In the dim light of evening, the financial world whispers of Ethereum-an ethereum of hope, despair, and perhaps a dash of grandiosity. Recently, the Funding Rate-a curious thing-has dipped into the negative, casting shadows over traders’ hearts. What ghosts haunt this market now? Well, let’s peer through the fog.

Ethereum Funding Rate: The Market’s Cranky Mood

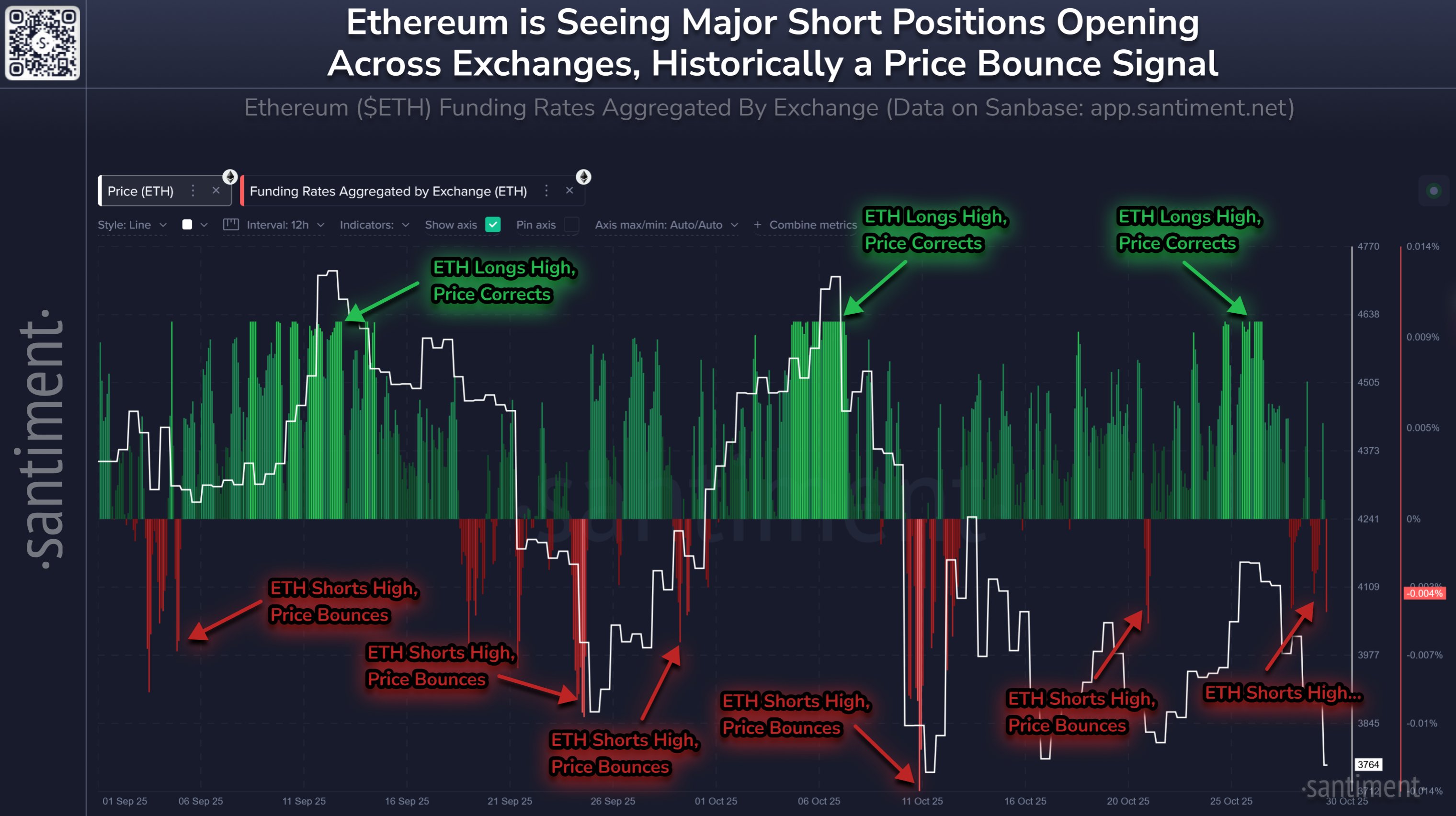

According to Santiment, the wise owl of analytics, traders now favor short positions more than they favor their morning coffee. The “Funding Rate,” as the cool kids call it, reflects the periodic monetary exchange among derivatives traders. Think of it as a financial soap opera where long holders pay short sellers, or vice versa, depending on the mood of the day.

If the rate is positive, imagine the longs waving their banners, paying a premium to keep their dreams alive. A bullish anthem, yes? But when the rate falls below zero, it’s more like a grim bathroom mirror-reflecting bearish thoughts, gloom, perhaps even existential dread.

And so, here is the chart shared by Santiment, a lovely visual reminder of the tumultuous sea of traders’ emotions:

Lo and behold, the Funding Rate has tumbled into negative territory-suggesting that traders are now leaning towards bearishness, probably dreaming of crashing prices. But in the grand cosmic dance, such dark clouds often hide a silver lining.

Interestingly enough, history shows that when Ethereum’s Funding Rate dips into these depths, the price often does a peculiar dance-correcting when it should rally, rallying when it should settle. A contradiction? Perhaps a sign that markets love a good squeeze-liquidation cascades, whirlpools of chaos, the kind of excitement that only traders can love.

Nevertheless, the current negativity isn’t as deep as the past crashes, which means we’re all watching how the next act of this medieval mystery unfolds.

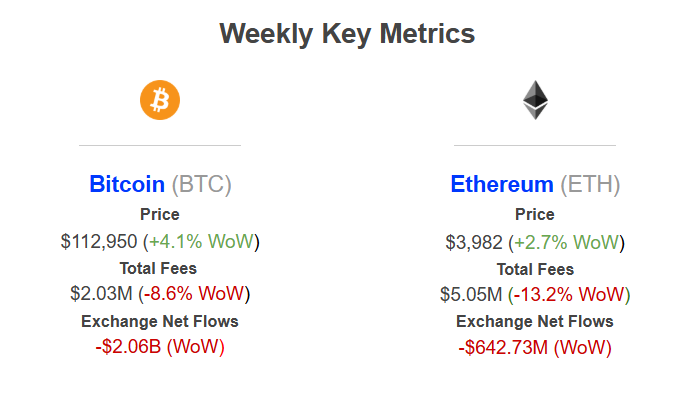

Meanwhile, Ether’s unloved cousin, Ethereum, has seen a hefty outflow of about $643 million this week, according to Sentora, a fine institution of financial wisdom. Over on Bitcoin’s side, over $2 billion has escaped-like a thief in the night. Sentora claims it’s a bullish sign, a long-term hold’s badge of honor-though it sounds like good riddance, really.

ETH Price: The Rollercoaster Continues

As of now, Ethereum is nominally perched at around $3,850, climbing more than 2% in a day-perhaps comforted by the knowledge that markets remain unpredictable as a fox in a henhouse.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- Silver Rate Forecast

- Brent Oil Forecast

- USD HKD PREDICTION

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

2025-11-01 11:19