It’s official: the crypto market has finally gone utterly, completely, and totally bonkers 🤪. Bitcoin‘s recent rally to a new all-time high above $117,000 has triggered a market-wide resurgence in trading activity, lifting altcoins and sending traders scrambling to jump on the bandwagon 🚂.

One of the biggest beneficiaries of this bullish wave is Ethena’s native token ENA, which has surged a whopping 25% in the past 24 hours 🚀. This makes it the top gainer in the market today, because who doesn’t love a good underdog story? 🐕

ENA Leads the Charge as Spot Demand and Derivatives Activity Go Through the Roof

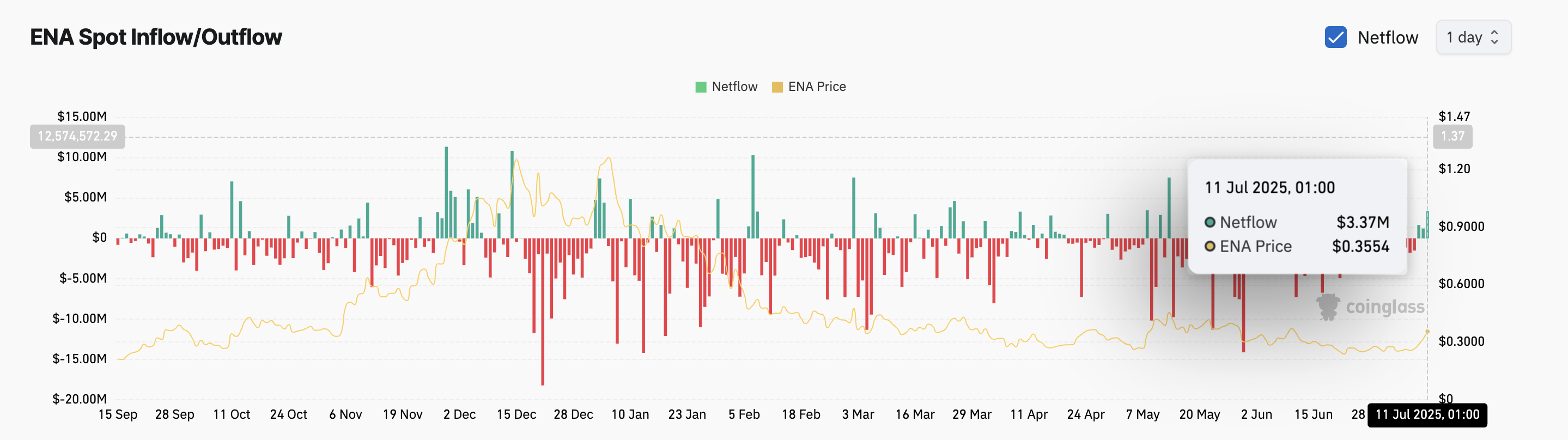

Now trading at its highest level in 30 days, ENA’s rally comes with a significant spike in investor interest 📈. Spot inflows into the altcoin have surged to a two-month high, signaling a rapid increase in demand from traders looking to ride the bullish momentum of the past 24 hours 🎢.

According to data from Coinglass, net inflows into ENA spot markets sit at $3.37 million on Friday, marking the token’s highest single-day inflow since May 12 📊. This reflects a sharp uptick in investor demand and growing confidence in ENA’s short-term prospects 🤔.

Spot inflows signal investor confidence and often confirm the positive shift in market sentiment toward an asset 📈. When net inflow climbs, there is an increase in the purchase of that asset in the spot market, where transactions are settled immediately 💸. This indicates a rise in demand for the asset, as buyers are willing to acquire it at the current market price 📊.

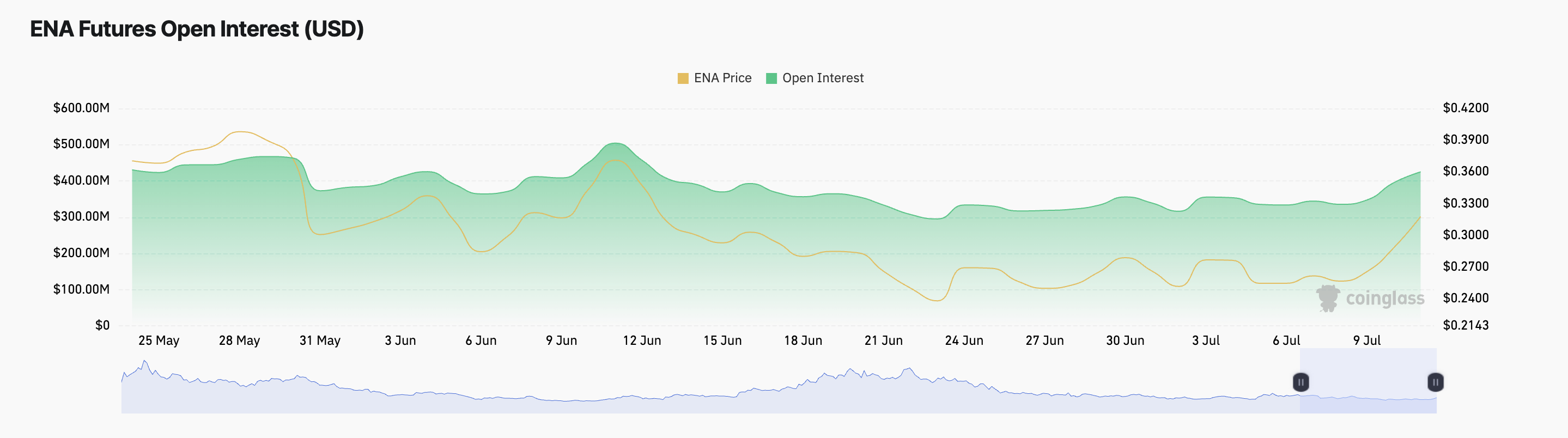

Moreover, ENA’s futures open interest surged 8% over the past 24 hours 📈. It is $425 million at press time — its highest level since June 16 📆.

An asset’s futures open interest measures the total value of its outstanding futures contracts that have yet to be settled 📝. When it increases, new money is entering the market 💸.

This confirms the growing conviction in ENA’s upward movement, especially as traders position themselves to benefit from further price appreciation 📈. It’s like a big game of musical chairs, except instead of chairs, it’s money 💸.

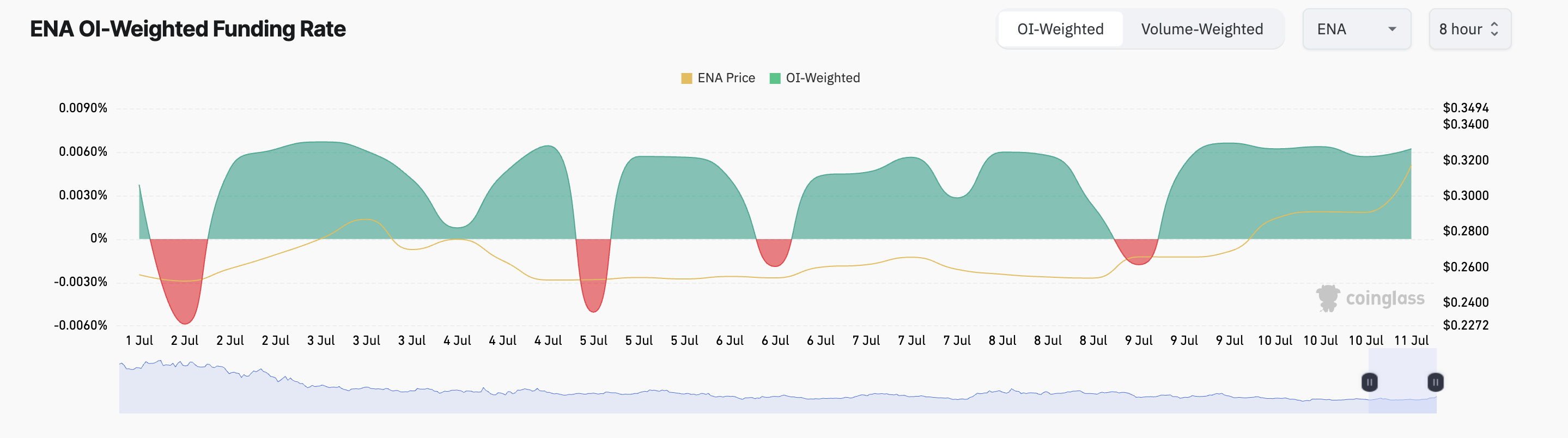

It is reflected in ENA’s funding rate, which stands at 0.0062% at the time of writing 📊. Funding rate is a mechanism used in perpetual futures contracts to keep their prices aligned with the underlying spot market 📈.

ENA’s positive funding rate indicates that long-position holders are paying short-sellers a premium, suggesting a bullish sentiment among futures market participants 🤔. It highlights traders’ willingness to maintain leveraged long positions in anticipation of further price gains 📈.

With Bulls in Control, ENA Could Break Through to Multi-Week Highs

Readings from the ENA/USD one-day chart show the altcoin trading significantly above its 20-day exponential moving average (EMA) 📈. At press time, this key moving average forms dynamic support below ENA’s price at $0.28 📊.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices 📆. When price trades above the 20-day EMA, it signals short-term bullish momentum and suggests buyers are in control 🚀.

If this continues, ENA could extend its gains and rally toward $0.37 📈. A successful breach of this resistance level could drive the altcoin to $0.41 🚀.

However, if profit-taking strengthens, this bullish outlook will be invalidated 🚫. If selling pressure increases, ENA could witness a pullback and attempt to break below the support formed at $0.32 📊.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-07-11 15:21