Oh boy, Tom Lee is at it again, predicting Ethereum is gonna be worth $30,000 🤯. He’s got a whole thread on X, six whole posts, and it’s all about how companies are gonna treat Ethereum like MicroStrategy treats bitcoin, and voilà! The price goes up 📈. Because, you know, math 📝.

Lee’s argument is that MicroStrategy’s shares went from $13 to $455, a 35-fold gain 🚀. And get this, only 11 of those gains were from bitcoin’s price increase, the rest was from their “treasury strategy” 📊. I’m not gonna bore you with the details, but basically, they’re doing some fancy financing moves that make their BTC per share go up faster than the coin’s price 💸.

Now, Lee says Ethereum can do the same, and lists three magic moves to make it happen 🔮: issuing new stock to buy more ETH, using token volatility to lower borrowing costs, and relying on convertibles or preferred shares to cap dilution 📈. Because, you know, Ethereum’s volatility is still higher than bitcoin’s, Lee thinks they can drive down the cost of debt-and-option structures and accumulate more tokens 💰.

And, of course, Lee’s got his own company, BitMine Immersion Technologies, which bought a whopping $1 billion worth of ETH in its first week 🤯. That’s four times more than MicroStrategy bought in its first week back in 2020 📊. Lee’s like, “Hey, we’re on our way to acquiring 5% of the overall ETH supply 🚀”. Yeah, sure, Tom 🤔.

Other companies are following suit, like SharpLink Gaming, chaired by Ethereum co-founder Joseph Lubin 🤝. They’re raising money to buy more ETH, and Bit Digital is like, “Hey, we’re gonna be the biggest ETH holding company in the world 🌟”. Okay, okay, we’ll see 🤔.

Together, these three companies control around 682,000 ETH, which is like, half a percent of the circulating supply 📊. Lee thinks this creates a “reflexive loop” 🔄, where higher share prices provide cheaper capital to buy more tokens, and the price goes up 📈. Yeah, because that’s exactly how it works 🤣.

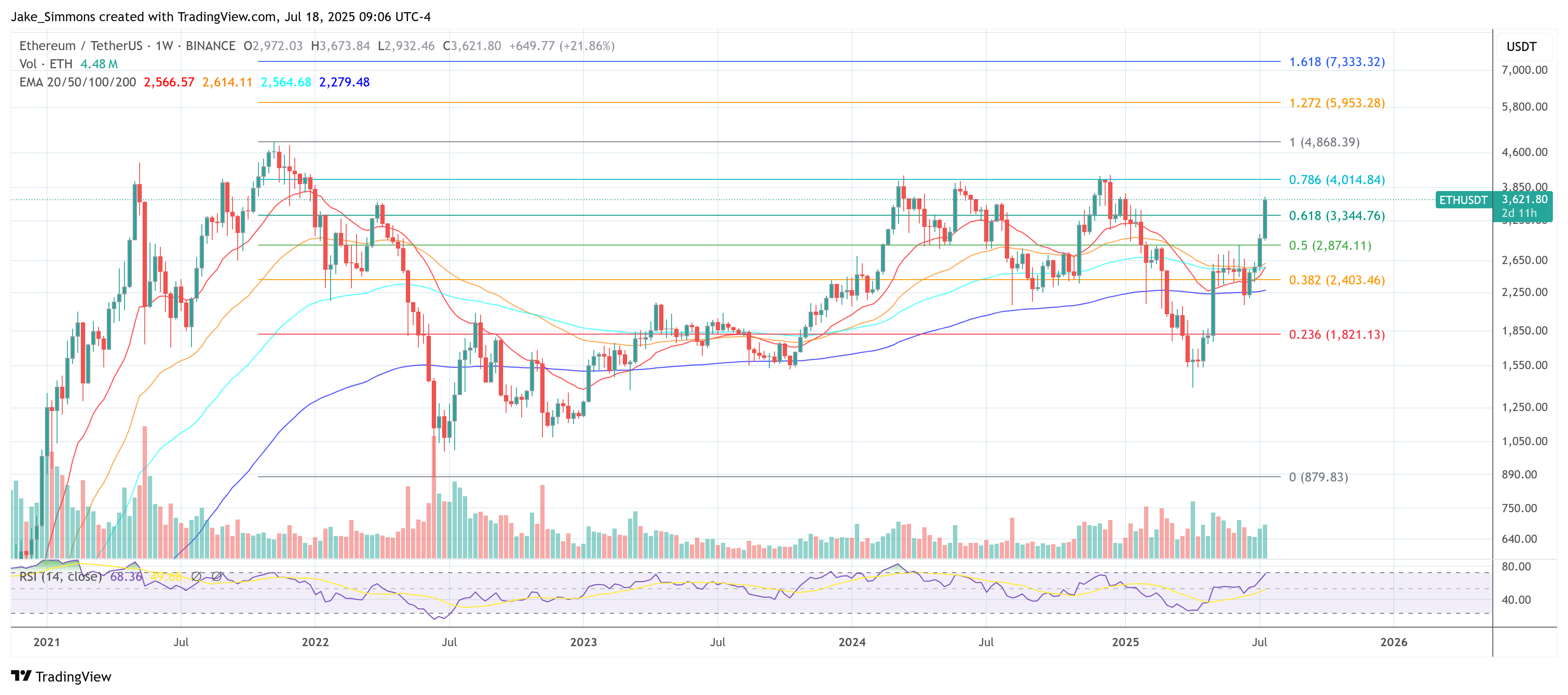

Crypto analyst DCInvestor is like, “Tom Lee is basically calling for $30-80K ETH 🤯”. And some people are like, “Yeah, right, and I’m the King of England 👑”. Ether’s trading at $3,600 today, so an eight-fold move to $30,000 would be like, a big deal 📈.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD HKD PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Solana’s Breakout: Is $200 Just the Beginning? Find Out Now!

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

2025-07-19 01:17