Ah, Ethereum (ETH), the cryptocurrency that makes even the most stoic investors look like they’re trying to solve a Rubik’s Cube blindfolded. On-chain data has revealed something curious: its whales-the big fish in this digital ocean-are doing what whales do best. Swimming in opposite directions. 🌀

And by “swimming,” I mean one group is hoarding ETH like it’s toilet paper during an apocalypse, while another group seems to have misplaced their shopping list. This delightful chaos has left everyone scratching their heads and wondering if Ethereum is about to moon, sink, or just… float awkwardly like a rubber duck in a bathtub. 🛁

Mega Whales Hit Pause, Mid-Tier Whales Go Shopping-Is ETH Ready to Pivot? Or Just Pivotalize Everyone’s Patience?

In a recent post on X (formerly Twitter, formerly known as “that place where people yell into the void”), Glassnode-a blockchain analytics platform with more charts than your average weather report-noted that Ethereum whales are playing a game of financial chess. And apparently, no one told them it’s supposed to be checkers.

“In August, ETH’s biggest holders moved in opposite directions,” the post read. Because why make things easy when you can make them cryptic?

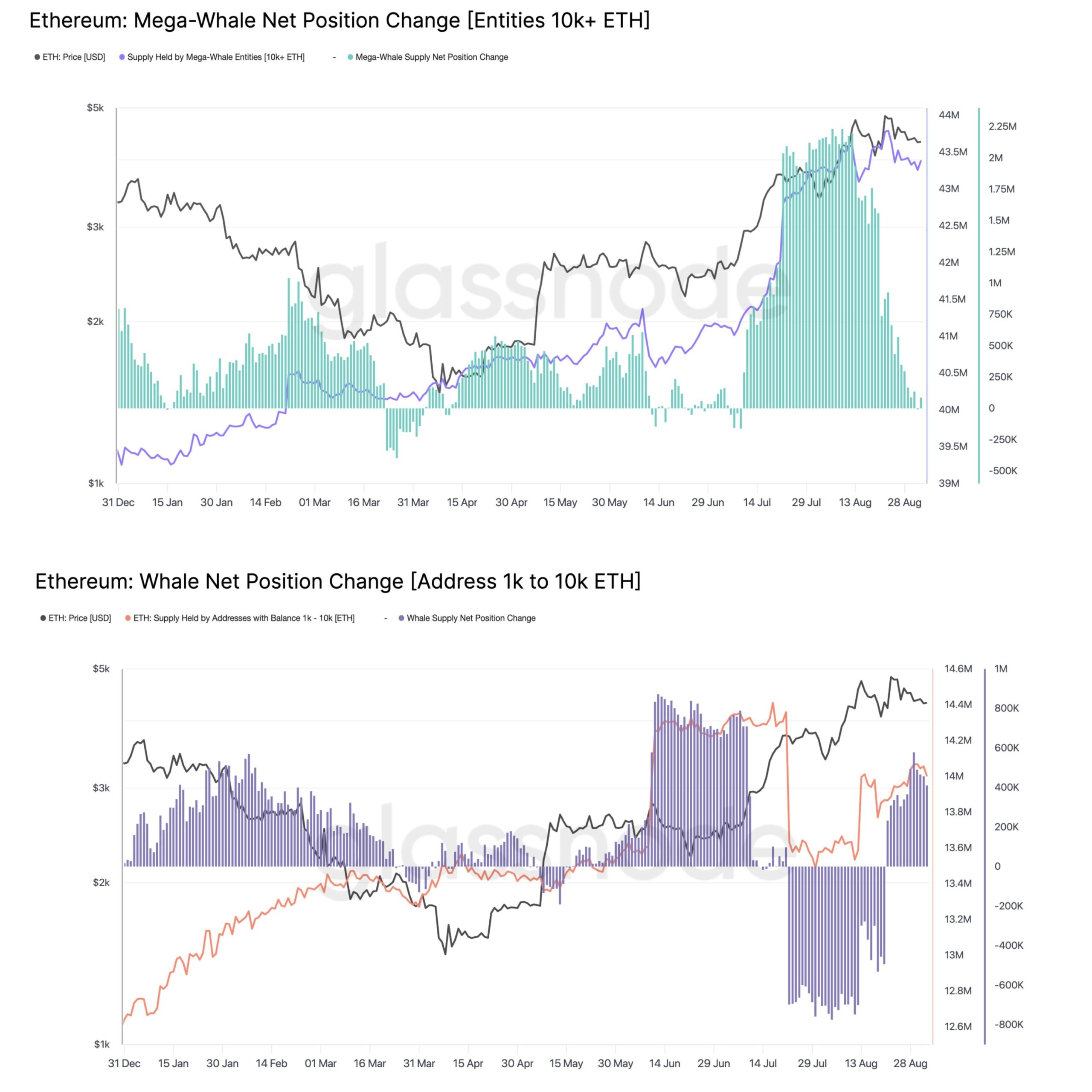

The mega whales-those majestic creatures holding over 10,000 ETH each-were the life of the party earlier this year, accumulating a whopping 2.2 million ETH in just 30 days. But now? They’ve hit the pause button faster than you can say “blockchain.” Meanwhile, the mid-tier whales (with wallets stuffed between 1,000 and 10,000 ETH) decided it was time to shop again, adding around 411,000 ETH to their stash in the same period. Clearly, whales don’t consult each other before making decisions. Imagine family dinners at Whale Manor. Awkward. 🦈

This behavioral split might reflect differing risk appetites-or maybe some whales just got tired of scrolling through whale TikTok and decided to try something new. Whatever the reason, the community is buzzing with theories. Some observers warn that the mega whales’ sudden pause could be a trap. Yes, dear reader, a trap! Like a mousetrap baited with cheese-shaped numbers. 🧀

“The pause at the top is bait, the mid-tier rotation is the real tell,” FOMOmeter tweeted, because apparently we needed yet another term to confuse us.

Translation: When the big whales stop buying, it looks like the party’s over, tempting smaller traders to panic-sell. But oh no, it’s all part of the plan! While everyone else panics, the mid-tier whales quietly start accumulating again, signaling that the smart money knows something you don’t. Classic misdirection, folks. It’s almost poetic. Almost. 🎭

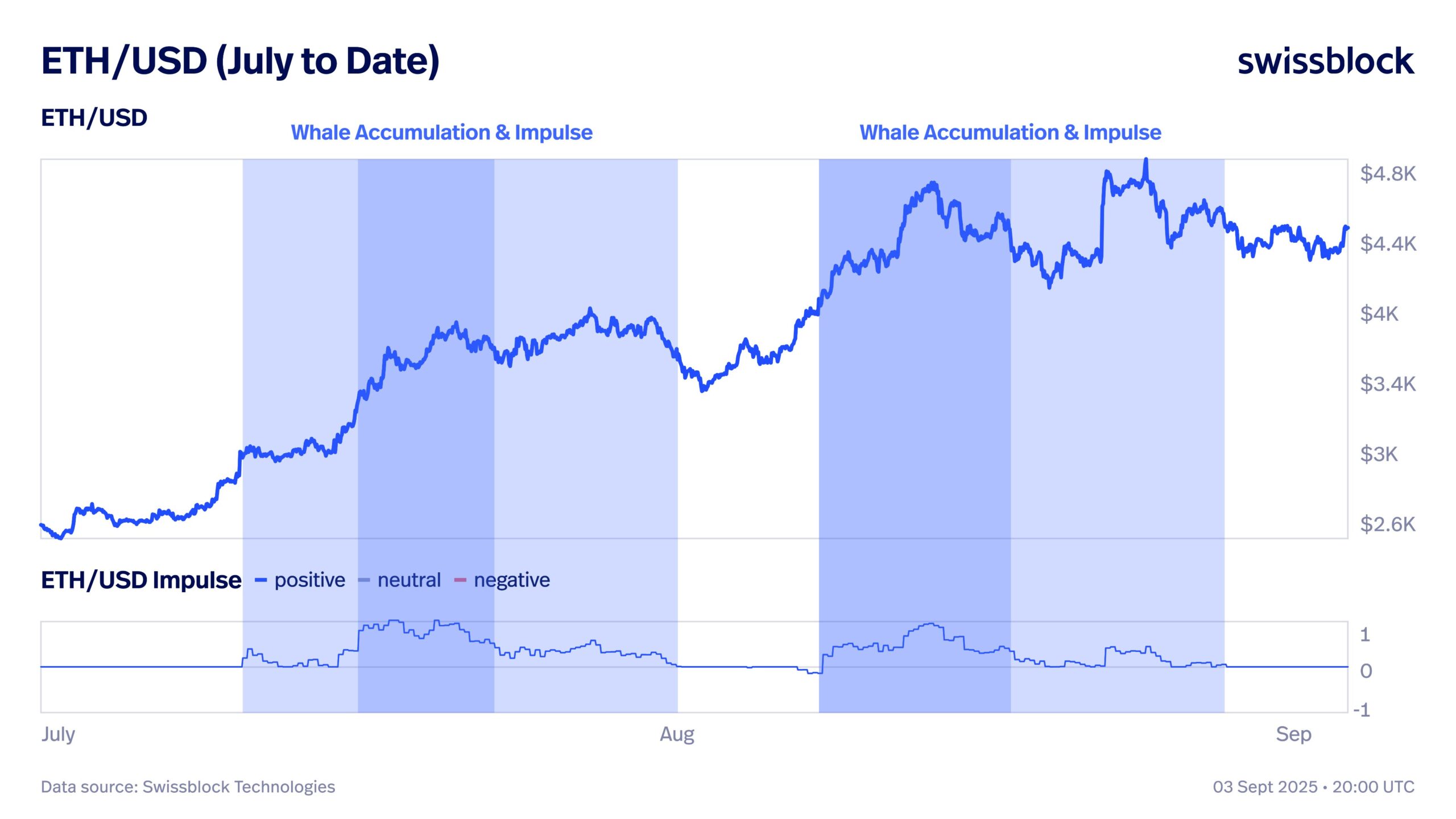

Meanwhile, Altcoin Vector chimed in with some wisdom, noting that Ethereum’s upward moves tend to follow whale accumulation patterns. Apparently, these whales aren’t just randomly swimming around-they’re choreographing an elaborate dance routine that only they understand.

“The accumulation of whales is key: Mid-July through August showed strong accumulation by mega whales (≥10K ETH), followed by large whales (1K-10K ETH). Those accumulation periods align with the development of ETH’s aggregate impulse,” Altcoin Vector explained.

But here’s the kicker: To break $5,000, ETH needs fresh whale fuel to power its rocket ship. Right now, derivatives trading is steering the ship, which means rallies could collapse faster than a soufflé in a wind tunnel. However, if spot demand picks up, confidence might return, and ETH could blast off like a firework on New Year’s Eve. 🚀✨

“Nevertheless, this can change if ETH breaks out and spot demand increases. Confidence in the short-term trend could resume and generate a new impulse capable of clearing the prior highs,” Altcoin Vector added optimistically.

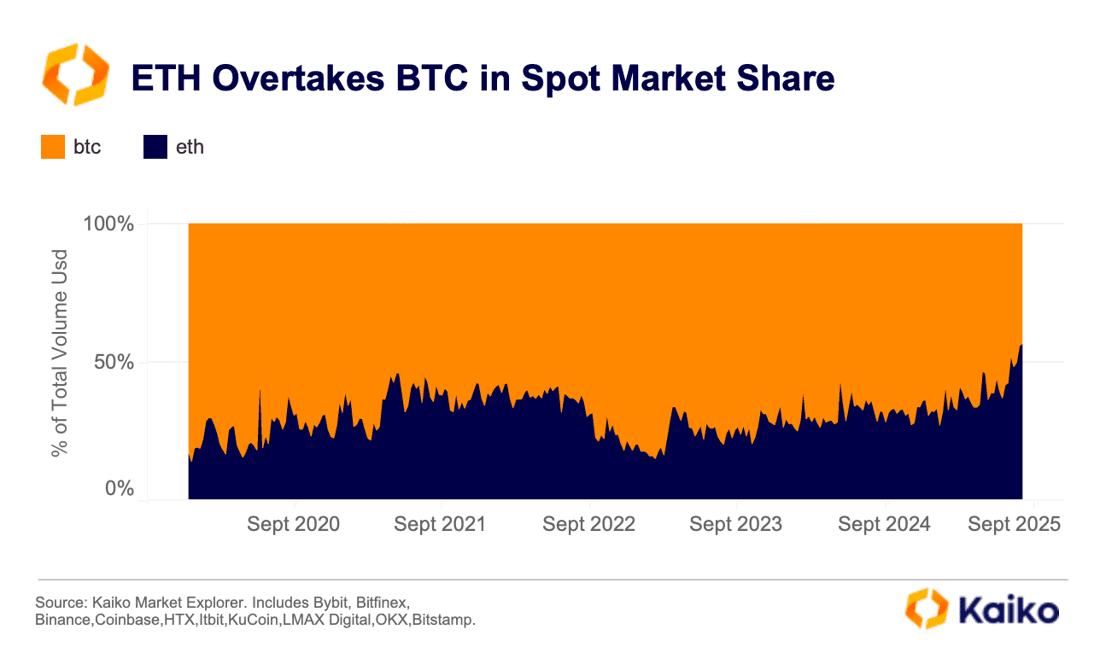

Adding to the drama, Kaiko reported that ETH spot trading volume recently outpaced Bitcoin’s, suggesting institutional and retail interest is heating up faster than a teapot on a stove. A $4 billion Bitcoin whale pivoted to ETH, buying 886,000 ETH, while ETF inflows favored Ethereum over Bitcoin. Even DeFi and NFTs are showing signs of life, proving that Ethereum isn’t dead-it’s just taking a dramatic nap. 💤

“There’s a major shift between BTC & ETH: $4 billion Bitcoin whale pivots to ETH, buying 886K ETH. $1.4 billion ETH ETF inflows vs BTC’s $748 million. Finally! Ethereum cross-chain UX upgrades in the works. DeFi + NFTs showing fresh upside. These sharp moves signal momentum building for ETH,” Token Metrics posted.

And let’s not forget the pièce de résistance: Ethereum supply on exchanges has hit a three-year low. Reduced selling pressure is usually a good sign, unless, of course, everyone forgot how to sell entirely. Either way, Crypto Crib predicts a “monumental” supply shock in Q4, which sounds both terrifying and exhilarating. Like riding a rollercoaster operated by penguins. 🐧🎢

“Ethereum supply on exchanges hits 3-year LOW at 17.4 million ETH. Quant says the supply shock will be monumental for returns in Q4,” Crypto Crib forecasted.

So, where does this leave us? Ethereum is standing at a crossroads, surrounded by conflicting signals, divergent whale behavior, and enough uncertainty to fill a library. Tightening supply and surging trading volumes suggest potential fireworks ahead-but whether those fireworks will light up the sky or fizzle out remains anyone’s guess. Stay tuned, dear readers. The whales are writing the script as we speak, and frankly, none of us knows how this movie ends. 🎬

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-09-04 09:10