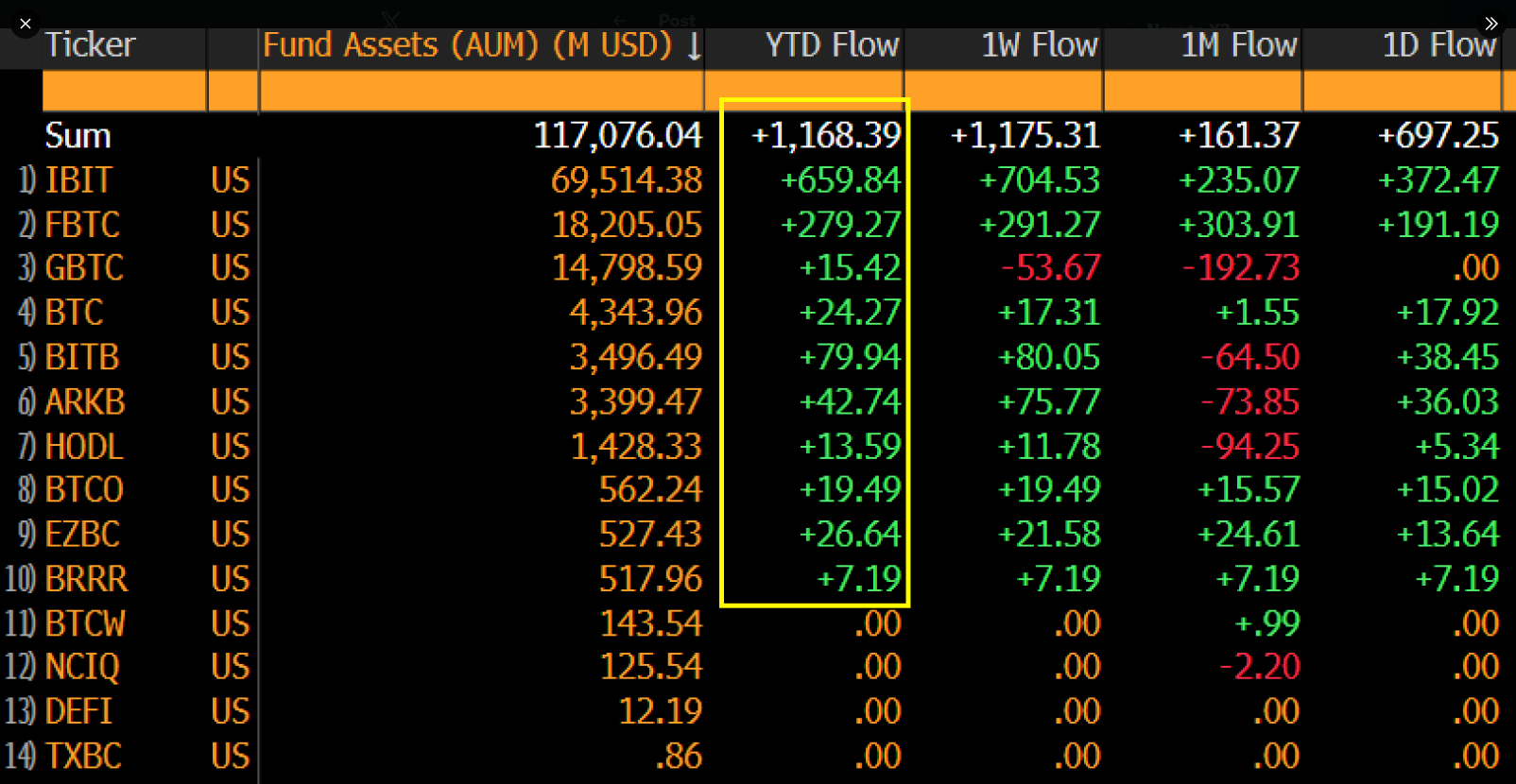

Spot Bitcoin ETFs kicked off 2026 like they’ve got a very good reason to party-namely, $1.2 billion in inflows during the first 48 hours. Some analysts were blindsided, others just smirked and sipped their lattes. “Classic crypto,” one muttered, “it’s either a revolution or a pyramid scheme. We’ll know when the coffee goes up.”

Bloomberg’s Eric Balchunas, that wizard of ETFs, dropped the numbers like a hot mic: $1.2 billion in two days. If this keeps up, he reckons we’re looking at $150 billion annually. “That’s 600% more than 2025,” he said, “which, if you’re keeping track, is like going from a toddler’s allowance to a kleptocrat’s bank balance.”

“Spot Bitcoin ETFs are coming into 2026 like a lion,” Balchunas declared. “Or a Bitcoin maximalist with a caffeine addiction. Either way, hold on to your socks.”

Everyone’s Invited (Except the Underdogs)

Most ETFs partied like it was 2024 again, but WisdomTree’s BTCW? Still waiting for the invites. Meanwhile, BlackRock’s IBIT hoovered up cash like it was on a diet. Balchunas called the flows “broad-based,” which is just a fancy way of saying “everyone’s eating, even the cat.”

“$1.2B in two days. If they can take $22B when it’s raining, imagine when the sun’s shining,” Balchunas tweeted. “Spoiler: it’s a fire sale.”

Last Year’s Party Was Less Glorious

In 2025, ETFs managed a paltry $21 billion-half of 2024’s spending spree. But Monday’s $697 million single-day inflow? That’s the kind of energy usually reserved for Black Friday sales or a crypto influencer’s Twitter thread.

Bitcoin flirted with the $90k mark, then kissed it goodbye as shorts got liquidated faster than a NFT collection in a bear market. Traders were left wondering: “Is this a rally, or just the prelude to the next crash?” (Answer: probably both.)

Morgan Stanley filed for Bitcoin and Solana ETFs, because why not? They’ve got $8 trillion under management, but suddenly, they’re the cool kids at the crypto table. Their Bitcoin trust? “No leverage, no derivatives, just pure, unadulterated greed,” Balchunas joked.

Analysts whisper that ETFs could slurp up Bitcoin’s liquidity so fast, exchanges might start rationing. But don’t get too comfortable-Fidelity had a surprise outflow Tuesday. “Crypto’s version of ‘This Is Fine’ painting,” one trader quipped, “everyone’s panicking, but the dog’s sipping champagne.”

Maduro’s arrest by U.S. forces? Bitcoin shrugged. It dipped below $90k, then bounced back like it was reading a script by Phoebe Waller-Bridge. “It’s not the news-it’s the anticipation of the news,” said a trader. “We’re all just waiting for the next plot twist. Spoiler: it’s worse.”

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Oops! User Accidentally Burns $75K Worth of PUMP Tokens! 🔥

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

- PENGU: The Cryptocurrency Drama Fit for a Molière Play 🎭💰

- Bitcoin’s Wild Ride: Coinbase & Strategy Laugh All the Way to the (Crypto) Bank! 🚀💰

- DOGE PREDICTION. DOGE cryptocurrency

- Zcash: The $520 Fiasco 🎭💸 – Will ZEC Ever Break Free?

- Barclays Bets on Ubyx: A Token Tale of Tons of Cash! 💰🚀

2026-01-07 14:13