Ah, the world of crypto exchange-traded funds (ETFs)-where fortunes can be made and lost faster than you can say “blockchain.” This week, Bitcoin and Ether decided to go for a swim in the red, accompanied by heavy outflows that could make even the most seasoned investor weep. XRP joined the pity party, but Solana, bless its heart, actually had a few people showing up with cash!

Bitcoin ETFs Bleed $410 Million as Crypto Outflows Accelerate

Let’s take a moment to appreciate the sheer artistry of investors pulling capital from these crypto ETFs like they’re fleeing a zombie apocalypse. Bitcoin’s spot ETFs bled a hefty $410.37 million this week, and trust me, it wasn’t just a small cut. Ten funds joined in on the fun, but Blackrock’s IBIT led the charge downwards with a whopping $157.56 million gone. Fidelity’s FBTC and Grayscale’s GBTC also felt the love-or lack thereof-with losses of $104.13 million and $59.12 million, respectively. Grayscale’s Bitcoin Mini Trust didn’t escape either, shedding $33.54 million, while Ark & 21shares’ ARKB lost $31.55 million. Talk about a collective “Oh no, what have we done?”

And if that wasn’t enough, some other funds decided to join the exodus too: Bitwise’s BITB ($7.83 million), Invesco’s BTCO ($6.84 million), and Franklin’s EZBC ($3.79 million) added to the drama. Total assets dwindled to a measly $82.86 billion, which is still a lot unless you’re talking about crypto.

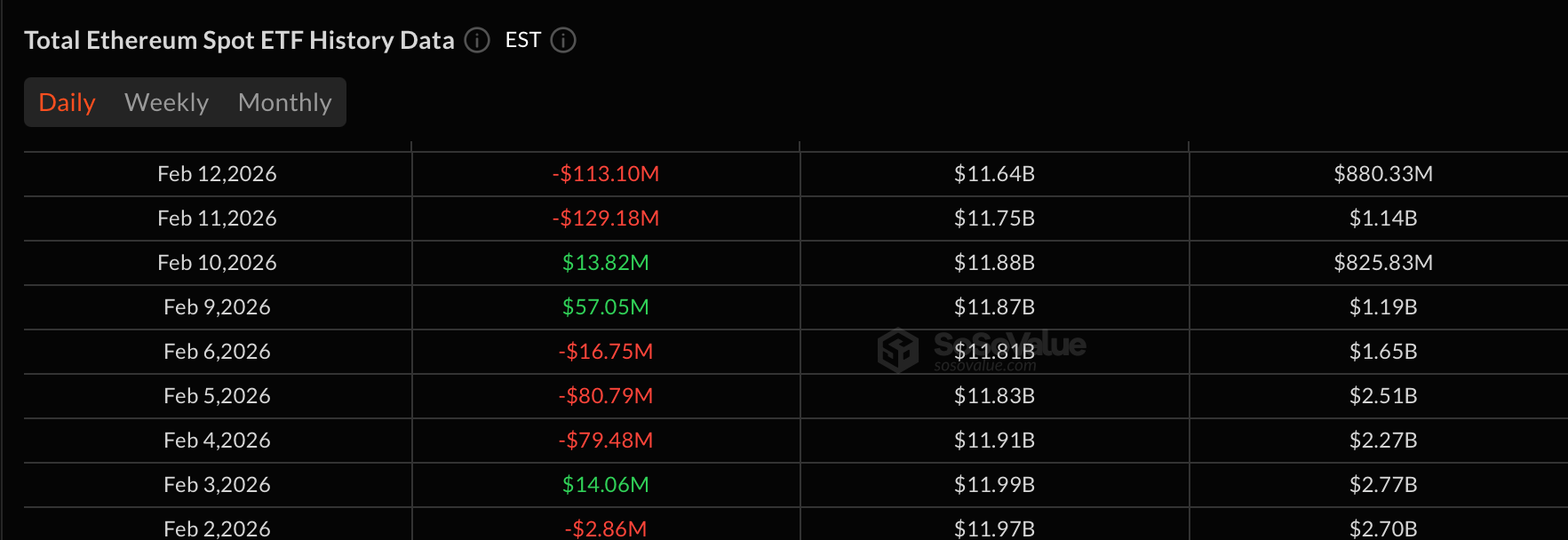

Ether ETFs followed suit, because why let Bitcoin have all the fun? They recorded net outflows of $113.10 million, with Fidelity’s FETH leading the way at $43.52 million. Blackrock’s ETHA was not far behind, saying goodbye to $28.99 million. Grayscale’s Ether Mini Trust and ETHE lost $18.11 million and $13.43 million, respectively. Meanwhile, trading activity totaled $880.37 million, which is a lot of action for a bunch of folks wanting to run for the hills!

XRP ETFs also decided to get in on the action, slipping into negative territory like a bad sitcom character. Despite Canary’s XRPC charming $1.44 million, and Franklin’s XRPZ adding a modest $737,470, the real villain was Grayscale’s GXRP, which saw an $8.91 million outflow. The segment closed with a $6.42 million net outflow, while trading volume stood at $12.52 million, and net assets dropped to $970.66 million. It’s a rollercoaster ride where no one wants to keep their hands inside the car!

Now, let’s take a moment to appreciate the shining star of this gloomy saga: Solana ETFs! With a gallant $2.7 million net inflow, fueled by Bitwise’s BSOL and Grayscale’s GSOL, they proved that not all heroes wear capes. Trading volume reached $27.12 million, with net assets finishing at $656.29 million. Not bad for the underdog!

So, there you have it-another thrilling episode in the wild world of crypto ETFs. As Thursday rolled on, the air was thick with caution. Bitcoin and Ether faced heavy redemptions, XRP’s charm fizzled out, and Solana danced through the chaos unscathed like it just won the lottery.

FAQ 📊

- Why did bitcoin ETFs see heavy outflows?

Because apparently, everyone suddenly remembered they had bills to pay and reduced their exposure. - How much did ether ETFs lose today?

Ether spot ETFs recorded $113.10 million in net outflows-definitely not the kind of party anyone wanted to attend. - Why were XRP ETFs negative despite some inflows?

Because Grayscale’s GXRP showed up ready to ruin the fun with an $8.91 million outflow. Who invited that guy? - Which crypto ETF category performed best?

Solana ETFs managed to stay green-talk about being the life of the party!

Read More

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2026-02-13 18:47