Ah, Ethereum. The noble, fickle beast of the crypto realm, now prancing proudly on the precipice of a magnificent surge. NasdaqBTCS CEO, Charles Allen, in his infinite wisdom, dares to predict that ETH could surge to $10,000 by the end of 2025—if the institutional cavalry, much like the Bitcoin ETF parade before it, rides in with wallets wide open. What a thought! A tale as old as time, yet somehow, we still hope it might come true. 🧐

Ethereum Price Rally Gathers Pace Amid Institutional Frenzy

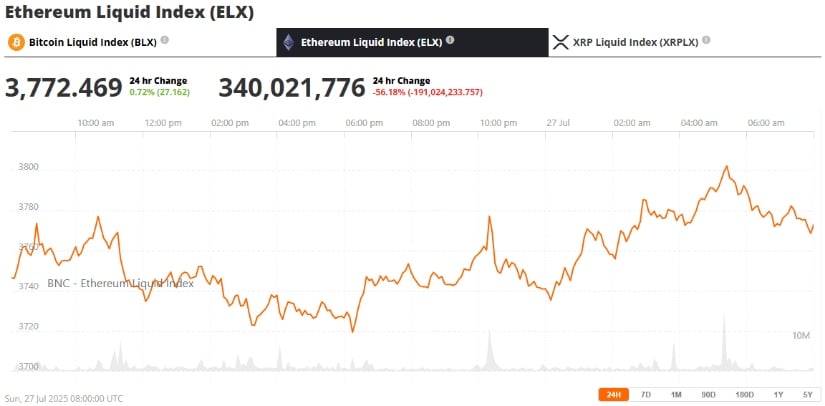

Ah, but let’s not get ahead of ourselves. The price of Ethereum, dear reader, has been galloping ahead, leaving mere mortals in its dust. Since June’s end, it has surged by nearly 75%. Yes, you heard that right—nearly 75%! Breaking past the once-holy $3,500 resistance like an unstoppable force, it now struts around the $3,770 mark, like it owns the place. This rally, naturally, is fueled by an onslaught of spot Ethereum ETF inflows, a bizarre surge in on-chain volume, and a growing hoard of whales who seem to be accumulating ETH as though it’s the last piece of bread in a famine. The market sentiment? Oh, it’s as bullish as a bull on steroids. 🐂

Allen himself, who is not known for his clairvoyant tendencies, nevertheless predicted that ETH could indeed climb to $10,000 if institutional interest mirrors Bitcoin’s ETF success. “Ethereum hasn’t hit $10,000 yet,” he said, which is the most underwhelming understatement since I last told someone I “felt a little tired” after running a marathon. Still, one must admit—things are looking up, and “key market participants” are suddenly taking notice. “Sentiment is shifting,” Allen adds, as if this sudden shift weren’t the most predictable event in cryptocurrency history. But let’s not be cynical. Or maybe just a little. 🤔

Market Overview: Ethereum Technical Structure Signals Breakout

Now, let us turn our gaze to the stars, or rather, to Ethereum’s price chart. It is flashing all sorts of bullish signals—bright, neon, and impossible to ignore. Analysts, who are apparently endowed with the rare gift of seeing beyond mere market fluctuations, are proclaiming that Ethereum is breaking out of a 3.7-year long descending trendline. Yes, three point seven years! As if it were a child finally walking after years of crawling. It is also forming a broadening wedge pattern—always a promising sign of explosive price movements. Or is it? One can never be too sure in these volatile times. 🤨

And lo, we stand at the gates of $4,000—a psychological threshold so hallowed that it could very well catapult ETH into realms previously thought unreachable. Should it close above this magical level with the required volume, it could just rocket toward $4,800, like a spaceship toward new all-time highs (ATH) above $4,878. Some might say it’s a long shot. Others might just say, “It’s about time.” Analysts are whispering of the “final consolidation before breakout.” Make of that what you will. 🤑

ETF Inflows Hit Records, Spark Institutional Supply Shock

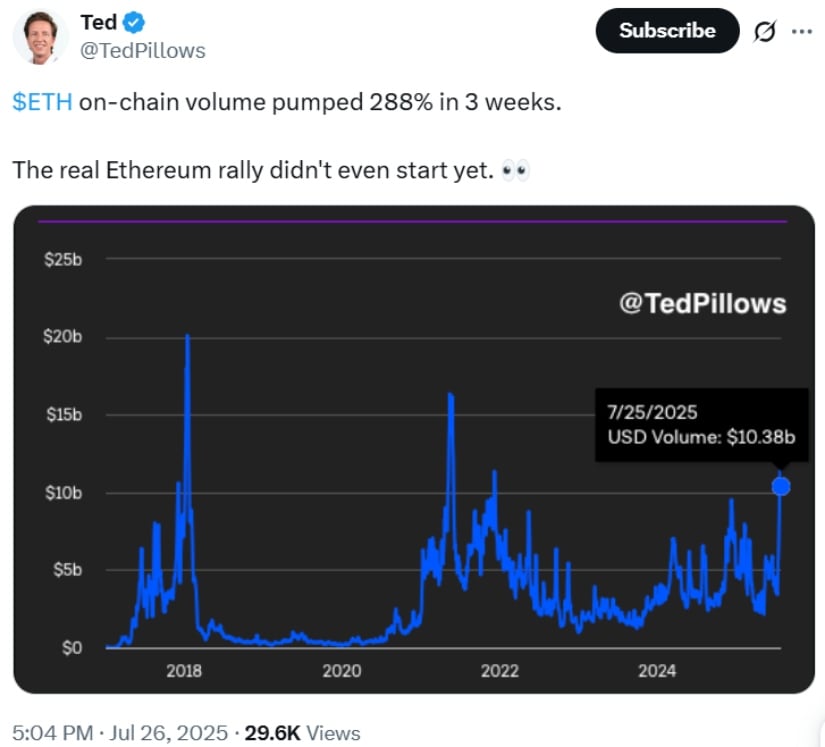

Now, let’s talk about the magic ingredient—the ETF inflows. Ethereum ETFs have seen a truly historic $2.4 billion inflow in just one week. For comparison, Bitcoin ETFs managed to collect a meager $827 million over the same period. The ETFs, in their tireless pursuit, have absorbed 1.36 million ETH—an amount so large that it’s practically absorbed 18 months’ worth of new supply in a mere three weeks. Imagine that! A supply shock so rare it could make a grown whale cry. 🐋

And let’s not forget the short positions, which have reached historic levels, forcing a spectacular short-covering frenzy. No one does drama quite like the crypto market, do they? But, as analyst Ted Pillows points out, BlackRock’s ETHA ETF is pulling in millions by the day. “This is the strongest institutional signal we’ve ever seen,” he says. But of course, the real breakout? That hasn’t even started yet. Hold on to your hats, ladies and gentlemen! 🏇

Whale Accumulation Signals Smart Money Confidence

On the subject of whales—let’s dive into that delightful topic. On-chain data from Glassnode reveals the emergence of over 170 new whale addresses since July 9th. These addresses hold more than 10,000 ETH apiece—making the rest of us look like small change. These whales, these magnificent creatures of the deep, are loading up on ETH as though they know something we don’t. But don’t worry, it’s just another day in the market’s greatest show on Earth. 🦈

Analyst Ali Martinez is of the opinion that whales are buying the dip and stacking up Ethereum, which, frankly, is something the rest of us can only dream of. Their activity aligns perfectly with ETF buying, and it suggests that we’re on the precipice of yet another “accumulation phase.” Oh joy, another phase! Who doesn’t love a good phase? 😂

Layer 2 Ecosystem and Network Activity Add Bullish Pressure

But wait! Ethereum’s growth isn’t just about whales and ETFs—it’s about the ever-expanding Layer 2 ecosystem, too. Solutions like Arbitrum, Optimism, and zkSync are blossoming like flowers after a spring rain. The TVL (Total Value Locked) is rising, and transaction throughput is soaring. Suddenly, Ethereum doesn’t seem like such a congested, expensive place after all. If only we could all make things run smoothly so effortlessly. The Dencun upgrade is coming, and with it, the promise of even lower gas fees and greater scalability. What’s not to love? 🚀

Ethereum vs Bitcoin 2025: Could ETH Flip BTC?

And then, the question that has plagued us all—could Ethereum ever challenge Bitcoin’s supremacy? With ETH outperforming BTC by 4% last week, some analysts are even whispering that Ethereum might flip Bitcoin by year’s end. One can only hope that Ethereum reaches the heights it deserves, though not without the inevitable drama, of course. 📈

Mike Novogratz, CEO of Galaxy Digital, seems to think so. “Ether feels destined to knock on the $4,000 ceiling,” he said, with all the confidence of a man who has seen both sides of the crypto rollercoaster. Well, Mike, if you say so—let’s see how long it takes to break through that glass ceiling. 🧑🚀

Ethereum Price Prediction: $10,000 Still in Sight?

As for the immediate future? Ethereum is still eyeing that $4,000 resistance. It’s a tough one, but not impossible. Once past that? Analysts predict a swift climb to $4,500, then maybe even $5,000. ETF inflows and whale activity seem poised to take it there. And the Fear & Greed Index? It’s at a healthy 71. Greed is in the air, my friends. ✨

Changelly expects ETH to hit $4,274 by August 2025. CoinCodex, on the other hand, sees it reaching $6,184 by October. The future looks… almost absurdly bright, doesn’t it? 🤩

Final Thoughts: Ethereum’s Future Outlook Brightens

With a market cap approaching $400 billion, Ethereum is looking like the crypto market’s next great hope. A blend of technical strength, institutional inflows, whale activity, and Layer 2 expansion is making it look as bullish as a stampede of bulls. NasdaqBTCS CEO’s prediction of $10,000 may sound outlandish, but with all this momentum, perhaps it’s not as far-fetched as it seems. And if the conditions stay favorable? Who knows! A historic breakout might just be on the horizon. ⚡

For now, traders are watching for a weekly close above $4,000. If it happens, the door to new price discovery will swing wide open, and Ethereum might just rewrite the history books. 📖

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD ILS PREDICTION

- Brent Oil Forecast

- Fed’s $55B Injection: Will XRP Hit $3? 🚀

- ETFs: Bitcoin Falls, XRP Rises! 🚀

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- USD THB PREDICTION

- Silent Whales: Bitcoin’s Shadow War on Binance

- Paradex: When Glitches Meet Gold, and $650K Later…

2025-07-27 20:55