Well, folks, it looks like the ether exchange-traded funds (ETFs) decided to throw a party, tossing in a cool $297 million and setting a new record for daily trading volume. Meanwhile, Bitcoin ETFs, those old reliable, took a day off and shed $131 million—like a grumpy cat refusing to play fetch. 🎩💸

Bitcoin ETFs Take a Break After 12 Days of Green Glory, While Ether Turns Green Again

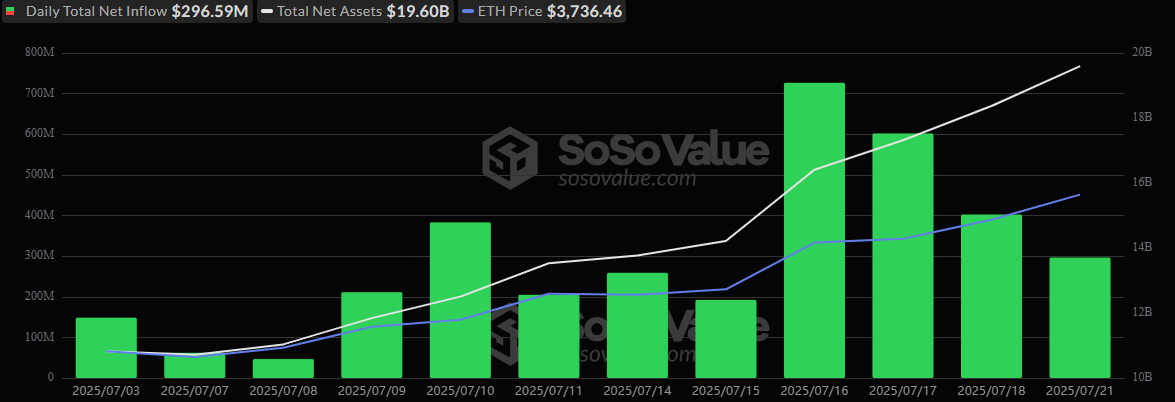

Ether ETFs kept their winning streak alive, grabbing another $296.59 million — 12 days straight of catching the green wave. Fidelity’s FETH and Blackrock’s ETHA were the star performers, pulling in $126.93 million and $101.98 million respectively, as if to say, “We’re just getting started.”

Grayscale’s Ether Mini Trust chipped in with a hearty $54.90 million, while Bitwise’s ETHW added a modest $13.15 million. Only a tiny, insignificant $374K flowed out of 21Shares’ CETH—probably just a sleepy yawn in the sea of green.

Trading volume also hit a new record—$3.21 billion—because apparently, if you’re not making money in crypto, you’re doing it wrong. Net assets skyrocketed to $19.60 billion, now flexing at 4.32% of ether’s market cap. Someone’s feeling pretty confident, or maybe just showing off.

Meanwhile, the Bitcoin ETFs, those once-pristine champions of the crypto world, tripped over their shoelaces, bleeding out $131.35 million. Quite the plot twist after 12 days of green, huh? It’s like a bad hair day eclipsing a summer of sunshine.

Bitcoin ETFs’ rapid decline was spearheaded by Ark 21shares’ ARKB, which hemorrhaged $77.46 million, followed by Grayscale’s GBTC with $36.75 million and Fidelity’s FBTC at $12.75 million. Even Vaneck’s HODL and Bitwise’s BITB couldn’t escape the red ink, bleeding $2.48 million and $1.19 million respectively. 🎢

Despite all that drama, trading volume stayed lively at $4.10 billion, and net assets held their ground at $151.60 billion, suggesting maybe—just maybe—this was a little blip in the grand spectacle. The crypto market, always the drama queen, teeters on the edge of chaos and glory.

As ether ETFs steal the limelight, leaving Bitcoin in the dust with a smirk, perhaps the biggest story isn’t what’s up, but what’s next. The crypto narrative keeps spinning—favorite altcoin or not, they’re all just characters in this wild, unpredictable show.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD ILS PREDICTION

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- USD THB PREDICTION

- Silent Whales: Bitcoin’s Shadow War on Binance

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

- Bitcoin, Baby! 🤯 Asia’s Wild Ride into the Crypto-Void 🌪️

2025-07-22 19:27