Ethereum, that elusive creature of the crypto world, has managed to climb back above the $3,000 mark after weeks of being crushed under the weight of its own volatility. Investors, still trembling from the market’s tantrum, are wondering: is this the beginning of a beautiful reversal, or just a brief respite before the storm? The price action may look promising for the short term, but the larger market forces and resistance levels are doing their best to keep everyone on edge. 🎭

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ETH seems to have pulled off a neat little bounce from the $2,600-$2,500 support zone. It’s currently bobbing above $3K, flirting with that nasty little zone where support turned resistance. Oh, the drama! Now, we’re heading toward the 200-day moving average, which lurks just around $3,500 – a key level, and more importantly, a psychological threshold that could send traders into fits of either euphoria or despair. 🤷♂️

The daily RSI has managed to crawl back from the depths of the oversold abyss and now sits at 42.91. Is that a sign of bullish energy returning to the market? Possibly. But let’s not get too carried away; we’re still far from a definitive trend reversal.

The chart structure, though, remains suspiciously gloomy, with lower highs and lower lows still in place. For real change to happen, buyers must push past $3,500. Anything below that, and sellers are likely to pounce. If the bounce fizzles out and falls below the $2,500 demand zone, the dreaded $2,100 level will be the last line of defense. And let’s face it, that’s not where you want to be. 🙄

The 4-Hour Chart

Switching to the 4-hour chart, ETH has been cruising within a tidy rising channel since its jump off the $2,600 support. It’s now tapping at the $3,000 mark, which conveniently sits right in the middle of the resistance zone. What a coincidence, right? But here’s the thing: the price action currently resembles a bearish flag, which, let’s be honest, is the chart pattern that screams “continuation of a downtrend.” Yet, if buyers can force their way above the $3,200 mark and maintain that, they could destroy the bearish setup, triggering a push to $3,500. Fingers crossed, folks! 🤞

Right now, ETH is consolidating in this resistance block, and the RSI sits at 64.42. This could indicate a potential pullback or, if you’re feeling adventurous, a short-term slowdown. Don’t get too comfortable, though. If this bullish flag breaks to the downside, the next stop is the $2,800 low, and from there, it’s back to the $2,500 demand zone. Let’s hope we don’t go that route. 🙃

On-Chain Analysis

Exchange Reserve

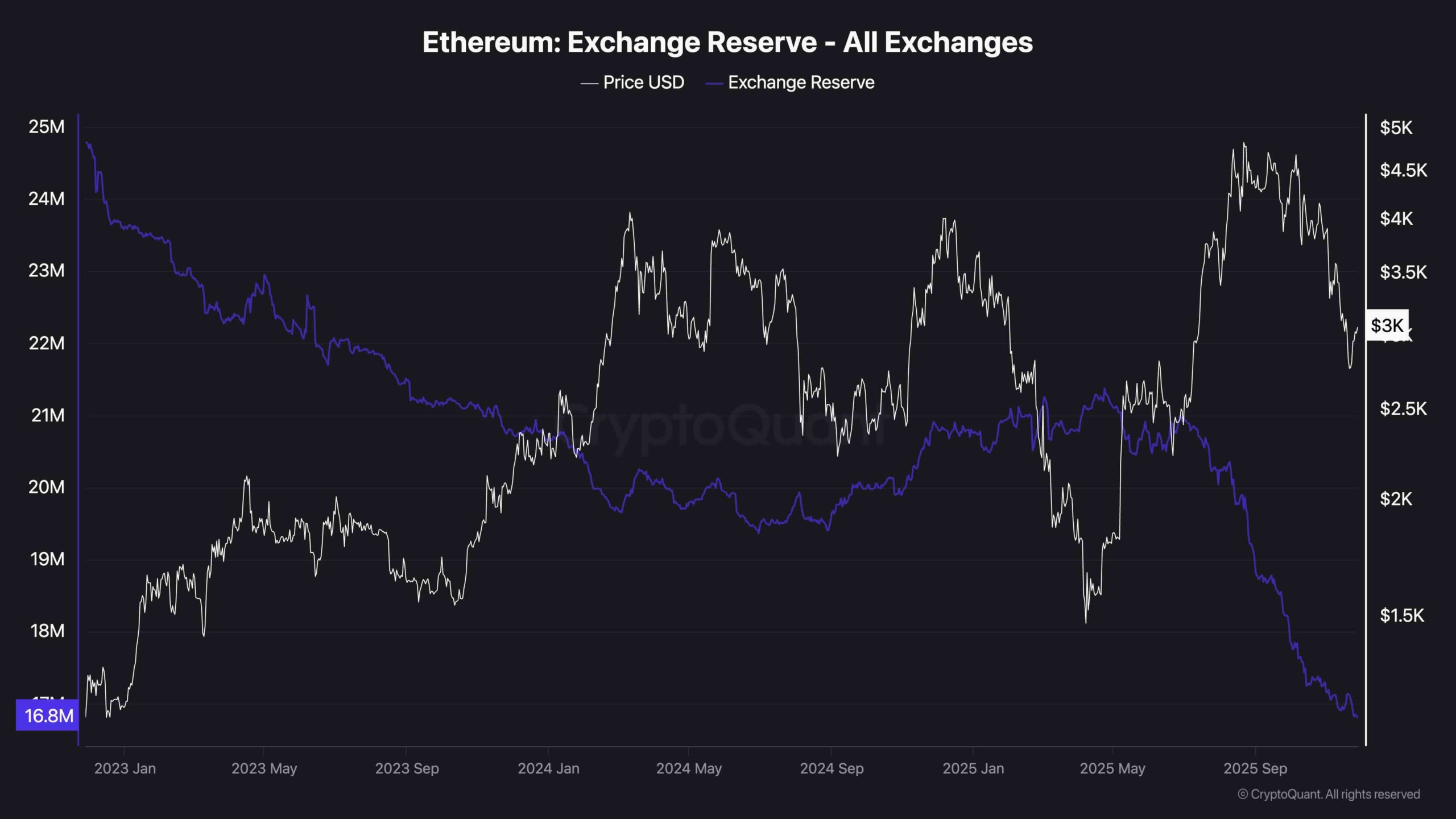

From the on-chain perspective, Ethereum’s exchange reserves are dropping like it’s a hot potato (a very expensive one, mind you). We’re now at a multi-year low of 16.8M ETH. That’s right, folks-more and more ETH is leaving centralized exchanges, likely to be safely tucked away in cold storage or staked, which is generally a bullish sign in the long run. Who needs exchanges when you can store your coins like a treasure chest? 🏴☠️

This outflow from exchanges is a pattern we’ve seen before, and it tends to precede significant rallies. But, of course, predicting timing is always the tricky part. Still, this shrinking supply is adding a hopeful, if somewhat hesitant, undertone to Ethereum’s overall outlook. Maybe, just maybe, if macro risks start to calm down, we could see something exciting. But don’t hold your breath. 😏

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- EUR AED PREDICTION

- USD ILS PREDICTION

- EUR NZD PREDICTION

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

2025-11-28 15:40