Ah, the mighty Kraken and the ever-ambitious Robinhood! These titans of trade have once again graced us with their second-quarter financial theatrics for the year 2025.

Much to our amusement, Kraken boasted of robust year-over-year growth—an extravaganza!—yet, like a tumble of overly festive fireworks, experienced a quarterly decline. Meanwhile, Robinhood joined the party, strutting in with its own sob story of faltering performance compared to Q1 2025.

Kraken’s Q2 Performance: Earnings Dip Amid Market Turbulence

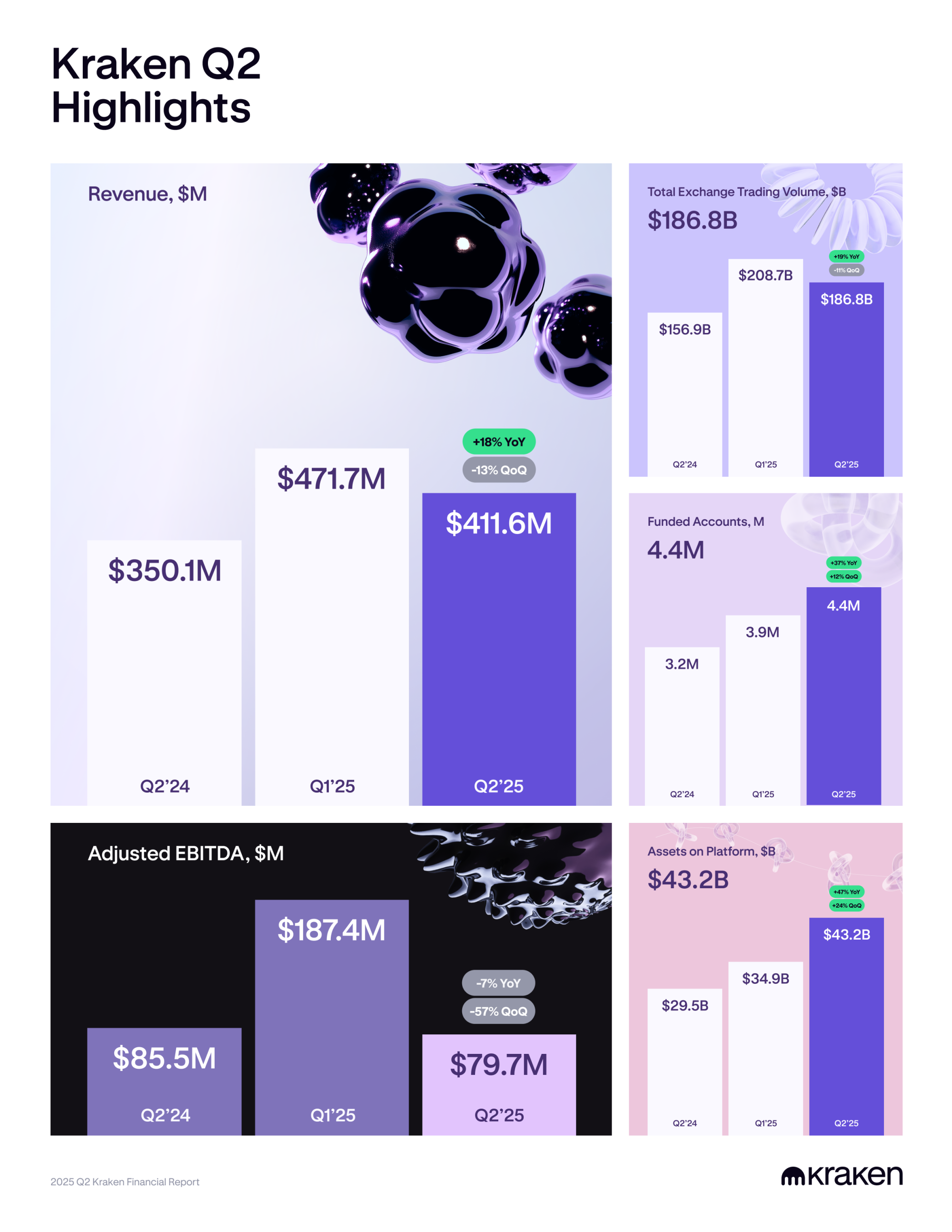

Ah, what drama unfolded when Kraken, the exalted cryptocurrency exchange, unveiled its Q2 2025 results on a surprisingly quiet July 30. They wowed us with a revenue of $411.6 million!

What a sight! An 18% uptick year-over-year—huzzah! But wait, there’s a catch: a 13% drop from Q1 2025. It’s like ordering a gourmet dinner only to find half your plate missing. Their total exchange volume reached a staggering $186.8 billion, up 19% from the previous year, though it still slipped by 11% since last quarter.

And if that wasn’t enough to tickle your fancy, the exchange’s Adjusted EBITDA—essentially its financial spirit—suffered a 7% fall YoY, landing at $79.7 million, and took a staggering 57% plunge from the previous quarter!

“After a robust Q1, we faced market turbulence, battered by U.S. tariffs and a delightful storm of economic uncertainties. As tradition holds, Q2 is somewhat of a languid sloth in the trading world,” the report lovingly stated.

Yet amidst this financial circus, Kraken still flexed a muscle or two. By the close of Q2, their assets inflated to a jaw-dropping $43.2 billion—a fantastic 47% growth YoY, along with a 24% rise from the previous quarter. Who knew inflation could be so profitable!

More astonishingly, the number of funded accounts swelled by 37% compared to the previous year, reaching a magnificent total of 4.4 million! And let’s not overlook their strategic waltz in the stablecoin market, boosting their stable-fiat spot volume share from a meager 43% to a splendid 68%!

“As we see the TradFi and crypto realms shaking hands more often, we’re throwing our dice on innovation and expanding our product range to fuel this wild growth. In Q2, we hastened our product delivery and platform improvements, alongside some marketing shenanigans that seemed to yield a fantastic ROI,” Kraken jubilantly added.

The report emerged amidst rumors swirling around Kraken’s potential public offering. BeInCrypto claimed the company is aiming to rake in $500 million at a whimsical $15 billion valuation, with a public debut peeking around early 2026!

Robinhood’s Q2: Crypto Revenue Jumps 98%

Now, let us not forget Robinhood, which elegantly pirouetted onto the scene, surpassing Wall Street’s expectations with a dazzling performance. The trading platform reported an astonishing 98% year-over-year bump in cryptocurrency revenue.

The numbers soared to a dizzying $160 million, up from a modest $81 million in Q2 2024. Yet, in a twist worthy of a soap opera, revenue dipped by 37% compared to Q1 2025. You can’t make this stuff up!

Robinhood’s crypto trading volume blossomed by 32% to hit $28.3 billion, although it too buckled under pressure, registering a 39% decline quarter over quarter. Additionally, net revenue climbed to a robust $989 million, showcasing a 45% yearly and a satisfying 7% quarterly increment. Net income more than doubled—up 105% YoY to $386 million. Quite the rollercoaster!

“Our Q2 was fueled by relentless product velocity, and may I boast, we launched tokenization—truly the pièce de résistance of innovation in our whimsical industry over the last decade!” exclaimed Vlad Tenev, Chairman and CEO of Robinhood.

Moreover, CFO Jason Warnick noted that Q3 is kicking off with a bang! Customers accelerated net deposits to a staggering $6 billion, demonstrating a delightful spurt in trading across various categories.

Thus, the hilariously unpredictable paths of Kraken and Robinhood continue, showcasing resilience with significant year-over-year growth despite amusing quarterly misadventures. Kraken’s focus on product innovation and market expansion, combined with Robinhood’s tokenization escapade, casts a humorous yet strategic light on their attempts to navigate this topsy-turvy market and drive future growth.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- EUR AED PREDICTION

- USD ILS PREDICTION

- EUR NZD PREDICTION

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

2025-07-31 10:22