity’s FBTC added $5.89 million. Alas, these crumbs couldn’t save the soufflé. Total trading volume? A respectable $3.05B. Total assets? $85.52B. Still, the vibe was “trying too hard.”

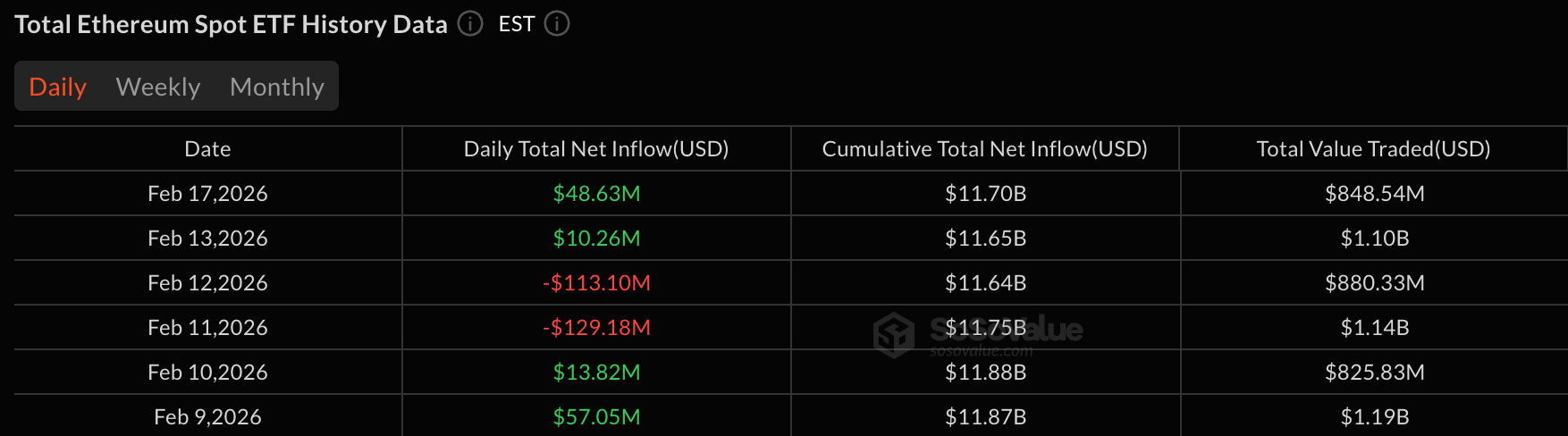

Meanwhile, Ether ETFs lounged on a velvet chaise, collecting $48.63 million in inflows. Blackrock’s ETHA ($22.89M), Fidelity’s FETH ($14.41M), and Grayscale’s Ether Mini Trust ($11.32M) played the role of doting suitors. Trading volume: $848.60M. Assets: $11.47B. Classy, darling.

Solana ETFs? The wallflower with a secret admirer. $2.19 million in inflows (thanks, Bitwise and Fidelity!) and $24.22M trading volume. XRP ETFs? Crickets. Not a penny moved. Still, darling, we adore your commitment to the bit.

Bitcoin ETFs had a “hot mess” moment, Ether ETFs sipped martinis, and Solana played hard to get. XRP? Practicing mindfulness. The market? A theater of the absurd. Curtain call: Investors still dancing in the aisles.

FAQ 📊

- Why did Bitcoin ETFs hemorrhage $105M?

Because Blackrock’s IBIT hosted a fire sale, and everyone else joined in like sheep in a stampede. Panic, darling, is contagious. - Which Ether ETFs stole the show?

Blackrock’s ETHA, Fidelity’s FETH, and Grayscale’s Ether Mini Trust. They’re the new It Girls of crypto. - Did Solana and XRP ETFs matter?

Solana ETFs whispered “I’m here!” with $2.19M. XRP ETFs? Still waiting for their close-up. (Cue sad trombone.) - What’s the bottom line?

Bitcoin ETFs: $3.05B traded, $85.52B assets. Ether ETFs: $848.60M traded, $11.47B assets. Solana ETFs: $24.22M traded, $726.23M assets. XRP ETFs: awkward silence.

Read More

- Brent Oil Forecast

- PUMP Pumped or Plundered? Traders Beware the Bull! 🤦♂️

- Gold Rate Forecast

- Tina Fey’s Take: Crypto Prices Dive Before Powell’s Big Speech 📈💰

- Silver Rate Forecast

- Crypto Chaos Calms Down, Congress Prepares for “Crypto Week” – Get Ready for Some Serious Coin Talk! 💸📈

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- XRP’s Precarious Price Ballet: Will It Waltz Past $2.5 or Trip Below $2?

- Crypto Chaos: Monero Got Mugged & Bitcoin’s Mooning 🚀🤡

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

2026-02-18 21:48