It was a morning much like any other-tea lukewarm, toast burnt, and the financial markets murmuring softly like a library full of sleeping hedge fund managers-when lo and behold, Dash decided to turn into a rocket strapped to a bull on roller skates. In just 24 hours, the plucky little privacy coin rocketed 66.6% higher (accurate to the first digit of the Beast’s own phone number), leaving stunned traders, broken stop-losses, and at least one weeping Telegram group in its wake. 🚀💸

Market cap? Up 64% to a sprightly $1.8 billion. Trading volume? Spiking 40%. Weekly gains? A jaw-dropping 194%. If Dash were a schoolboy, his teacher would write: “Exceeds expectations-showing off.” And let’s not forget the three musketeers of mayhem behind this derring-do: the privacy coin sector suddenly remembering it exists (up 80% weekly), a parade of bullish news so vibrant it could power a pantomime, and a technical breakout so violent it made a 968-day downtrend evaporate like morning mist off a well-polished monocle. 🧐

But the pièce de résistance? A short squeeze worth $13 million-yes, thirteen million smackers-ripped from the trembling hands of underprepared bears. It was less a market move, more a financial mugging. Traders stampeded in like pigs at a truffle festival, sending Dash rocketing past $140. Charts lit up like a Christmas pudding in a fireworks factory. The combination of technical fireworks and wallet-emptying liquidations has made Dash, for today at least, the talk of the crypto ton. 🎉🐷

$7+ Million in Liquidations? More Like a Financial Guillotine

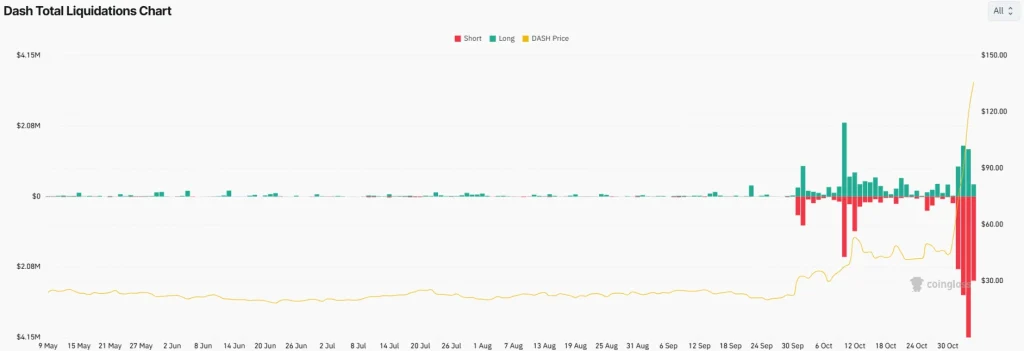

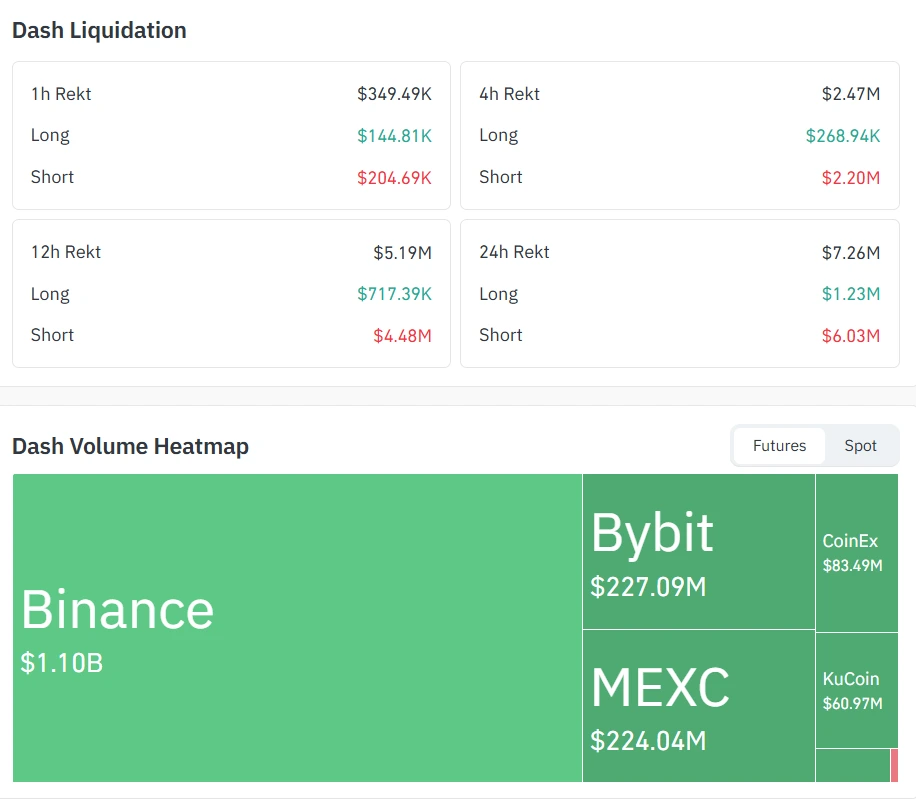

According to the coin-hoarding wizards at CoinGlass (and their very serious graphs), over $13 million in short positions were summarily executed-lined up against a wall and shot at dawn. In just 24 hours, $7.26 million vanished from the marketplace, with poor, doomed shorts accounting for $6.03 million of that. 🎯

It was like watching a slow-motion train wreck where the train is made of money, and the wreck is hosted by Wall Street’s angriest uncle. The squeeze itself stretched across 12 hours of pure, unadulterated market vengeance, with $5.19 million lost and $4.48 million of that belonging to those who’d foolishly bet against Dash. The grand champion of liquidation redistribution? Binance, moving a cool $1.10 billion-enough to buy a small island or at least a very large moat. 🏝️

CoinGlass’s data paints a picture of a market in full stampede-like a herd of nervous antelope who just spotted a lion, except the lion is momentum and the antelope are traders trying to short a meme-fueled rally. Not a good look. 🦌💔

Price Analysis: Or, How to Make Your Heart Skip a Beat

At the time of writing, Dash was traipsing about at $144.22 like a tipsy aristocrat at a garden party, having guzzled a 63.83% one-day spike and an eye-watering 194% weekly rise. It blew past $90 like it hadn’t seen it since university, then kicked over $130 with the grace of a startled flamingo. The 968-day downtrend? Reduced to ash. A smoldering memory. A cautionary tale told in hushed tones at trading desks after lights out. 🔥

Now, I must be the bearer of slightly dampening news: the RSI on the 4-hour chart sits at 82.49-deep in the “overbought” zone, a realm so perilous it comes with a warning label and possibly a permit. 🚨 Recent candles show Dash flirting with a 24-hour high of $148.98 before doing a modest curtsey and retreating, volatility spiking like a startled poodle. Bollinger Bands? Wider than a country squire’s belt after Christmas dinner. High volatility, indeed.

Now, if Dash were a novel, the plot would be this: Can our hero survive the overbought curse and press on to $159.95? Or will the cruel hand of correction yank him back to $90 or-gasp-$59.76? Key resistances lie at $140 and $159.95. Supports await at $90.06 and $59.76, like safety nets woven by nervous optimists. Binance, with its $1.1 billion volume, now holds the lever to the detonator-whales twitch, and everyone jumps. A further squeeze? Possible, if the bulls summon their inner Sherman. But a sharp correction? Oh, most assuredly. Markets, like butlers, demand balance.

FAQs: For the Bewildered and the Broke

What caused Dash’s explosive price rally?

Dash, in a moment of rare ambition, caught three lucky breaks: the privacy coin sector remembered it’s not just a niche relic, a breakout obliterated years of gloom, and $13 million in shorts were vaporized-making for excellent spectacle and excellent profit, if you were on the right side of the ledger. 🎩✨

Is Dash at risk of correction after this spike?

Is Bertie Wooster at risk of getting engaged to the wrong aunt’s niece? Yes. The RSI at 82.49 screams “I’ve had too much champagne,” and a pullback looms like a disapproving valet. Profit-taking at resistance could send Dash reeling faster than Jeeves discovering a sock drawer organized by emotion.

Where are key technical levels for Dash right now?

Resistance: $140 (where dreams are tested) and $159.95 (where legends are born or bankrupted). Support: $90.06 (a comforting shoulder) and $59.76 (the dungeon level). If Dash dips below support, get ready for more liquidations than a vacuum cleaner convention. 💦

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Brent Oil Forecast

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- AAVE: Oh, the Drama!📉

- Flipster’s Bold Leap: Zero-Spread Crypto Trading Unveiled! 🚀

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

2025-11-04 09:50