Ah, the fickle dance of markets! Once upon a time, in the land of charts and candlesticks, the cryptocurrency realm, led by the indomitable Bitcoin 🤑, marched in lockstep with the solemn procession of the US stock market. Up went the stocks, up went the crypto; down went the stocks, down went the crypto. A harmonious, if not somewhat predictable, waltz. But lo! On the morn of September 2nd, as the United States emerged from its Labor Day slumber, the music changed, and the dancers diverged. 🕺💃

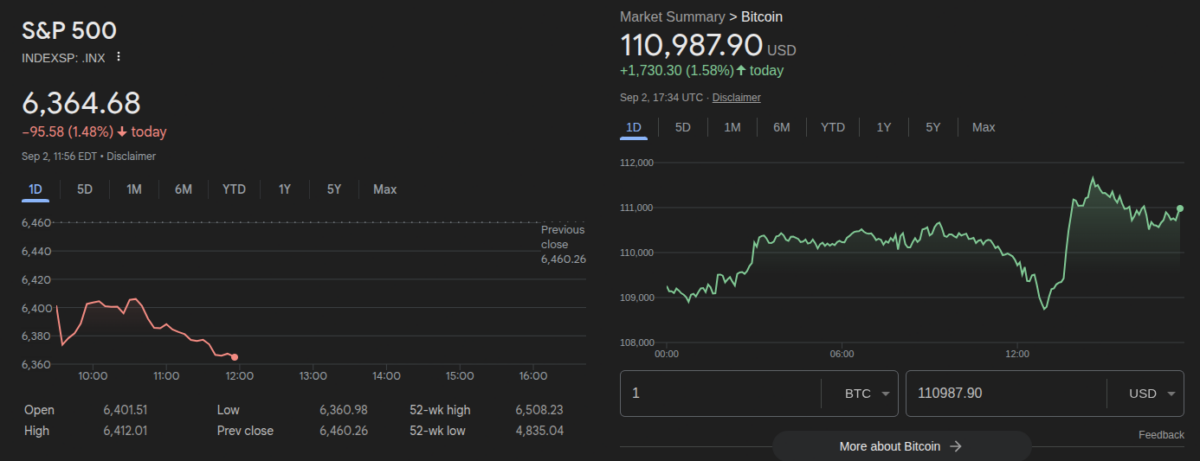

Behold, the S&P 500, that stalwart barometer of American financial health, stumbled out of the gates with a 1.48% plunge, landing at 6,364 points. Meanwhile, Bitcoin, ever the maverick, gleefully bounded forward with a 1.58% gain, reaching the lofty heights of $110,987 per coin. Such irony! As the stock market wept, crypto laughed. 😂

S&P 500 chart (left) and Bitcoin price chart (right) on September 2 | Source: Google Finance

But Bitcoin’s rebellion is not a solitary act. The altcoins, those lesser nobles of the crypto kingdom, have joined the fray, their gains as significant as they are unexpected. TradingView’s crypto total market cap index swells above $3.77 trillion, a 1.5% intraday ascent. Ah, the sweet scent of decoupling! 🌪️

Earlier, the sage Michael van de Poppe, with a wave of his analytical wand, attributed the delayed altseason to gold’s relentless rally, a battle of risk-on and risk-off positioning between the institutional titans and the retail minnows. Yet, the market, ever the trickster, whispers of an altseason’s dawn, even as gold scales new peaks. 🏔️

Among the omens, the Bitcoin Dominance Index (BTC.D) has shattered its multi-year uptrend, its capital slowly migrating to the altcoins. Institutional investors, too, play their part, with ETH ETF inflows and ancient Bitcoin whales trading their BTC for Ethereum. A shifting of the guard, perhaps? 🦈

The Altseason Index on Coinglass, that harbinger of crypto fortunes, has ascended to 61, its highest in eight months. “Altcoin strength is growing against Bitcoin,” proclaims Lucky, the crypto seer, on X. “With silent whale accumulation underway, the stage could be set for the next altcoin season.” 🌊

The Altseason Index has climbed to 61, this is the highest level in 8 months, altcoin strength is growing against Bitcoin really strong.

With silent whale accumulation underway, the stage could be set for the next altcoin season.

– Lucky (@LLuciano_BTC) September 2, 2025

Bitcoin’s Waltz Away from the S&P 500

Ah, the historical correlation between Bitcoin and the S&P 500, a tale as old as crypto itself. Together they rose, together they fell, their movements mirrored in the cross-asset chart from TradingView. Yet, like a restless lover, Bitcoin has occasionally broken free, first to soar to dizzying heights, then to crash back to earth, only to resume the dance. 🕊️

Two such moments stand out in the annals of crypto history: 2017, the second-largest bull market, followed by the first great altseason, with BTC.D plummeting from over 90% to below 40%; and 2021, the grandest bull market of all, featuring the second altseason, with Bitcoin’s dominance shrinking from 70% to, once again, below 40%. History, it seems, has a sense of humor. 🎭

BTC/USD and SPX 1W correlation chart | Source: TradingView

As the quill scratches these words, BTC.D hovers around 58%, having peaked at 65% this cycle. Bitcoin, ever the provocateur, teases a decoupling from the stock market. In this intersection of worlds, Michael Saylor’s Strategy (NASDAQ:MSTR) announces a colossal Bitcoin purchase, acquiring over 4,000 BTC for $449 million, perhaps near a local bottom. A strategic move, or a gambler’s roll of the dice? Only time will tell. 🎲

Read More

- Gold Rate Forecast

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

2025-09-03 00:37