Ah, Ethereum (ETH) – the cryptocurrency equivalent of that friend who promises to buy you a drink, but then spends the next hour in an emotional spiral. On Tuesday, ETH took an 8% tumble, landing around $3,940, as if it decided to erase Monday’s optimistic gains with the swipe of a hand. This brought about a staggering $115 million in liquidations. It seems the traders, though brave, were not spared, especially across the major exchanges. But do not despair, dear readers, for some analysts maintain that this fall might just be the opening act of a dramatic rise, possibly sending ETH toward the lofty heights of $10,000, provided that $3,800 support holds strong.

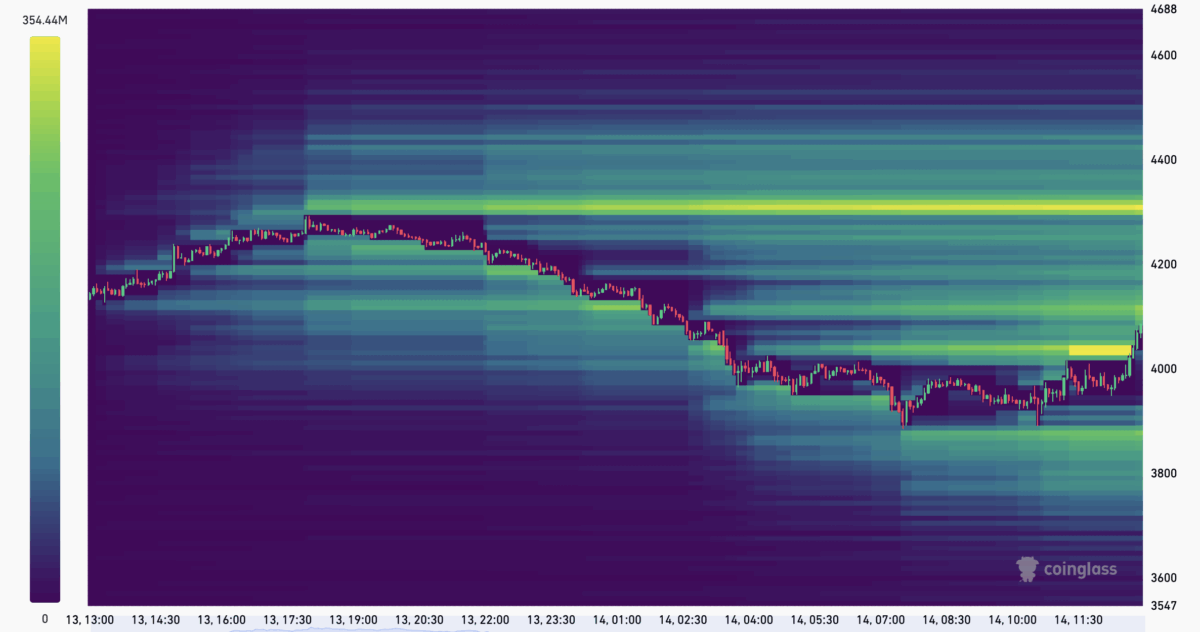

According to CoinGlass data, a whopping $650 million worth of liquidations swept through the crypto markets over the last 24 hours, with ETH carrying its fair share, around $114.5 million. The largest liquidation took place on OKX, involving an ETH/USD pair valued at $5.5 million. Fear not, however, as there is still hope. Beneath the $3,800 mark, analysts observe a potential buying frenzy, indicating that a local bottom may just be lurking.

Now, as for the technicals, the charts are still painting a rather optimistic picture. ETH is still dancing inside a “bull flag” on the weekly chart-a lovely pattern that, if confirmed, could send prices soaring to around $10,050. However, there’s a catch. The RSI, which once flaunted a healthy 74, has now descended to 54 over the past seven weeks. This suggests that momentum might be losing steam. A daily close below $3,800? Well, that could spell trouble, exposing ETH to further dips around $3,500. But fear not, there is still hope in the charts, as we all know that crypto is just like a roller coaster, with a bit more screaming involved.

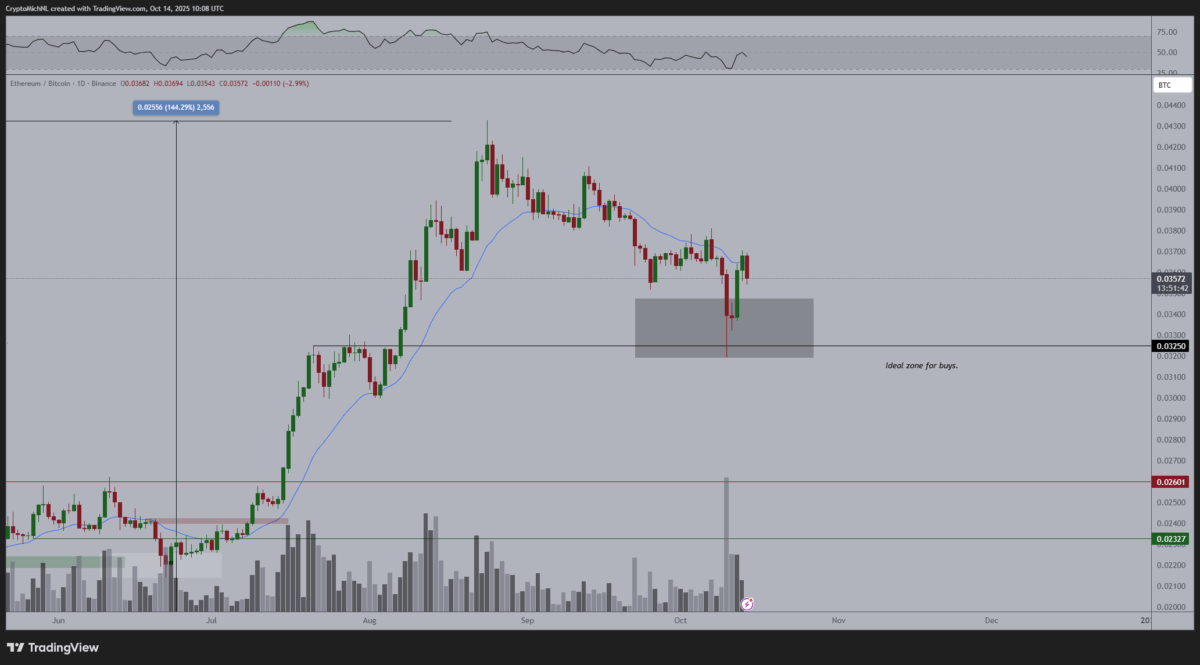

Michael van de Poppe, the ever-optimistic CIO and founder of MN Fund and MN Capital, insists that ETH is merely in a consolidation phase. His proclamation that the ETH/BTC ratio has reached an “ideal buy zone” at 0.032 sounds promising. Surely, ETH is about to “trend switch” and make us all look like geniuses for holding on.

$ETH hit the ideal zone for buys and I think it’s ready for a trend switch.

What does it need?

A higher low and then we’re off towards new highs.

– Michaël van de Poppe (@CryptoMichNL) October 14, 2025

Meanwhile, technical analyst Titan of Crypto is practically jumping up and down, declaring that a multi-year RSI breakout is on the horizon. He boldly claims that “a massive move is loading” and could “melt faces.” I can only imagine the looks on traders’ faces as they prepare for this potential face-melting moment. Will it happen? Stay tuned!

#ETH breakout is loading…

And it could melt faces

– Titan of Crypto (@Washigorira) October 13, 2025

Leverage Rises Again as ETH Rebounds

Oh, the joys of leverage. Recent data reveals that open interest on ETH futures surged by 8.2% in the past 24 hours, signaling a return to speculative leverage. Traders, no longer content with simply existing, are diving in once again-despite the muted spot inflows. Analysts caution, though, that this “revenge trading” pattern could lead to yet another fleeting rally. History has a way of repeating itself, after all.

Maartunn from CryptoQuant observed that roughly 75% of these leverage-driven rebounds fail to sustain themselves. He warns that many of you are likely “trying to trade your money back.” It’s almost like watching someone frantically search for their glasses that are already on their face.

Leverage chasing on ETH again 🥵

Open Interest jumped +8.2% in 24h, fueling this revange pump.

Looks like some of you are trying to trade your money back…

Historically, 75% of these leverage-driven pumps revert, while 25% keep running.

Trade carefully.

– Maartunn (@JA_Maartun) October 12, 2025

Ethereum’s Structural Test

The recent correction and leveraged bounce highlight the eternal dance of Ethereum’s market cycles-resilience mixed with risk. While long-term technicals point to a bullish future, excessive leverage threatens to distort the natural order of price discovery. It’s almost like watching a group of people trying to push a car that is clearly out of gas.

Ethereum’s fundamentals remain robust, but as open interest rises and retail positioning becomes more aggressive, reaching $10,000 ETH may rely less on momentum and more on maintaining stability. Because as we know, the crypto market is anything but stable. But who doesn’t love a good drama, right?

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Silver Rate Forecast

2025-10-14 20:30