Crypto ETFs are basically the new gold, but with more “I’m not a financial advisor” disclaimers. 🎯💸

Wall Street is basically doing a TikTok dance to the crypto beat 🕺💸, and everyone’s watching. Nate Geraci, who probably has more ETFs than a stockbroker’s resume, dropped some stats so spicy even a Bitcoin whale would blush. 🐟🔥

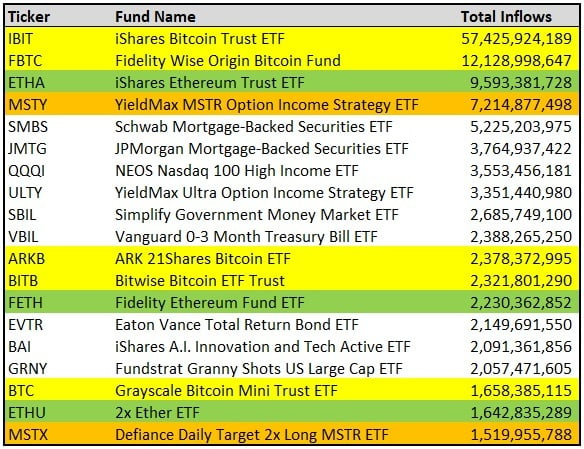

1,300+ ETFs have launched since beginning of last yr… 10 of top 20 are crypto-related (incl top 4 overall). 🤯

Five of them are spot BTC ETFs, two are spot ETH ETFs, two are MSTR ETFs, and one is a leveraged ETH ETF. It’s like a crypto-themed “Game of Thrones” but with more spreadsheets and fewer dragons. 🐉📊

Traditional stuff like mortgage ETFs? They’re basically the backup dancers in this crypto concert. MSTY is fourth with $7.21 billion-because nothing says “financial stability” like a company that’s basically a Bitcoin ATM. 💸

Other high-ranking digital asset offerings included the ARK 21Shares Bitcoin ETF (ARKB) at $2.38 billion, Bitwise Bitcoin ETF Trust (BITB) with $2.32 billion, and Fidelity Ethereum Fund ETF (FETH) at $2.23 billion. It’s like the crypto version of a “I’m not obsessed, I just own 100% of this” vibe. 🧠

Market observers say these figures underscore growing institutional and retail demand for crypto exposure via regulated investment vehicles. Which is just a fancy way of saying, “We’re all just trying to get rich quick, but with more paperwork.” 📄📈

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Brent Oil Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- Silver Rate Forecast

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

2025-08-12 04:57