Just days after flirting with its peak near $4,878, Ethereum finds itself back below $4,300. Yet, despite the dip, it clings to a robust 15.3% monthly gain, a testament to its stubborn resilience.

While the short-term enthusiasts are eager to “buy the dip,” the road ahead isn’t without its shadows. A ominous bearish signal is emerging on the 4-hour chart, casting a wary eye on the near-term prospects.

Short-Term Buyers Multiply, But Reserves Remain Skeptical

The Ethereum HODL wave chart reveals a steady influx of new buyers over the past 30 days.

Two key short-term groups-those holding ETH for 1 day to 1 week, and 1 week to 1 month-have seen their shares grow:

- 1d-1w cohort expanded from 2.8% to 3.39%

- 1w-1m cohort surged from 6.3% to 8.5%

This uptick in fresh buying suggests that dip-buying is gaining momentum among traders who likely saw an opportunity during the recent pullback. HODL Waves offer a glimpse into the shifting dynamics between long-term and short-term holders.

For token TA and market updates: Craving more token insights? Don’t miss Editor Harsh Notariya’s Daily Crypto Newsletter here.

Meanwhile, Ethereum’s exchange reserves remain stubbornly low, hovering near 9-year lows. Despite some whale-led inflows, the reserves barely budged, moving from 18.389 million ETH on August 15 to 18.404 million ETH at press time. This scarcity means that each dip is met with fresh buying, a double-edged sword for the bulls.

Low reserves typically indicate a limited supply of ETH ready for immediate sale, a silver lining for those betting on a rise.

A Chart Pattern That Could Spell Trouble for Ethereum

Amidst the bullish signals from buyers and exchange flows, a potential pitfall looms on the short-term chart.

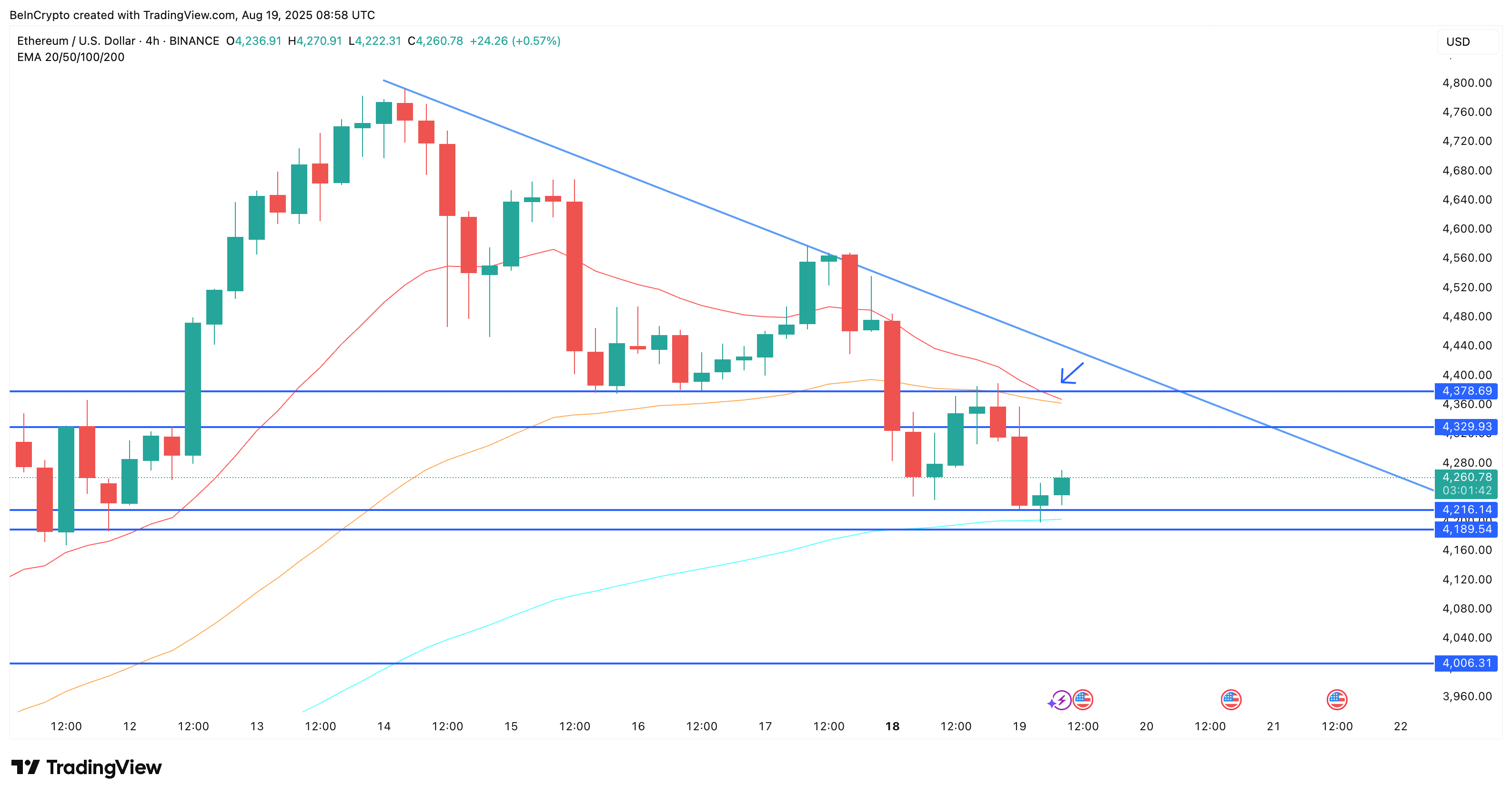

The 4-hour chart is hinting at a bearish “death” crossover, where the 20-period EMA (red line) is poised to drop below the 50-period EMA (orange line). This crossover is often a harbinger of increased selling pressure, a cautionary tale for the bulls.

The EMA, a moving average that prioritizes recent price movements, helps traders stay agile in the face of market shifts. When a shorter-period EMA crosses a longer-period EMA, it can signal a change in the price trend, for better or worse.

Compounding the concern, Ethereum is shaping a descending triangle, a bearish continuation pattern. It’s currently testing two critical support levels: $4,216 and $4,189. A breach below these could spark a more aggressive sell-off.

The heatmap reveals weak demand zones just beneath these levels, suggesting that ETH might plummet to $4,006 if sellers gain the upper hand.

The bearish forecast might ease if Ethereum can reclaim $4,378. Such a move could invalidate the bearish crossover, turning the 20-EMA and 50-EMA lines into supportive barriers.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Silver Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- USD HKD PREDICTION

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-19 22:13