In an occasion remarkably reminiscent of that delightful jubilee known as “once-in-a-decade,” the esteemed Mr. Kevin of Kev Capital has proffered a proclamation regarding our modern monetary marvel, Ethereum. With all the fervor of a newly engaged gentleman, he asserts that the charts have conspired in an unusual manner, unearthing bullish signals which, he dares to suggest, have never graced us with their presence quite so splendidly before.

The Final Hurdle Awaits

Two fortnights ago, at the peak of despondency in the Ethereum community, Mr. Kevin, like a valiant knight of old, issued a clarion call based on various monthly charts of ETH/USD, ETH dominance, and ETH/BTC. “We truly were amongst the very first to herald these alarming signs regarding Ethereum,” he declared, “it was as unmistakable as the knowledge that one ought not to wear a bonnet in the rain.” Since that fateful forecast, ETH has galloped forth, gaining a staggering 150%, whilst its so-called beta counterparts-Chainlink, Uniswap, and Ethereum Classic-have enjoyed a rather exuberant rise that might rival the giddiest of ballroom dances. 🎉

This surge, Mr. Kevin elucidates, commenced with a remarkably akin to a literary “out of the blue” moment: a newfound demand candle at crucial support-a phenomenon that history whispers precedes tremendous rallies. This was further buoyed by various momentum indicators which sprang back from a rather tiresome state of extreme oversold levels.

oversold RSI and Stock RSI, a most timely MACD cross, and prices pawing at the very same support that heralded the 2019-2020 affair. He ventures to propose that this bottom may indeed be the commencement of a phase quite advantageous for ETH, a prospect that would, he intimates, uplift the lesser altcoins to new heights. The ETH/BTC chart, in his view, has not been shy in confirming this timing, as “the lead altcoin certainly showed the way… the bottom is undeniably in.”

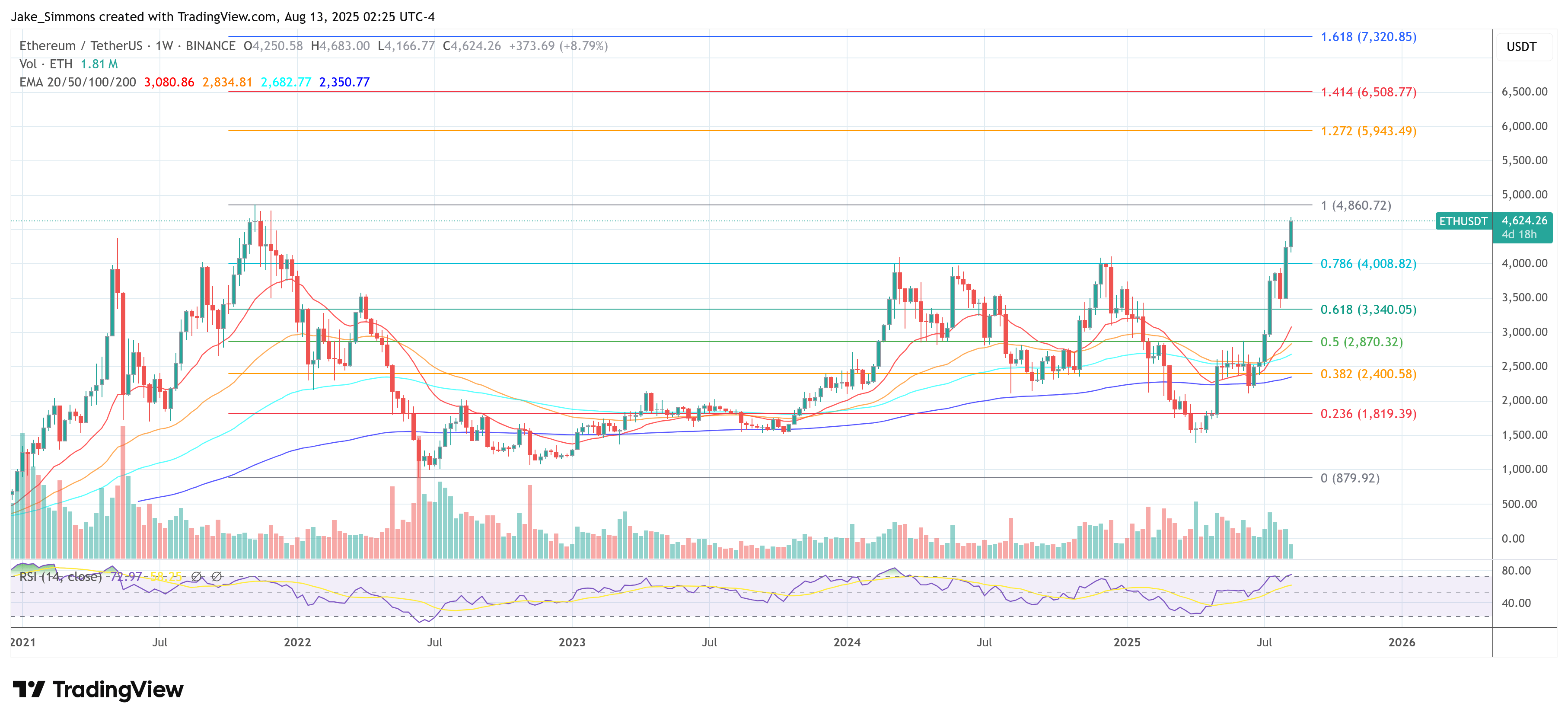

Yet, our astute observer remains cautious, expressing that Ethereum has not quite entered the realm of unbridled price discovery. The formidable barrier looms before us, the previous all-time high meticulously marked at roughly $4,850. “We are certainly not in the clear! It is ill-advised to invest whilst faced with such monumental historical resistance, as that would inevitably end in distress,” he warns, much akin to the wise elders of a village cautioning against a hot-blooded elopement.

It appears that the macro conditions may sway the outcome of this affair. With CME FedWatch now presenting an impressive probability of 90% or more for a US interest rate cut this September, alongside further reductions anticipated in the following months, Mr. Kevin posits that the delightful cocktail of easing monetary policy and favorable technical setups may serve as a “perfect recipe” for the glorious outperformance of altcoins. Be mindful, however, as he advises against chasing fortunes blindly into resistance, lest one suffer a most unbecoming fall from grace.

For the moment, Mr. Kevin finds solace in acknowledging a rare confluence of technical signals that he believes has inscribed its significance in history. “Our proclamations concerning ETH dominance and the comparative forecasts against Bitcoin have unfurled most satisfactorily… While one may expect drawdowns, we find ourselves on the latter half of this bull market,” he expresses with a swoon of optimism. However, whether this back half leads to a revelation of price discovery rests upon a solitary number: $4,850. Until that moment arrives, Ethereum’s once-in-a-decade bull signal remains but a shimmer-a promise yet untold.

At the hour of this account’s conclusion, ETH finds itself trading at the princely sum of $4,624.

Read More

- Gold Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

- EUR HUF PREDICTION

- Brent Oil Forecast

2025-08-13 10:31