Ah, Ethereum! A tale of ambition, institutional interest, and technological triumph. Who would have thought that a cryptocurrency once thought to be a passing fancy would now be gearing up for a breakout worthy of the greats? Ethereum, the proverbial phoenix, is setting itself up for a potentially jaw-dropping ascent this August. With all that institutional money flowing in, a regulatory environment that even the most skeptical might consider favorable, and upgrades galore, this coin is ready for its next act. How far will it climb? Only time will tell-but, dear reader, it’s looking promising.

Market Overview: ETH Breaks $4,000 Barrier With Momentum

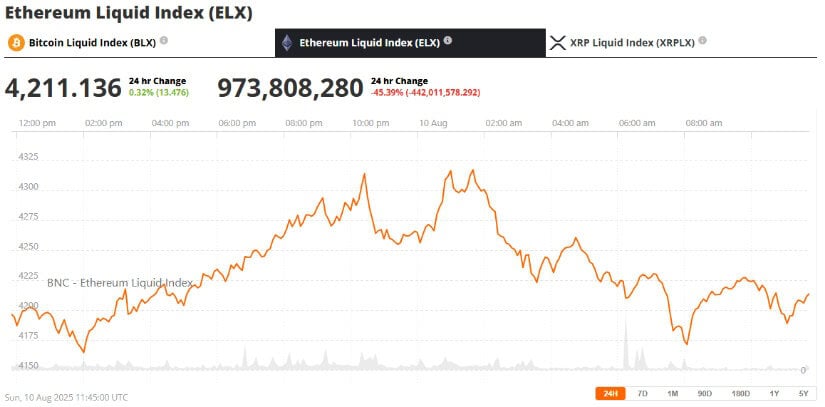

After what seemed like an eternity of consolidation below the $4,000 mark, Ethereum has broken through, reaching intraday highs above $4,300. It’s a glorious sight, one that could inspire even the most cynical among us to raise a glass (or perhaps just their eyebrows). Analysts are gushing, noting that ETH’s price chart is backed by a rising trendline and a series of higher lows. So, it appears that Ethereum is, indeed, not just a fluke. With all this momentum, it’s safe to say that the excitement is contagious-so contagious, in fact, that it’s spreading through the market like wildfire.

The surge is being driven by, dare we say, institutional capital. Yes, you read that right. Over $8.7 billion has flowed into Ethereum-focused exchange-traded funds (ETFs) since their launch. The kind of buying pressure that makes one wonder if ETH might be just the thing to bring the proverbial “institutional herd” to the yard. And if you’re wondering whether the rise will last, just look at the charts. It’s looking solid, at least for now.

Layer 2 Ecosystem Fuels Growth and Efficiency

Scalability. A problem that has plagued Ethereum like an unwanted guest. But lo and behold, Ethereum has found a solution in the form of Layer 2 protocols. Networks like Arbitrum, Optimism, and zkSync are making Ethereum cheaper to use. Who knew that Ethereum’s struggles would one day lead to this? With faster transactions and cheaper gas fees, Ethereum has become more attractive to developers and users alike. And it’s not just for show. As Layer 2’s Total Value Locked (TVL) continues to grow, decentralized applications (dApps) are flocking to these networks. Could this be the future of Ethereum? Perhaps-but let’s not get too carried away just yet.

But the fun doesn’t stop there. As gas fees drop and staking opportunities rise, Ethereum’s demand for ETH is accelerating. Because, naturally, why not make a few bucks while you’re at it? The people have spoken, and they want ETH, and they want it now.

Institutional Demand Rises with Favorable Tax and Regulatory Environment

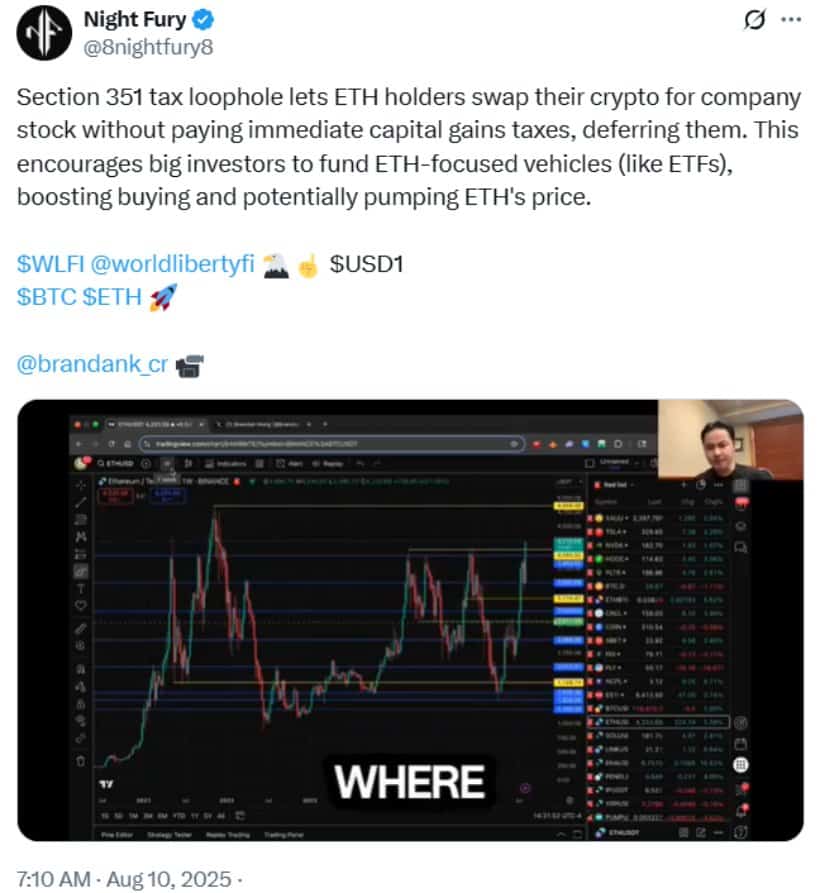

And just when you thought it couldn’t get any better, here comes the good news for institutional investors. Ethereum’s latest rally is partly fueled by a regulatory environment that even the most jaded might applaud. With tax-advantageous structures like IRS Code 351 allowing long-term holders to exchange Ethereum for treasury shares without incurring capital gains tax, it’s clear that Ethereum is no longer just a “retail” play.

Big companies are also taking notice. Bitmine and GameSquare are now accumulating Ethereum as part of their corporate treasury strategy. Oh, how times have changed. Could we see a future where these corporate giants control 10% of the total supply? Only time will tell. But it sure does make you think, doesn’t it?

Oh, and did we mention the U.S. regulatory moves? The GENIUS Stablecoin Act and new executive orders allowing retirement funds to invest in crypto? Yes, it appears the regulatory landscape is now giving Ethereum a warm, welcoming hug. Investors are flocking to ETH like moths to a flame. And with the market buzzing, it’s hard not to wonder: Is Ethereum on the brink of greatness?

Technical Analysis: Key Resistance Levels to Watch

Now, let’s talk about the technicals. Ethereum has reached a crucial point. The immediate resistance is at $4,370, but the real action is expected around the $4,800 to $5,000 mark. If ETH can hold above $4,000, the rally might just continue. But-oh, what’s this? There’s a catch. If Ethereum can’t hold its support levels between $3,200 and $3,400, we might see some pullbacks. And let’s not forget the volatility that comes with massive liquidations. Just recently, over $114 million in ETH was liquidated within an hour. A warning shot, perhaps?

Vitalik Buterin’s Net Worth Hits $1 Billion Again Amid Rally

And, oh, let’s not forget the man behind the curtain-Vitalik Buterin. The Ethereum co-founder has once again earned his “on-chain billionaire” status, as his portfolio now stands at over $1.03 billion. But, of course, don’t let his success fool you into thinking all is smooth sailing. Buterin, ever the realist, has warned against over-leveraged treasury policies. Let’s face it: even billionaires have their concerns.

What Lies Ahead for Ethereum?

So, what’s next for Ethereum? It seems that Ethereum’s rally is here to stay for a while, thanks to the influx of institutional buying, technical improvements, and a more favorable regulatory environment. And with Layer 2 usage increasing, we might just see ETH soar to new heights. Will it hit $5,000? Perhaps. Will it break new all-time highs? Only time will tell, but the future seems incredibly bright for Ethereum.

As for the rest of us, we’ll just keep watching, hoping, and maybe, just maybe, holding on for the ride. After all, in this market, anything can happen.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Why Is Everyone Obsessing Over These Cryptos? 🤔

- USD MXN PREDICTION

- CRO PREDICTION. CRO cryptocurrency

- USD JPY PREDICTION

- EUR THB PREDICTION

- AVAX Poised for a Jump: Why the Next $80 Might Just Be a Matter of Time

- BNB Hits ATH, But Bearish Whispers Grow 🚀💸

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

2025-08-10 23:27