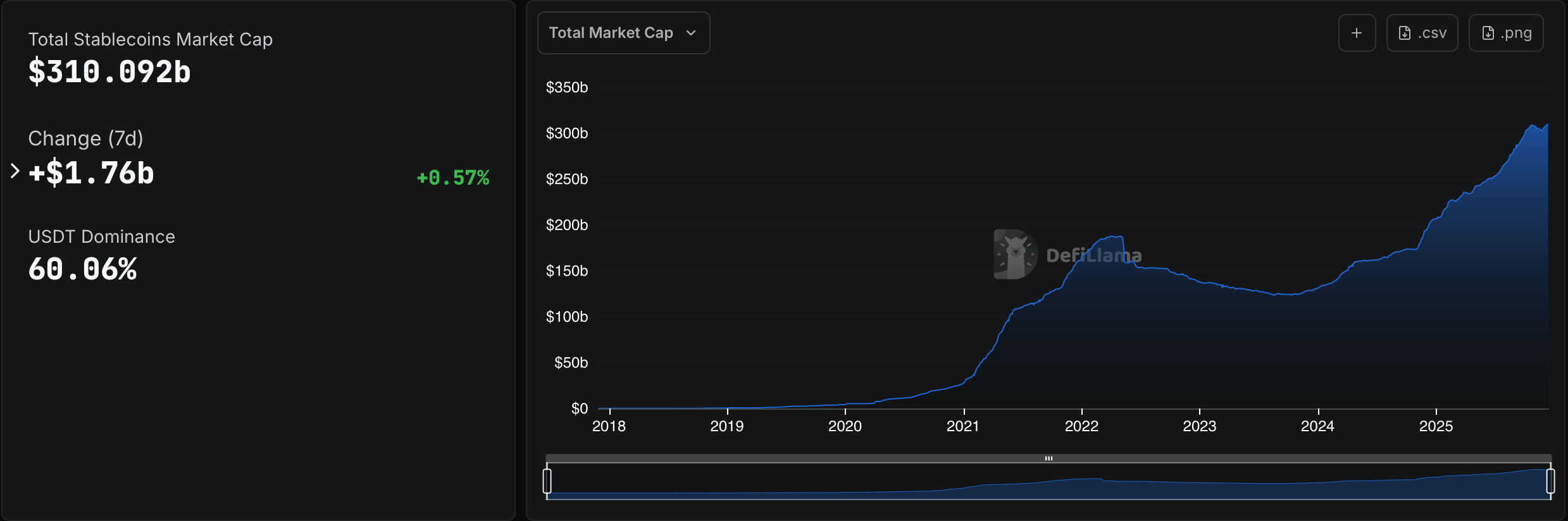

Amidst the cold, unfeeling machinery of finance, the specter of stablecoins looms ever larger, a colossus straddling the abyss of fiat and crypto, now commanding a grotesque $310 billion empire in the shadow of December’s icy dawn.

Stablecoin Market Ascends to Gargantuan Heights, Mocking Mortals With $310 Billion

Recall, dear reader, the fleeting humility of mid-November: a mere $302 billion, a paltry tremble before the storm. Yet from this frailty sprang resilience! Like Raskolnikov rising from fevered delirium, the sector clawed its way to $310.092 billion by December 13, 2025-a Sisyphean triumph. 🏋️♂️

A meager 0.57% gain? Pah! $1.79 billion flowed in, a trickle to some, but to Tether-a leviathan devouring the seas-it meant a 60.06% crown jewel, swelling to $186.256 billion. USDC, the dutiful squire, added $613 million, now $78.414 billion strong. Are we not all merely pawns in their game? ♟️

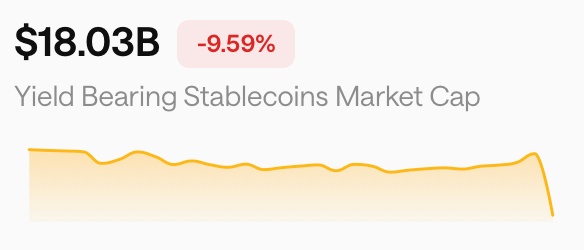

Circle’s USYC, a sprightly 4.02% upstart, while Blackrock’s BUIDL-once proud, now humbled-shrinks by 13.24%, a Jacobin guillotine slicing through its $1.321 billion. Tron’s USDD and crvUSD? They leap like lunatics freed from the asylum! 🏃♀️🏃♂️ But Ethena’s stablecoins drag, USDe limping down 2.98%, USDtb a staggering 18.99%. Oh, the irony! After October’s crash, yield-bearing coins now taste the bitterness of irrelevance. 🍋

Stablewatch.io whispers: yield coins have shed 9% in 30 days, $18 billion clinging to life. Redemptions! AlUSD plummets 73%, smsUSD 67%-a massacre masked as math. Investors, those eternal gamblers, now clutch liquidity like a crucifix against the vampire of risk. 🧛

In this age of anxiety, payment stablecoins reign-soulless, simple, ready to flee at a moment’s notice. Are we not all just pilgrims in a desert, thirsting for certainty? The road to 2026 stretches empty, its horizon veiled. But for now, let us feast on the crumbs of liquidity, for tomorrow… who can say? 🤷♂️

FAQ 🧠

- What is the current size of the global stablecoin market? A monstrous $310 billion, a Baal of modern finance demanding sacrifice.

- Which stablecoins are driving growth? USDT and USDC-relentless as the grave, liquid as a Dostoevskyian existential crisis.

- Why are yield coins collapsing? Investors, like ex-lovers, now prefer cold cash to empty promises. Trust, once spent, cannot be minted anew.

- Recent yield coin performance? A 9% drop to $18 billion. They decay like forgotten relics in a museum of failed utopias.

Read More

- Gold Rate Forecast

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- XRP’s Little Dip: Oh, the Drama! 🎭

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- Silver Rate Forecast

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

2025-12-14 00:59