The crypto markets, like a weary traveler, are beginning to stir, sensing the faintest breeze of change. Rising liquidity and the whispered promise of a Federal Reserve rate cut have kindled hopes of a digital-asset resurrection, as if the market itself is holding its breath for the next chapter.

Coinbase, That Ever-Watchful Sentinel, Raises a Flag of Hope

On the 5th of December, Coinbase Institutional, that stalwart of the digital realm, took to the digital forums to declare that the crypto sphere might be on the cusp of a revival. They pointed to the shimmering promise of improved liquidity, the tantalizing chance of a Fed rate cut, and the macroeconomic winds that might finally favor the digital asset crowd. 🕵️♂️

“It’s beginning to look a lot like a recovery,” they mused, their words as hopeful as a farmer’s prayer for rain. 🌧️

We think crypto could be poised for a December recovery as liquidity improves, Fed cut odds jump to 92% (as of Dec 4), and macro tailwinds build.

The crypto firm, ever the sage, elaborated on their vision, speaking of a positioning reset and the promise of a December reversal, as if the market were a horse about to break into a gallop. 🐎

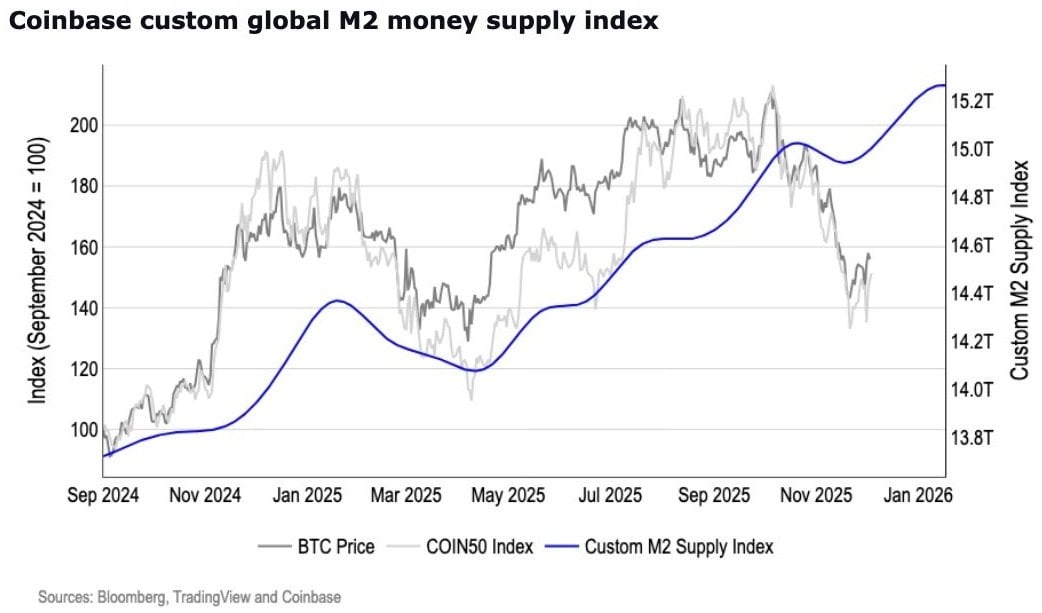

The institutional arm of Coinbase, ever the cartographer of the financial frontier, shared an image of their custom M2 index, a map of liquidity that hinted at a rising tide, even as the crypto prices danced like leaves in the wind. 🌬️

Analysts, those modern-day seers, have long tracked the ebb and flow of global M2, for in the dance of liquidity, the crypto markets find their rhythm. A macro environment leaning toward monetary easing could attract sidelined capital, particularly if volatility moderates. While inflation and growth uncertainty remain, crypto proponents argue that Bitcoin’s issuance structure and Ethereum’s evolving monetary profile may benefit from renewed liquidity expansion and a softer U.S. dollar. 💸

FAQ ⏰

- What did Coinbase Institutional signal about a crypto recovery?

It suggested the market might be entering a recovery phase, supported by improving liquidity and potential Fed rate cuts. (Or maybe they just saw a rabbit and thought it was a sign.) 🐇 - Why is global M2 important to Coinbase’s outlook?

Its custom M2 index tracks liquidity trends that often influence crypto market momentum. (Like a compass for the confused.) 🧭 - How could a Fed rate cut impact digital assets?

Monetary easing could boost liquidity and attract capital back into crypto markets. (If the Fed’s not busy playing hide-and-seek with rates.) 🕵️♂️ - Which assets might benefit from renewed liquidity?

Bitcoin and Ethereum are cited as potential beneficiaries of expanding liquidity and a softer U.S. dollar. (Or at least, they’re the ones with the most glitter.) ✨

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- EUR HKD PREDICTION

- ARB PREDICTION. ARB cryptocurrency

- Bitcoin’s Wild Ride: $135K by August? 🤑💸

- ETF Mania: Bitcoin And Ethereum Funds Hit Record $40 Billion Week

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

2025-12-07 05:58