In the shadowed corridors of December, Ethereum’s price languished, a ghost of its former self, as the $3,000 threshold crumbled like a poorly baked soufflé. Investors, once bullish as babushkas in a bread line, now faced the bitter truth: their digital holdings had turned to digital ice, melting into losses with the subtlety of a Soviet-era secret.

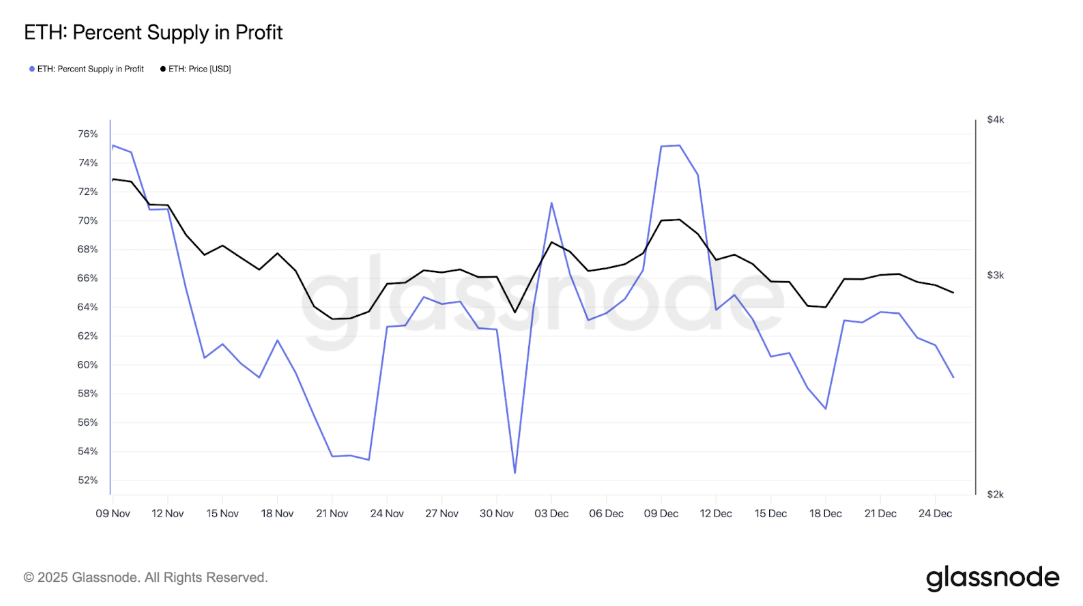

On-chain data, that cold, unblinking eye of modernity, revealed a grim tableau. The percentage of ETH supply in profit plummeted below 60%, a number so mundane it could only inspire existential dread. Meanwhile, institutions, those titans of capital, retreated like peasants from a plague, their once-mighty demand now a whisper. Glassnode’s charts, once vibrant with hope, now resembled a funeral march for dreams sold on margin.

The 60% Threshold: A Rubicon of Profitability

This 60% mark, once a fortress, now lay in ruins. Investors, like soldiers in a losing war, found themselves deeper in red, their wallets echoing the hollow thud of shattered expectations. The brief resurgence to $3,000 on December 22? A mirage, a cruel joke played by the market’s capricious hand. For hours, hope flickered-then died, smothered by the weight of reality.

As the price sank again, so too did the supply in profit, from a meager 70% to a pitiful 60%. Not merely new buyers suffered; even those who’d clung to Ethereum in early December now faced the reckoning. The pullback, once a trickle, became a flood, sweeping away the optimists and the opportunists alike.

ETF Exodus: When the Wise Men Flee 🏃♂️💰

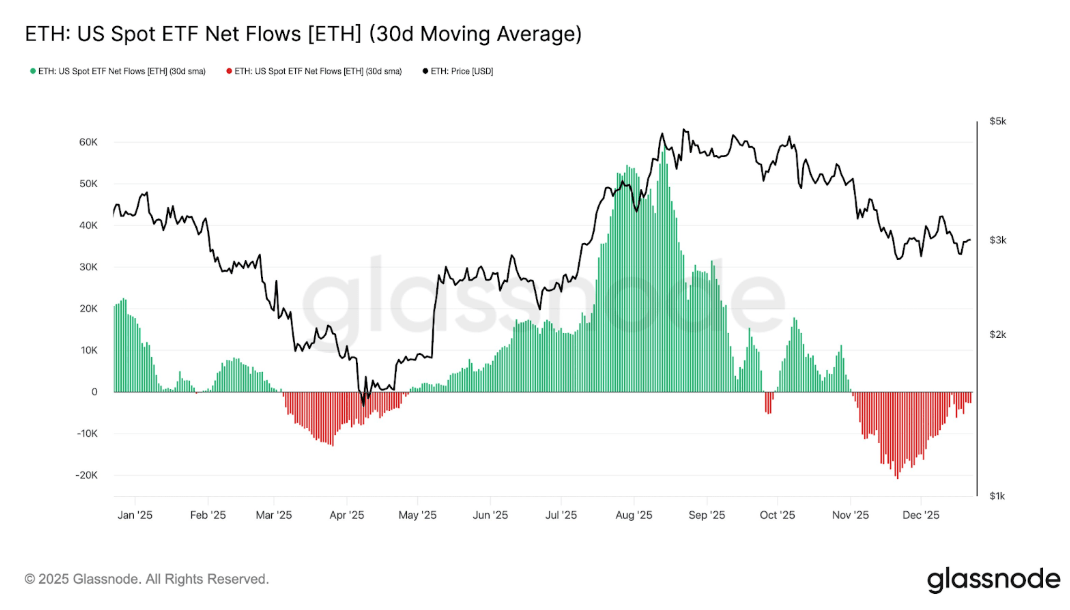

The ETFs, those modern-day Promethean fire carriers, had grown cold. Glassnode’s data painted a picture of institutional disengagement-a 30-day average of net outflows that turned negative and stayed there, like a bad neighbor refusing to move. The inflows that once propelled Ethereum to dizzying heights? Gone, replaced by a dirge of withdrawals.

The ETF chart, a once-glorious tapestry of green, now bore the stains of red. Without this lifeblood, Ethereum floundered, unable to absorb the sell-side’s voracious appetite. The $3,000 level, once a benchmark, became a tombstone for ambition.

And yet, the stage was set for a farce. Whales, those leviathans of liquidity, began their exodus. Erik Voorhees’ phantom wallet, dormant for nine years, awoke to swap 4,619 ETH for Bitcoin Cash-a move as dramatic as a monk converting to disco. “Not me!” he protested, as if the blockchain itself would believe him. Arthur Hayes, BitMEX’s fallen star, sold 1,871 ETH, his fingers likely crossed, hoping the market wouldn’t notice.

In this dance of folly and fear, one truth emerged: the digital gold rush had turned to a sand trap. The investors, the institutions, the Icaruses-all were left to wonder if they’d ever find their way back from the abyss. Or if, like Solzhenitsyn’s prisoners, they’d simply learn to dig deeper into the earth of their own delusions.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Sui’s Synthetic Dollar: A New Toy for the DeFi Aristocracy

- CRV PREDICTION. CRV cryptocurrency

- Crypto Circus Escalates: The Wild Ride After Ethereum’s $4.5K Breakout 🎢🚀

- Bitcoin’s $91K Slump: Spot Buyers Steal the Show (Again)

- EUR VND PREDICTION

2025-12-27 23:52