Ah, the sweet scent of freshly minted wealth! This week, the grand stage of finance witnessed a spectacle that could make even the most hardened cynic blink in disbelief: a record-breaking frenzy in US spot Bitcoin and Ether ETFs. Of course, the main attraction? Ether, the underdog, which suddenly awakened from its long slumber and skyrocketed into a money-making frenzy, dragging the whole circus with it.

ETF analyst Eric Balchunas-who, no doubt, is as shocked as a man who’s just seen his morning coffee spill all over his suit-reported that Ether ETFs alone achieved a staggering $17 billion in weekly trading volume. Yes, $17 billion! And this wasn’t some drawn-out, slow-burn drama; no, this was a flash fire, a sharp, unexpected spike after months of blessed silence. The whole event has caused trading desks to break into a cold sweat, rethinking just how fast the river of money can flow when the right winds blow.

Ether ETFs Record Big Volume

Hold your breath, for the numbers don’t stop there. Spot Ether ETFs didn’t just skim past the $17 billion mark; they shattered it. A record single-day net inflow of $1 billion was logged, leaving the market gasping for air. Yes, you read that correctly-a BILLION in a day. Forget about time, forget about reason. The first two weeks of August alone brought in more than $3 billion. Eric Balchunas, who probably had a nervous breakdown trying to keep track of this, summed it up perfectly: “It’s like Ether ETFs were asleep for 11 months, and then decided to pack a year’s worth of activity into six weeks.” Truly poetic, in the most absurd way possible.

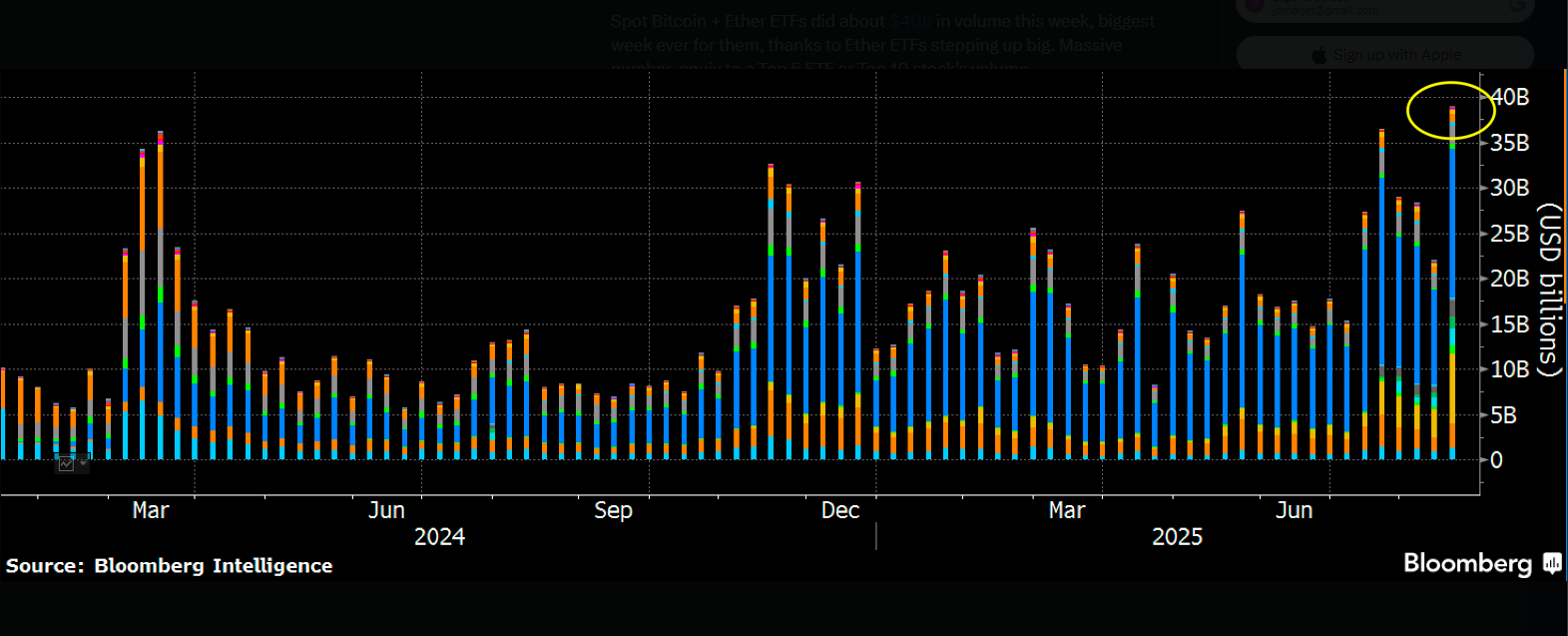

Spot Bitcoin + Ether ETFs did about $40b in volume this week, biggest week ever for them, thanks to Ether ETFs stepping up big. Massive number, equiv to a Top 5 ETF or Top 10 stock’s volume.

– Eric Balchunas (@EricBalchunas) August 15, 2025

Price Peaks And Quick Pullbacks

And now, the plot thickens. Bitcoin, feeling particularly full of itself, reached a high of $124,000 on Thursday-yes, that’s right, a headline-grabbing number. Ether, not to be left out, flirted dangerously close to its November 2021 high of $4,787. But alas, these highs were as fleeting as a good idea at 3 AM. By Friday, Bitcoin had dipped by more than 5%, sliding back to $117,648, while Ether lost 6.15%, settling near $4,475. You know, just another day in the world of crypto, where excitement meets liquidity in a cruel dance of rise and fall.

Let’s take a stroll down memory lane. Remember the Bitcoin ETF run from last year? Oh, how it made people sweat with excitement. Bitcoin ETFs soared to $73,680 just two months after launching in January 2024. Fast forward to today, and some traders are feeling quite optimistic, thinking this is just the beginning of another meteoric rise. The prophecy, it seems, is alive and well-at least for some.

But don’t get too cozy. The naysayers, as they always do, are warning that we may be in for another volatile ride. “Fresh all-time highs for Ether? Weeks, maybe months away,” they say. The market, like a fickle lover, can turn on a dime. One moment, it showers you with affection, and the next, it’s gone, leaving you wondering if you imagined it all. Traders, ever the opportunists, may cash out quickly, leaving the waves to recede just as fast as they rose.

And so, we wait. If Ether’s ETF magic continues, we might just see more gains. If not, well, enjoy the show while it lasts. Either way, this chaotic rush into Ether ETFs has made this one of the most absurd, exhilarating chapters in the crypto saga. Stay tuned-this story is far from over.

Read More

- Gold Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Silver Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-16 13:47