In a day that will surely make the history books (and perhaps even a few wallets a bit fatter), ether ETFs managed to surpass all expectations with a whopping $727 million in single-day inflows. Not to be outdone, Bitcoin ETFs continue their hot streak, hitting 10 days of green with a cool $799 million in net inflows.

Crypto ETFs Soar: Ether Hits New Inflow High With Bitcoin Pulling in $799 Million

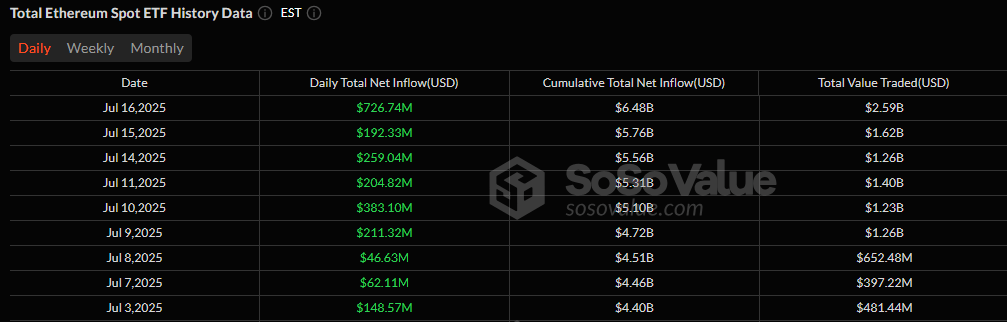

Ah, the world of ETFs—a place where numbers make hearts race and wallets sigh in relief. On this particular day, Ether ETFs didn’t just break records, they obliterated them, with an astonishing $726.74 million flowing in as if there was a sudden shortage of Ethereum in the world. Blackrock’s ETHA took the lion’s share, hauling in $499.25 million like it was just picking up loose change. But let’s not forget the other players in this game of financial musical chairs.

Fidelity’s FETH managed to scrounge up a respectable $113.31 million, while Grayscale’s Ether Mini Trust and ETHE added $54.18 million and $33.04 million, respectively. As for Bitwise’s ETHW, it didn’t quite hit the jackpot, but its $14.45 million was more than a nice consolation prize. Smaller contributions came from Franklin’s EZET ($5.10 million), Invesco’s QETH ($3.72 million), and Vaneck’s ETHV ($3.69 million). The total trading volume was nothing short of mind-blowing at $2.59 billion, and net assets skyrocketed to $16.41 billion.

And while Ether was making history, Bitcoin ETFs were busy flexing their muscles, extending their streak to 10 days of net inflows, totaling $799.40 million. Blackrock’s IBIT led the charge, pulling in a respectable $763.89 million, leaving other ETFs to scramble for the crumbs. Ark 21shares’ ARKB added $19.82 million, Fidelity’s FBTC chipped in $10.41 million, and Grayscale’s Bitcoin Mini Trust added $5.28 million to the growing pile. For the first time this week, no ETF saw outflows—an encouraging sign that the market’s bullish sentiment is alive and well (or perhaps even a little too alive, considering the numbers).

Bitcoin ETF trading volume stood tall at $5.09 billion, while net assets soared to a staggering $153.76 billion. As institutional demand pushes these crypto ETFs to dizzying heights, the market is evolving, and it’s no longer about simply participating—it’s about showing the world you mean business. And with the way things are going, it’s safe to say that “business” is thriving.

Read More

- Gold Rate Forecast

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- EUR HUF PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Will Ripple’s Court Drama Empty SEC’s Wallet? XRP ETF Madness Incoming! 🚀🔥

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

2025-07-17 17:09