In the dusty corners of the market, whispers of change flutter like moths to a flame. The traders, those hopeful souls, are now betting their last dimes on the Federal Reserve cutting rates three times before the frost of January settles in. The air is thick with anticipation, and the scent of crypto liquidity dances on the breeze, as eyes turn toward Bitcoin and the elusive altseason.

Markets, like restless cattle, are shifting their weight, preparing for a new pasture. The traders, with their calculators and dreams, now expect the Fed to loosen its grip, cutting rates thrice before the New Year bells chime. This expectation has already seeped into the very fabric of futures, prediction markets, and the collective psyche of crypto enthusiasts. 🤑

Lower borrowing costs, they say, often lead to a flood of liquidity into riskier assets. And this time, the spotlight shines brightly on crypto. With capital poised to rotate like a well-oiled machine, Bitcoin and its colorful altcoin companions may be gearing up for their next grand performance.

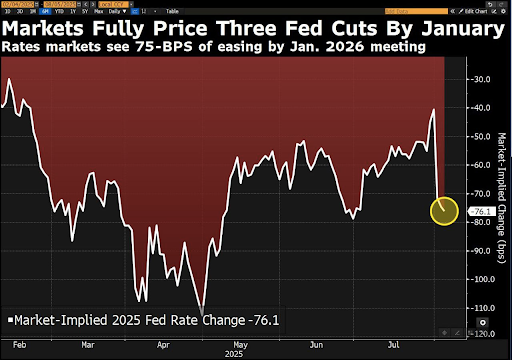

Three Cuts in Sight as Fed Pivot Locks In

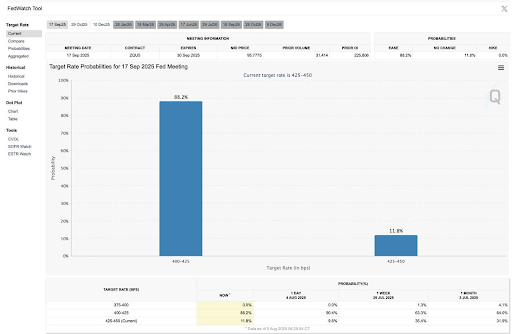

The CME FedWatch Tool, that oracle of financial fate, now shows a staggering 94% chance of a rate cut in September. Meanwhile, the gamblers over at Polymarket are placing their bets at 85%. Both retail and institutional players seem convinced that the easing cycle is about to kick off next month, like a long-awaited train pulling into the station.

Wise Advice, that sage of the markets, has reported that traders have fully priced in cuts for September, October, and December. This path, if followed, would drop the Fed funds rate by a whopping 100 basis points in just seven months. Goldman Sachs, ever the echo chamber of financial wisdom, has chimed in with the possibility of an even steeper 50-basis-point cut if unemployment decides to rear its ugly head.

Liquidity and Crypto’s Risk-On Play

Lower rates, like a siren’s call, tend to lure money out of the safety of cash and into the wild embrace of higher-risk assets. 🏦

Cryptoinsightuk, that ever-watchful eye, has shared that reports indicate this shift has historically favored crypto first. Liquidity tends to flow from the big guns like Bitcoin and Ethereum before trickling down to the smaller, scrappier altcoins. It’s like watching a parade where the headliners take the stage before the opening acts get their moment in the spotlight.

Interesting

– Cryptoinsightuk (@Cryptoinsightuk)

Alva, with a knowing nod, pointed out that past cycles have seen a two-phase rally. First, Bitcoin and Ethereum rise like the sun after a long night, as traders reposition themselves. Then, the capital flows into DeFi, layer-2 networks, and those niche narratives that tickle the fancy, like AI and real-world assets. 🌍

Altseason May Follow the Fed’s Lead

The timeline for rate cuts now appears as clear as a mountain stream. September, October, and December meetings are shaping up to be the turning points, aligning perfectly with the crypto market’s insatiable hunger for liquidity. This could very well set the stage for a new altseason, where dreams and dollars collide.

This rotation, however, is not carved in stone. Traders are positioning themselves like chess pieces, ready for the next move. Cheaper capital has historically fueled risk-taking, and crypto, that wild stallion, thrives in such conditions. With every anticipated cut, the case for a market-wide liquidity surge grows stronger, like a well-fed bear preparing for winter.

For now, all eyes remain glued to the Fed. The next decision may not just shift interest rates; it could very well determine how swiftly the next wave of crypto begins to crash upon the shores of fortune.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Silver Rate Forecast

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Brent Oil Forecast

- Tokenization: The New “Mutual Fund 3.0” You Didn’t Know You Needed

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

2025-08-06 07:55