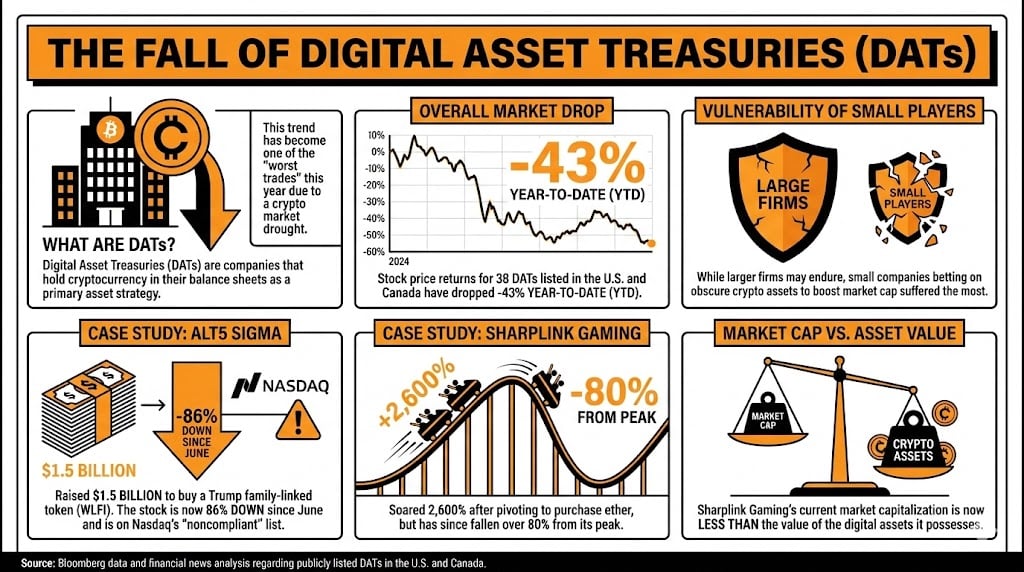

Ah, the latest chapter in the crypto saga unfolds… a veritable ballet of losses. The average return of these so-called Digital Asset Treasuries (DATs), those daring souls who dared to hold crypto on their balance sheets, has plummeted to a delightful -43%. While the titans of industry sip their brandy and chuckle at the chaos, the smaller startups are left scrambling, clutching their pearls and wondering how they got here.

Digital Asset Treasures: A Masterclass in Mismanagement

Digital Asset Treasuries (DATs), those intrepid companies who thought holding cryptocurrency was a clever idea, have become the poster children of 2025’s worst financial decisions. The recent crypto market drought has turned their once-glamorous portfolios into a Dickensian tragedy. 🌧️💸

The Facts, Madam or Sir

According to Bloomberg’s meticulous tally of 138 DATs across the U.S. and Canada, the stock price returns for these companies have nosedived by -43% year-to-date. One might say it’s a “disastrous result” of following trends that smell more like a Ponzi scheme than a stock market. 🤷♂️📈

While the likes of Strategy and Bitmine can afford to sip their champagne and laugh off the losses, the smaller DATs-those who bet on obscure crypto assets to inflate their market caps-have been left high and dry. 🍾🔥

Take Alt5 Sigma, for instance. They raised $1.5 billion in August to purchase 7.5% of a Trump family token (because nothing says “sound investment” like politics and crypto). Now, they’re down 86% since June and proudly listed on Nasdaq’s “noncompliant” list. A social invitation, if you will. 🎩📜

And then there’s Sharplink Gaming, a company that thought buying ether was a clever pivot. They soared 2,600%-then promptly fell like a lead balloon, leaving their market cap smaller than the value of the crypto they own. A triumph of hubris over strategy. 🎲📉

Why It Is Relevant (Or Why You Should Care)

Analysts whisper that the DAT sector’s collapse could send shockwaves through the crypto market as companies frantically sell their holdings to avoid bankruptcy. Even the mighty Strategy, the sector’s golden boy, has admitted they might have to sell Bitcoin to fund dividends. Phong Le, their CEO, hinted as much in a podcast-because nothing says “confidence” like threatening to liquidate your assets. 🗣️💰

Industry insiders, like Rob Hadick of Dragonfly, claim the DATs have been “providing selling pressure” since November. One might call it a “gentle nudge” to the bottom. 🛑📉

Looking Forward (Or Should I Say, Backward?)

Analysts predict the smaller DATs will crumble under the weight of their volatile assets, while the giants like Strategy and Bitmine will saunter ahead, sipping their tea and eyeing the wreckage. A tale of two cities, if you will-except one city is bankrupt and the other is laughing. 🏛️☕

FAQ

-

What are Digital Asset Treasuries (DATs)?

Ah, the question on everyone’s lips! DATs are companies that thought holding crypto was a clever way to inflate their balance sheets. Alas, they’ve become the punchline of 2025. 😅 -

How much have DATs lost in value recently?

A delightful -43% year-to-date, according to Bloomberg. One might say it’s a “modest decline” compared to the Titanic’s. 🚢🌊 -

Which companies have struggled the most in this downturn?

The smaller DATs, like Alt5 Sigma, have been particularly creative in their suffering. Down 80% from their peak, they’ve made Shakespeare’s tragedies look like rom-coms. 🎭💔 -

What implications does this decline have for the broader cryptocurrency market?

Analysts warn that as DATs sell their crypto to survive, they’ll create a “feeding frenzy” in the market. A true “buy the rumor, sell the news” scenario. 🦊📉

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- EUR HKD PREDICTION

- FET PREDICTION. FET cryptocurrency

- PENGU PREDICTION. PENGU cryptocurrency

- Bitcoin’s Wild Ride: $135K by August? 🤑💸

- USD MYR PREDICTION

2025-12-09 14:09