Ethereum, that sly fox, is winking at the charts, promising a $7K rendezvous by 2026. A conspiracy of numbers and hope, whispered by analysts who’ve clearly traded their sanity for a calculator.

Meanwhile, the asset dances on a tightrope, balancing on key levels like a drunk acrobat. Trading activity? A masquerade ball of consolidation, where everyone’s pretending they know the plot.

Weekly Chart Forms Bullish Pattern

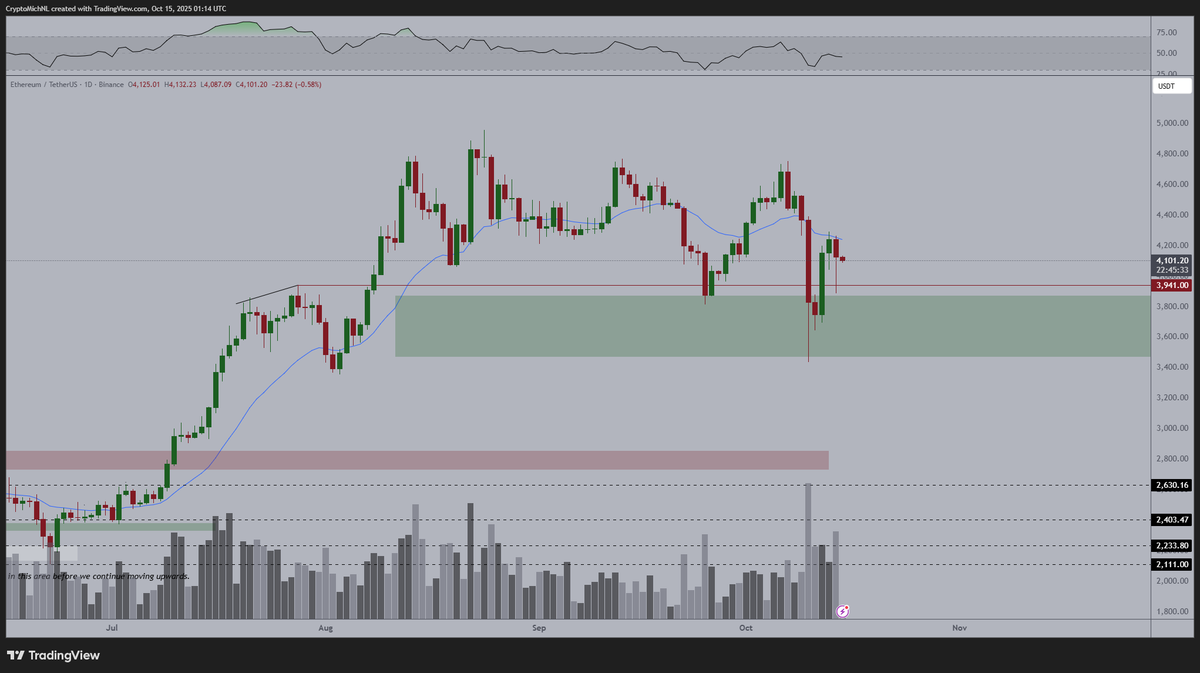

Analyst Mike Investing, a man who’s clearly spent too many nights in a dimly lit room with a screen, shares a weekly chart that resembles a flag of surrender. After a steady rise from late 2024, ETH took a brief nap near $4,100, like a weary knight after a battle.

$ETH is positioning within an aggressive bullish flag and is about to see a euphoric squeeze.

With $ETH bottomed out and completing its last hard pullback below $4k this year this opportunity is generational.

Bears are in major trouble now.

$7,000 by May 2026.

Mark my words…

– Mike Investing (@MrMikeInvesting) October 14, 2025

The chart, a Rorschach test for the desperate, suggests that this pullback is but a hiccup. The 200-week moving average, a relic of the past, still dares to hold the line. ETH, ever the diva, refuses to bow. The analyst, a prophet in a hoodie, predicts $7K by 2026. A date that feels as certain as a Russian roulette trigger.

Michaël van de Poppe, a man with a name that sounds like a villain from a 19th-century novel, spots a higher low. “A strong breakout,” he declares, as if the market is a horse he’s trained to jump over hurdles. His chart? A map to a treasure that may or may not exist.

The 21-day EMA, a fickle lover, is now flattening. If ETH dares to close above it, the market may finally remember how to climb. RSI, that indecisive jester, remains in the middle, leaving room for chaos. The pattern, a tightrope walk, depends on ETH’s ability to stay above support-a task as easy as convincing a bear to dance.

Exchange Balances Reach Multi-Month Lows

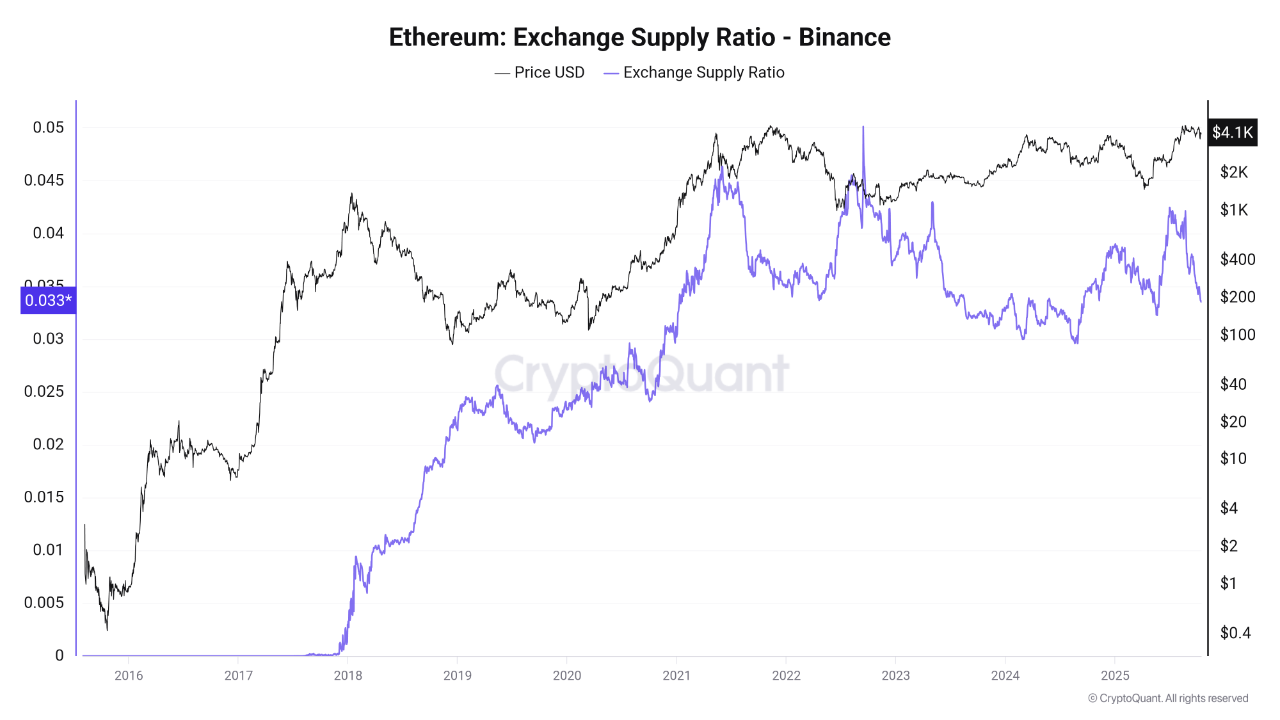

CryptoQuant analyst Arab Chain, a man who’s clearly never owned a pet, reports that Ethereum’s supply on Binance has dipped to multi-month lows. The supply ratio? A meager 0.33. A sign that more ETH is fleeing exchanges, seeking refuge in self-custody wallets. A trend as mysterious as a Bulgakov novel’s ending.

This exodus, a silent rebellion, hints at lower short-term selling. In earlier cycles, such moves were followed by price surges. Investors, it seems, are playing the long game, hoarding coins like a miser hoards gold. A strategy as wise as it is suspicious.

Whale Activity Rises as Retail Steps Back

Retail is fading $ETH.

Whales are loading up.

I’m following the smart money!

– CryptoGoos (@crypto_goos) October 15, 2025

The post, a manifesto of desperation, reveals a rift between small investors and the wealthy. Retailers, those noble fools, are retreating, while whales, the true masters of the game, amass their treasures. A tale as old as time, but with more crypto.

Meanwhile, institutional interest in self-storage and staking grows, like a cult gaining followers. Centralized platforms, once the kings of the realm, now hold fewer coins, their power waning. A sign of long-term holding strategies, or perhaps a prelude to a market crash. Only the stars know.

Read More

- Gold Rate Forecast

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- EUR HUF PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Will Ripple’s Court Drama Empty SEC’s Wallet? XRP ETF Madness Incoming! 🚀🔥

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

2025-10-15 20:00