XRP exchange reserves hit historic lows on Binance as institutional ETF inflows exceeded 900M. The supply shock increases with accelerating withdrawals.

Ah, XRP – the crypto that just can’t catch a break. If you’ve been keeping an eye on Binance lately, you’ll know things are getting downright dramatic. XRP exchange reserves have plummeted to all-time lows. And what’s behind this catastrophe? A tidal wave of institutional demand via ETFs, of course. Who could have predicted that? Certainly not us.

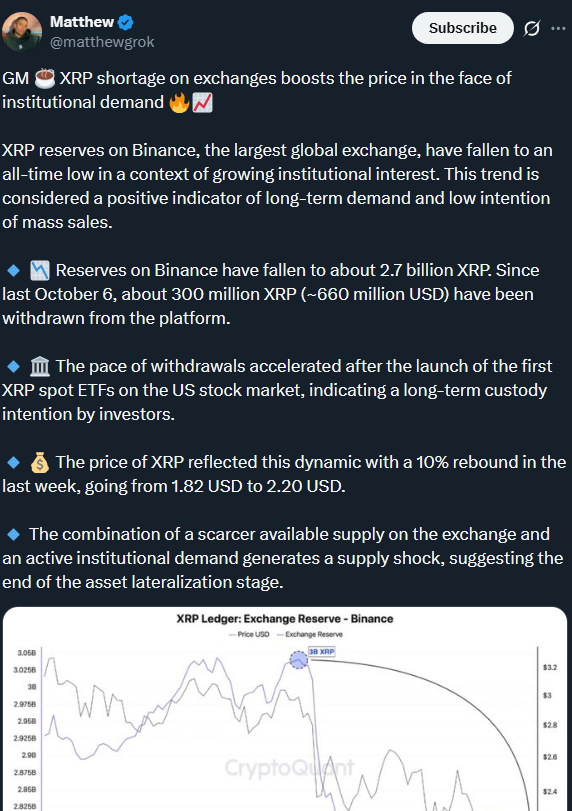

Now, imagine this: Binance, the biggest exchange on the planet, is seeing an exodus of XRP. A staggering 300 million XRP have slipped into the void since October 6. You’d think it was some sort of secret heist. The platform’s reserves? A pitiful 2.7 billion tokens – the lowest level in history. Who’s to blame? Only every institutional investor and their ETF craze.

Source: Matthewgrok on X,

Matthewgrok on X had this to say: “Classic supply shock situation. Little supply, tons of aggressive institutional buying. The exodus? Oh, that’s just long-term custody plans in motion.” Yeah, sure, that’s totally a ‘normal’ situation, right? The market freaked out, of course, and XRP surged from $1.82 to $2.20 last week. Ten percent! Because, as we all know, when things get tight in crypto, prices always react calmly.

The ETF Catalyst Nobody Expected

But wait, the plot thickens! The introduction of spot ETFs in November was supposed to be the calm before the storm. Instead, withdrawals went into overdrive. It’s as if the whole institutional world suddenly decided that XRP was their new precious. LordOfAlts had a field day on X, tweeting about the ETF madness. And here’s the kicker: in just fifteen days, 861 million XRP were gobbled up by ETFs. No big deal, right?

The ETF monster has almost eaten a quarter of the total supply. As LordOfAlts ominously tweeted: “Something sudden comes quickly.” Maybe this sudden thing is a FOMO-induced rally, who knows? But as long as this ETF madness continues, it seems like we’ll be hearing more of that in the weeks ahead.

The inflows? Consistently massive. Take Wednesday, for example. XRP ETFs raked in $50.27 million. That’s not pocket change, people. RipBullWinkle, the self-appointed XRP guru, estimates total assets near $906 million. Not bad for a quiet Wednesday.

You might also like: XRP Supply Shock: What Experts Say Will Trigger Price Surge

Supply Vanishes Behind The Scenes

What’s really going on behind the curtain? Whales, like the mysterious sea creatures they are, are quietly hoarding spot holdings. Corporations? They’re stockpiling XRP like it’s the last thing on earth. But you wouldn’t know it by looking at the price. It’s almost like XRP is playing the silent game. Behind the scenes, the supply is thinning, while the price does its best impersonation of a sloth.

RipBullWinkle’s take? “No proportional movement in price yet.” Yet, he says, the XRP supply is silently building up pressure. A little conspiracy theory? Perhaps, but look at the data! According to Arab Chain, XRP’s ratio to total supply has dropped to yearly lows. Exchanges are being replaced by private wallets. Do we smell something fishy?

On-chain analyst Darkfrost, who may or may not be hiding in a dark room with a cup of tea, suggests that these withdrawals are actually a bullish sign. Investors are moving their holdings into cold storage. The plot thickens. The long-term believers are buying, while the short-term traders are left in the dust.

And guess what? This isn’t just Binance. It’s happening across other major exchanges, too. Liquidity is vanishing into institutional custodianship like a ghost at a séance. Spooky stuff.

What Happens When Supply Runs Dry

The age-old question: What happens when supply runs dry? If history’s any guide, an explosion is on the horizon. The drop in exchange reserves usually signals a massive rally. When supply becomes scarce, the price pressure ramps up in ways that could make your head spin.

CryptoQuant’s latest reporting shows the unmistakable footprints of institutions in these withdrawals. A majority of XRP isn’t coming back to exchanges. It’s being tucked away in cold storage, where it will quietly gather dust in the hands of ETF custodians.

At this rate, we’re in for some dramatic drama. Weekly withdrawals are averaging 45-55 million XRP. If things keep up, Binance might hit 2.65 billion by year’s end. Will this trigger a spike? Let’s just say the $2.40-2.50 resistance levels might not hold for long. Break through those, and we’re looking at a feeding frenzy. FOMO buying, anyone?

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- ETF Mania: Bitcoin And Ethereum Funds Hit Record $40 Billion Week

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

- You Won’t Believe What DBS Just Did with Crypto! 😲💰

- Worldcoin’s Wobbly Waltz: Traders Tiptoe Between Hope and Hesitation 🕺💰

- 🚀 Ethereum’s Grand Farce: Developers Flock, Bitcoin Yawns, Solana Whirls! 🎭

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2025-12-07 11:01