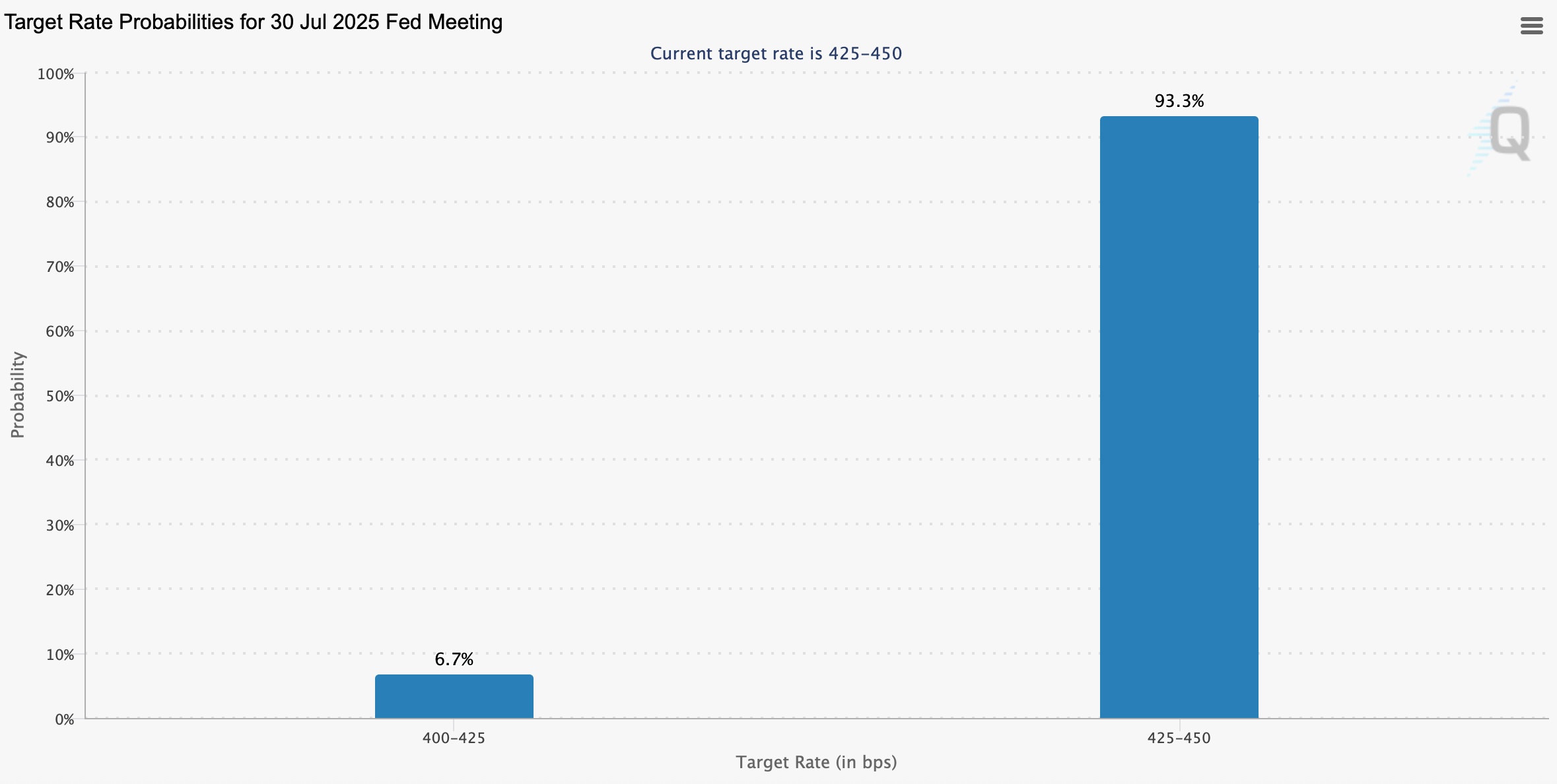

It’s a cruel, cruel world, and the U.S. Federal Reserve is not in the mood to make it any more pleasant for President Trump. Despite his increasingly vocal frustration with the Fed and its Chair Jerome Powell, the odds of a July rate cut are looking slimmer than a supermodel on a catwalk. A whopping 93.3% of CME futures market participants are betting on no rate change at all 🤦♀️.

The last time the Fed cut rates was during President Biden’s term, when the central bank lowered rates on Dec. 18, 2024, bringing the federal funds rate (FFR) to its current range of 4.25%–4.50%. Since then, the Fed has been stuck in neutral, refusing to budge even as other central banks around the world have eased 🌎.

But don’t just take our word for it! The CME FedWatch tool puts the odds of a quarter-point rate cut at a measly 6.7% 📉. And if you think that’s bad, prediction markets like Polymarket are pricing in just a 5% chance of a cut 🤯.

Meanwhile, a commanding 95% of traders on Polymarket are sticking to the view that rates will stay put 🙅♂️. And over on the regulated U.S. predictions platform Kalshi, the probability that the Fed holds steady sits at roughly 94% as of July 10 📊.

But wait, there’s more! The CME FedWatch tool paints a different picture for the September FOMC meeting—63.9% are anticipating a quarter-point trim, and 4.4% think a half-point move is possible 🤔. Roughly 31.7% still believe the Fed won’t make any adjustments come September 🤷♀️. Of course, all these bets could shift drastically in the next two weeks leading up to the July 30 FOMC meeting 📆.

One thing’s for sure: the market—and the Trump administration—will be paying close attention 👀. These Fed moves could end up steering how equities, crypto, and precious metals behave in the weeks ahead 📈.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Silver Rate Forecast

2025-07-10 18:57