TL;DR

- ETH forms a bullish engulfing candle near $4,200, a sign of renewed demand and potential trend continuation.

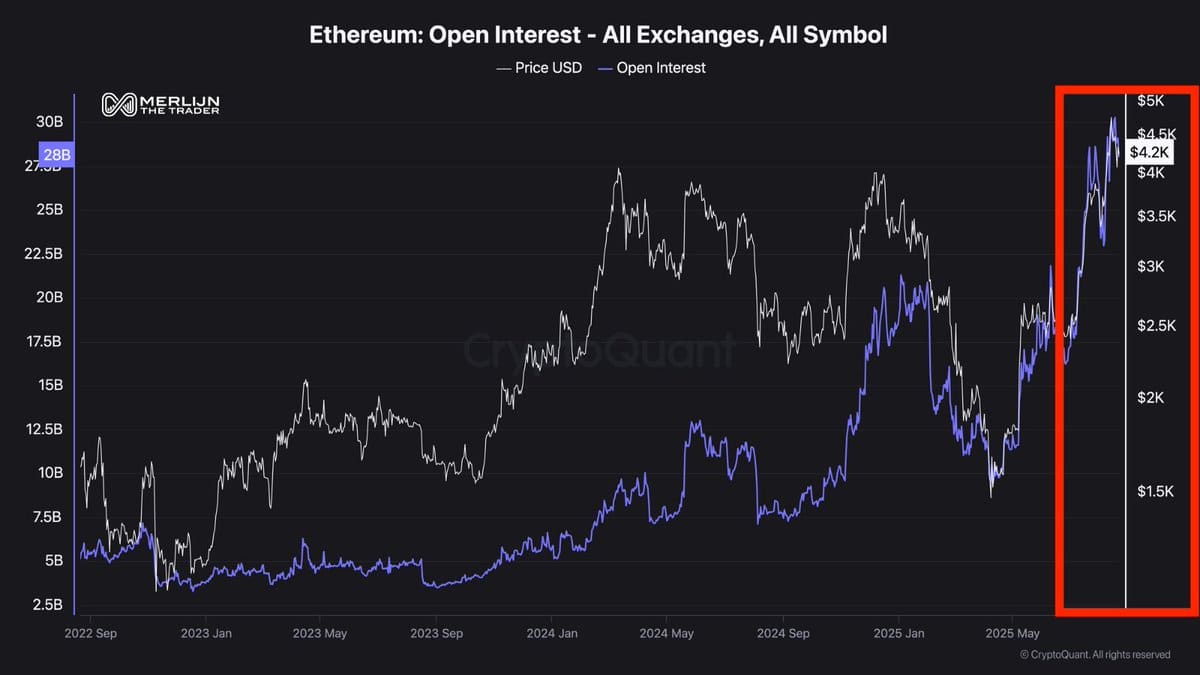

- Open interest soars to a record $28 billion, with traders eagerly awaiting Ethereum’s next grand movement.

- Whales and even the U.S. government are scooping up ETH during dips, tightening the supply and bolstering market confidence.

In the grand ballroom of the financial markets, Ethereum (ETH) has just executed a most elegant and bullish engulfing candle on the daily chart. Cas Abbé, a seasoned dance critic, observed that this particular step shows the buyers have returned to the floor. The green candle, like a dancer gracefully covering her partner, has fully enveloped the previous red one, a formation often interpreted by the audience as a change in the rhythm of the market.

Abbé further elaborated, noting that every dip is met with enthusiastic buying, institutions are joining the dance, and the original Bitcoin enthusiasts are selling their BTC tickets to join the ETH waltz. This performance took place near the $4,200 mark, which may now serve as a sturdy support. ETH continues to follow its ascending melody, a tune that has been playing since May, with the price harmoniously rising along its curve.

$ETH has formed a bullish engulfing candle here.

Dips are getting bought, institutions are buying while Bitcoin OGs are selling their BTC to buy ETH.

Now is the worst time to be bearish on ETH.

– Cas Abbé (@cas_abbe) August 22, 2025

Remarkably, the open interest in ETH has reached unprecedented heights, surpassing $28 billion. Merlijn The Trader, another keen observer of the market’s choreography, remarked, “Historically, these setups don’t consolidate. They detonate.” The data reveals that the leveraged positions are at their peak, indicating a vigorous and spirited engagement across various exchanges.

With Ethereum trading above $4,000, the surge in open interest suggests that a significant movement is on the horizon. Merlijn added that this could be Ethereum’s most spectacular breakout since 2021, given the substantial exposure now woven into the fabric of the market.

Accumulation by Institutions and Government

Merlijn also reported that the U.S. government, not one to miss a beat, has added $332,460 worth of ETH to its collection, bringing its total holdings to a staggering $254 million. He commented, “Governments don’t stack Ethereum for fun. They stack it for power.”

“Governments don’t stack Ethereum for fun. They stack it for power.”

On-chain analyst Ali Martinez noted that wallets holding between 10,000 and 100,000 ETH have purchased 400,000 coins during the recent dip. This treasure trove, valued at approximately $1.7 billion, has increased their total holdings to nearly 30 billion ETH, or 25% of the circulating supply. This accumulation has reduced the available supply on exchanges and demonstrates a robust participation from large holders.

Technical Setup Points Toward $4,666

Analysts are also keeping a keen eye on an inverse head and shoulders structure on the 4-hour chart. Bitcoinsensus identified a clear left shoulder, head, and right shoulder, with a neckline near $4,300.

A breakout above this neckline, if supported by high trading volume, projects a move toward $4,666. Bitcoinsensus emphasized, “Bulls need volume confirmation for breakout to stick.” Without it, ETH risks being rejected at resistance and might return to a more sedate, consolidating dance.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Brent Oil Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- XRP: A Most Lamentable Fall! 📉

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- XRP: Banking, Bonds, and Bonkers Politics – What’s Next?

2025-08-22 17:53