Imagine, if you will, a battleground where bullish fervor and skeptical whispers dance a wary tango – Ethereum, caught in the grand waltz of price and paradigm.

Market Overview: ETH Jumps, Whales Swell, and the Rich Get Richer-With a Chuckle

Our digital darling flirted briefly with a steely $3,730 before retreating gracefully to $3,639, as reported by Brave New Coin’s Ethereum Liquid Index (ELX). The leap was fueled, no doubt, by a Monday boogie of nearly 6%, courtesy of the behemoth BitMine Immersion Technologies-holding over 833,000 ETH, a neat $3 billion kitty, making it a sort of crypto mega-merlot in the world of treasury wines.

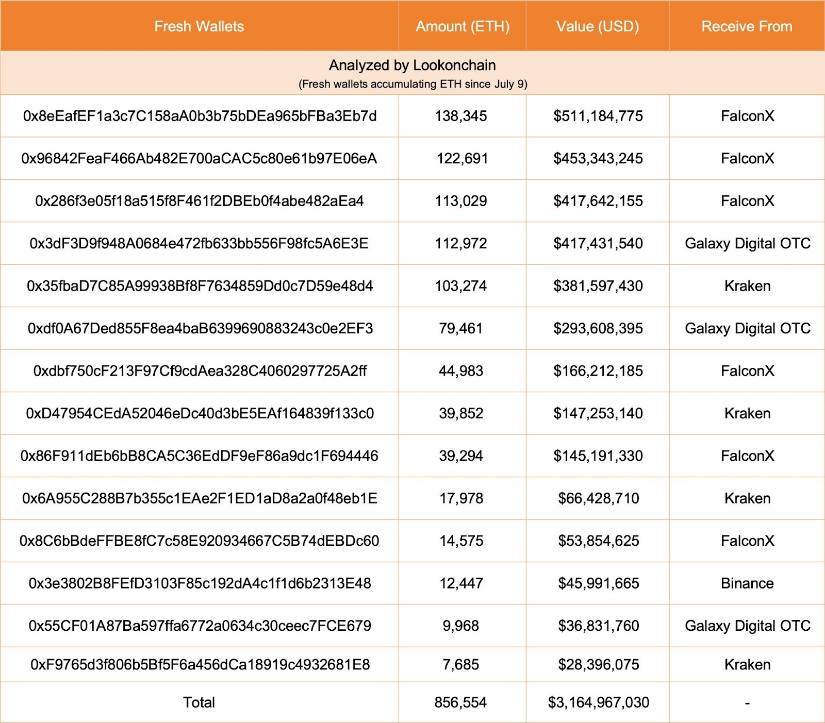

But wait, the whale parade is no subtext. Lookonchain, that eternal snitch of the blockchain, reports 14 fresh whale wallets gobbling up 856,000 ETH – think of it as a crypto buffet, with a delectable $3.16 billion bill, in just two days. Meanwhile, long-term confidence is bubbling up, with Ethereum wallets over 10,000 ETH swelling in number, perhaps contemplating their own mansion aspirations.

The Big Boy Reserve: Swelling to $10.8B and Powering Up

Ethereum’s grand reserve, dubbed the SER for short, has swelled from under three billion greenbacks to over $10.8 billion-seems like a financial miracle or a crypto miracle salad-within a mere six weeks. This marble monument holds roughly 2.45% of all ETH, a testament to institutional infatuation, or perhaps just a well-placed bet on the future.

Cas Abbé, the sage of crypto wisdom, calls Ethereum a “golden opportunity,” especially for those who missed Bitcoin’s recent rollercoaster. The signs are unmistakable: more firm hands accumulating, betting on a trip toward $4,000, all while scribbling charts and daydreaming of the glory days.

ETFs in Turmoil: The $465 Million Farewell-Bye-Bye, Baby

Meanwhile, the ETF scene is more soap opera than stock exchange. On August 5, the ETH ETF outflows hit a staggering $465 million, with BlackRock’s ETHA leading the vanishing act at $375 million. Fidelity’s FETH couldn’t resist either, shedding $55.1 million, while Bitcoin ETFs mourned with a $333 million downfall. But the market, ever the diva, shrugged and rallied 4% in a day-because volatility is just a fancy term for “watch what I do next.”

The outflows? Probably some profit-taking, or maybe just a case of “I need a vacation.” Whatever the reason, macro buffs hope this is just a blip, a temporary abstinence from the crypto buffet.

Activity Booming: Ethereum’s 15-Month High Party

The network, ever lively, hit a high note with 1.7 million daily transactions – the most in over a year! Wallets are sprouting faster than weeds, and activity surges like a caffeinated squirrel. Thanks to EIP-1559, ETH burns are keeping supplies tight, turning the network into a delicate balance of utility and scarcity, a kind of digital eco-restaurant.

Resistance or Resistance? ETH at the Crossroads

Ethereum now wavers between $3,400 and $3,800, bouncing 9% from a low of $3,355 – cheers for the bounce! Support whispers around $3,422, but the looming taxman, er, resistance, stands at $3,800. Breakthrough? Target $3,941 and beyond, but beware the pullback to $3,013 if confidence falters.

Options traders, those cautious cats, keep hedging; the 25% delta skew is quite the neutral party. It’s a wait-and-see game while everyone secretly hopes for a breakout-cue dramatic music.

Can Ethereum Outshine Bitcoin? The Great Flip or Flop

Bigger picture: does Ethereum have a shot at surpassing Bitcoin in a few months? Bitcoin still dominates headlines, but Ethereum’s hefty treasuries, stable staking rewards, and Layer 2 cheerleaders suggest it’s not just playing second fiddle anymore. Institutional interest is the new love affair, and the ETF exits may be a temporary heartbreak.

Tom Lee, the ever-optimistic chair of BitMine, sees Ethereum as the long game’s star-its NAV per share roaring, liquidity thriving, and competitors trembling in envy. The future? Bright enough to make a neon sign blush.

The Final Curtain: To Buy or Wait for the Curtain Call?

Long story short: Ethereum dances delicately, buoyed by on-chain strength but yet to charm institutional giants conclusively. The whale hoards and rising reserves shout bullish, but ETF drainages and macro jitters whisper caution. If the resistance at $3,800 shatters, expect a leap toward $6,000 come Q4 2025, or at least that’s what the wise say. Meanwhile, traders dance in the resistance zone, and holders clutch their bags, hoping for an encore.

Read More

- Gold Rate Forecast

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- USD HKD PREDICTION

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

2025-08-06 00:30