Amidst the ever-changing tides of the financial world, there are moments that stand out, moments that whisper of the grand drama of human endeavor. Such is the case with Ethereum, which, after a breathtaking rally of over 50% in less than a week, has soared above the $3,700 mark, much to the delight of its ardent followers and the chagrin of those who dared to bet against it. The air is thick with the scent of optimism, as traders and analysts alike gaze upon the horizon, waiting with bated breath for the next chapter in this epic tale of bull and bear.

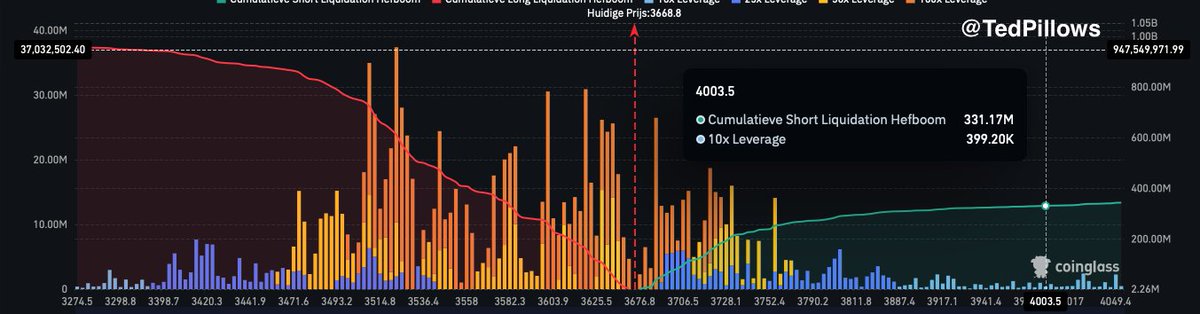

Now, the brave bulls of Ethereum prepare to assault the formidable fortress of $4,000, a level that stands as a testament to both the resilience and the ambition of this digital currency. According to the wise sages of derivatives data, this threshold is a crucible, a place where the fate of many a bearish position will be decided. Should Ethereum breach this sacred ground, the ensuing chaos could see the liquidation of $331,170,000 worth of short positions, setting off a chain reaction of forced buybacks that might propel the price to even greater heights.

But, dear reader, let us not get too carried away by the heady winds of speculation. For every advance, there is a retreat, and the market, in its infinite wisdom, demands a price for its favors. Market participants, ever the cautious breed, are watching for the telltale signs of confirmation—volume expansion and sustained buying pressure—that will signal whether this latest surge is the prelude to a grander ascent or merely a fleeting moment of glory. A decisive push above $3,800 could open the gates to $4,000 and beyond, while a failure to hold the line might lead to a brief respite, a moment of reflection before the next great battle commences.

And yet, amidst the technical jargon and the charts that chart the rise and fall of empires, there is a deeper story unfolding. Ethereum, you see, is not just a collection of numbers and algorithms; it is a living, breathing entity, shaped by the hopes and fears of those who believe in its potential. The recent legal clarifications in the United States, through the passage of the Clarity and GENIUS Acts, have brought a semblance of order to the wild frontier of cryptocurrency, reducing the regulatory fog that once clouded the path forward. Coupled with the growing influx of ETF investments and the resurgence of on-chain activity, these developments hint at a future where Ethereum might not only conquer the $4,000 mark but forge ahead into uncharted territories.

For now, Ethereum (ETH) trades with a certain regal dignity, perched at the lofty height of $3,817.49, having gained 1.57% on the day. The chart, a tapestry woven from the threads of past triumphs and setbacks, tells a story of a powerful upward trajectory, with ETH surmounting the formidable resistance at $2,850. Supported by robust volume, this latest breakout confirms the bullish spirit that has come to define Ethereum in recent times, as it inches closer to the hallowed ground of $4,000.

The technical indicators, those trusted guides of the market, are all aligned in favor of the bulls. The 50-day, 100-day, and 200-day moving averages march in unison, pointing skyward, while ETH remains comfortably above all key SMAs, including the 200-day SMA at $2,824.88, which now serves as a bulwark against any potential downturn. The next challenge lies just beyond, in the $3,850–$4,000 zone, a region that has seen its share of battles. A successful conquest here could herald a new era of growth, perhaps even leading to new yearly highs.

Yet, in the world of finance, as in life, one must always be prepared for the unexpected. After such a meteoric rise, a period of consolidation or a gentle pullback would not be out of character for our hero. Should Ethereum falter and fail to secure a foothold above $4,000, it might find itself retreating to the safety of the $3,742 support level, a momentary setback in an otherwise triumphant journey.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR NZD PREDICTION

- EUR ARS PREDICTION

- Solana Network: Is the Surge in TVL Just a Fluke, or a Real Bullish Turn? Find Out!

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Dogecoin’s Bull Run? Don’t Bet Against This Chart, Says Analyst 🐕💸

2025-07-21 20:48