Dear Reader, one cannot help but observe the most praiseworthy endeavors of SharpLink Gaming, a company of considerable repute, whose chairman, the estimable Joseph Lubin, is no stranger to the realm of Ethereum. With a most calculated and prudent endeavor, the company has augmented its Ethereum reserves by nearly 30%, a feat most commendable in these trying times of financial flux.

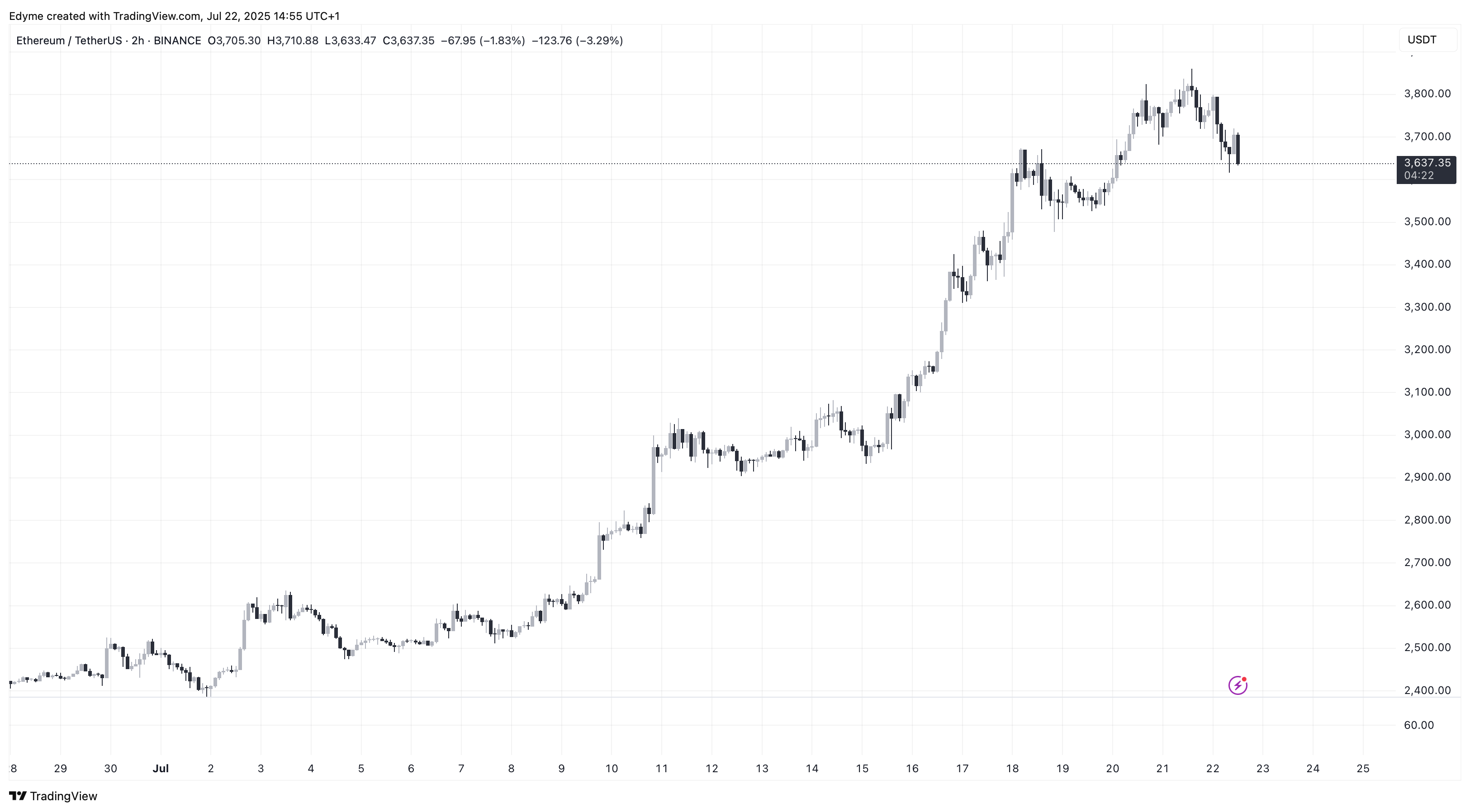

Indeed, between the 14th and 20th of July, SharpLink acquired a most substantial sum of 79,949 ETH, at an average price of $3,238 per token, thereby elevating its total holdings to a staggering 360,807 ETH. One might say this is a most strategic move, akin to a well-timed ball at a society gathering, where the goal is to secure the most advantageous position. 💰

Staking Activity and Market Strategy

To fund this grand acquisition, SharpLink raised a sum of $96.6 million through its at-the-market equity program, issuing approximately 3.8 million shares. One might wonder if the shareholders are as delighted as a cat with a saucer of cream, though the company assures us the funds are not fully deployed, leaving ample room for further acquisitions. 🧠

This move has solidified SharpLink’s position as the largest corporate holder of Ethereum, a title most coveted, and has elevated the token to the status of primary treasury reserve asset. The company’s ETH Concentration metric, a measure of crypto exposure per share, has risen to 3.06, a 53% increase since mid-June. A most impressive feat, one might say, though it does raise the question: is this a prudent strategy or a folly of the highest order? 📈

Since announcing its digital treasury strategy on June 2, SharpLink has earned 567 ETH in staking rewards, a testament to its intent to generate yield while maintaining long-term holdings. One might liken this to a well-managed estate, where the fruits of labor are reaped with patience and foresight. 🍇

The weekly ETH purchase of nearly 80,000 tokens marked the company’s largest acquisition during any reported period, a bold stroke of genius, or perhaps a most calculated gamble. SharpLink emphasizes that its treasury model aligns with its broader business goals and shareholder value enhancement efforts. A most admirable sentiment, though one cannot help but wonder if the shareholders are as enamored as a young lady at a ball. 💼

Chairman Joseph Lubin, a man of considerable intellect and influence, stated that the company’s treasury strategy aims to capitalize on market conditions to build a substantial ETH reserve. His words, as ever, are imbued with the gravitas of a man who knows his worth. 🧠

The continued strength of ETH and our ability to acquire significant volume at opportunistic prices support our aim to continue enhancing ETH concentration and shareholder value through disciplined execution of our treasury growth strategies.

Policy Developments and Regulatory Context

In addition to its ETH expansion, SharpLink also responded to regulatory developments, specifically the recent passage of the GENIUS Act by US President Donald Trump. A most bipartisan legislation, it introduces a federal framework for stablecoins and digital asset operations, requiring full asset backing, regular audits, and clear issuer guidelines. SharpLink, ever the dutiful citizen, expressed support for the bill, citing its potential to create a more favorable climate for blockchain integration and innovation. 🏛️

Lubin remarked that the legislation reduces regulatory ambiguity, enabling firms like SharpLink to build more confidently in the digital asset space. His words, though measured, betray a certain satisfaction, as if a long-held worry has finally been alleviated. 🧠

With the GENIUS Act now law, the regulatory uncertainty that has surrounded crypto innovation is finally easing. We believe this ushers in a more supportive environment for companies like SharpLink to… harness the full potential of Ethereum — including its security, scalability and smart contract utility.

With more capital still available for ETH purchases and favorable legislative conditions emerging, SharpLink’s Ethereum-based treasury strategy may continue to expand. A most promising prospect, though one cannot help but wonder if the company’s ambitions are as lofty as a pigeon in flight. 🦜

The firm’s alignment with Ethereum’s ecosystem positions it to capitalize on infrastructure growth, institutional adoption, and broader market developments in the crypto space. A most astute observation, though one might question if the firm is as wise as it is wealthy. 📈

Featured image created with DALL-E, Chart from TradingView

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- EUR NZD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- Meme Coin Mania: A $500 Million Frenzy 🤑

- OKB’s Wild 160% Ride After a Burn & a Glow-Up-Crypto or Circus? 🤡🔥

- Dogecoin: $1 Dream or Financial Nightmare? 🚀💸

- Why MSTR Stock Just Took a Nosedive: Bitcoin Drama Unfolds!

2025-07-23 09:30