If you were hoping for a peaceful July in the world of economics, congratulations! You got the exact opposite. The U.S. Producer Price Index (PPI) decided to break records by leaping 0.9% month-on-month, which is only about 350% higher than people optimistically predicted, and 3.3% year-on-year, which is frankly just showing off.

June’s rise was the financial equivalent of a polite cough-zero monthly increase and 2.4% on the year. July, conversely, was that cough from an opera singer – loud, dramatic, and impossible to ignore, reminding everyone that inflation at the wholesale level is like trying to keep damp socks dry: it just doesn’t work.

Core PPI, for those who feel food and energy are unnecessary luxuries, shot up 0.9% too. So, unless you live on a diet of pure nostalgia and sunlight, this probably affects you.

This is “unprecedented”:

Core CPI inflation has cheerfully clambered back above +3%, and PPI inflation’s hotter than the sunburn you got in March 2022.

Meanwhile, President Trump wants to cut rates by 300 basis points, presumably because he thinks numbers work backwards, and also might replace Powell with a golden retriever dressed as Alan Greenspan.

Is anyone ready for whatever comes next?

(a thread)

🦄 – The Kobeissi Letter (@KobeissiLetter) August 14, 2025

This heroic economic plot twist instantly made everyone believe the Fed was going to keep rates sky-high for eternity-at least until someone finds the lost city of Atlantis or invents inflation-free lasagna. Pre-announcement, everyone was dreaming of a September rate cut (imagine the parties!), but now it’s only a 96% chance, according to the magical CME FedWatch tool that presumably runs on hope and old tea leaves.

Cryptocurrencies, ever the drama queens, didn’t wait for the encore: Bitcoin tumbled from $124,000 to below $119,000 in mere minutes, Ethereum shed 4% to $4,550, and Solana and XRP performed their own bungee jump. Someone, somewhere, is probably blaming this on astrology, too.

If anyone still believed crypto was a rebellious teenager ignoring its parents’ macroeconomic indicator lectures, reality set in: the markets moved faster than a caffeinated squirrel upon hearing about higher inflation, especially since borrowing costs and liquidity now apparently decide how much you’ll pay for digital monkey pictures.

Labor data joined the fun (spoiler: it didn’t help). Jobless claims were 224,000, just a bit below forecast-barely enough for the Bureau of Labor Statistics to high-five themselves. Ongoing claims hit 1.95 million, meaning the “stellar labor market” now resembles a slightly battered soufflé.

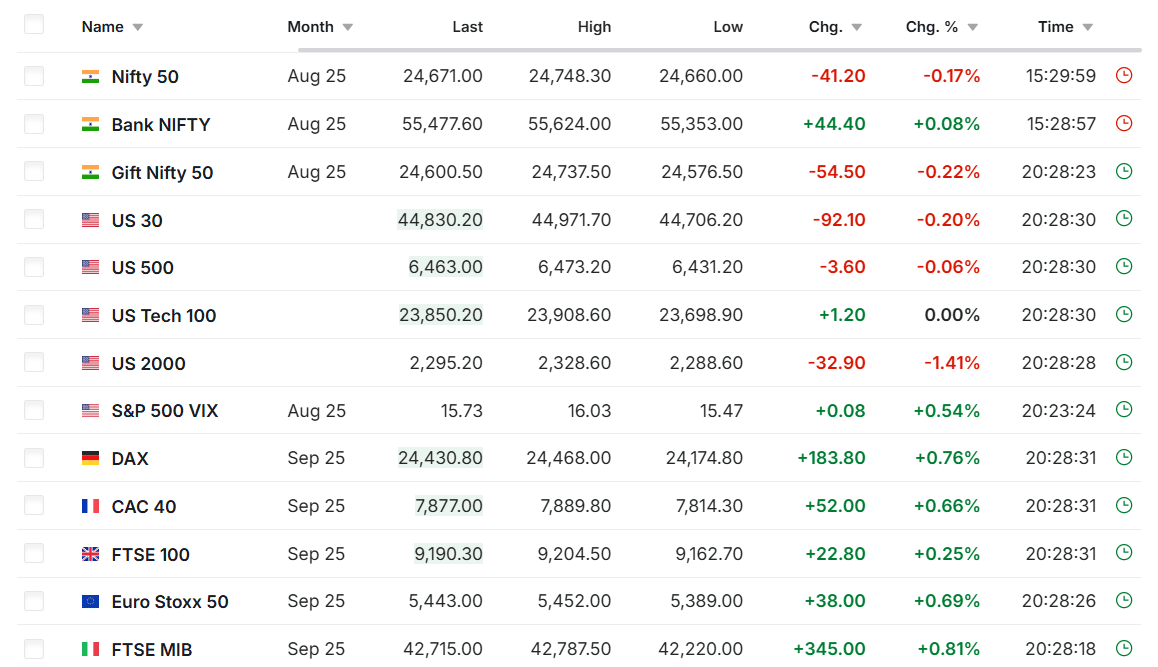

Equity index futures tripped over their own shoelaces and fell 0.5%. The dollar puffed its chest and appreciated. The 10-year Treasury yield edged up by five basis points to 4.25%, which is basically the financial world’s way of looking serious and moving their pens around a lot.

In conclusion, the PPI surge is an inconvenient reminder, like an alarm clock in a holiday resort, that inflation pressures are delightfully sticky and Fed policy decisions are now being made using a combination of advanced economic models, tarot cards, and possibly a hamster running on a wheel. 🚀🔮

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- EUR KRW PREDICTION

- EUR ARS PREDICTION

- Shocking Crypto Caper: Nano Labs Goes Wild with $50M BNB Bonanza! 🚀💰

- Russia’s Crypto Crackdown: When Miners Go Rogue 🤑⚡

- China’s Crypto Dream: Stablecoins, Yuan & a Bit of Chaos-Will They Make It or Just Flop? 🚀💰

- Deep Dive into Ethereum: Greed, Squeeze, and the Never-Ending Chase for All-Time Highs

2025-08-14 20:06