\n

\n\n

What to know about 2025? Gold, that glorious golden sandwich that warms the heart of every medieval wizard, surged 65%. Meanwhile, Bitcoin, the shiny new trinket everyone insisted was “going to the moon”, suffered a 7% slump. Spoiler: August was the turning point. Both assets had been frolicking in the realm of +30% gains until gold decided to throw a lavish party and Bitcoin spectacularly knocked over the punch bowl.

\n\n

- \n

- Gold: 65% profit. Bitcoin: -7% profit. Gold: not just a currency, a cultural icon. 🏆

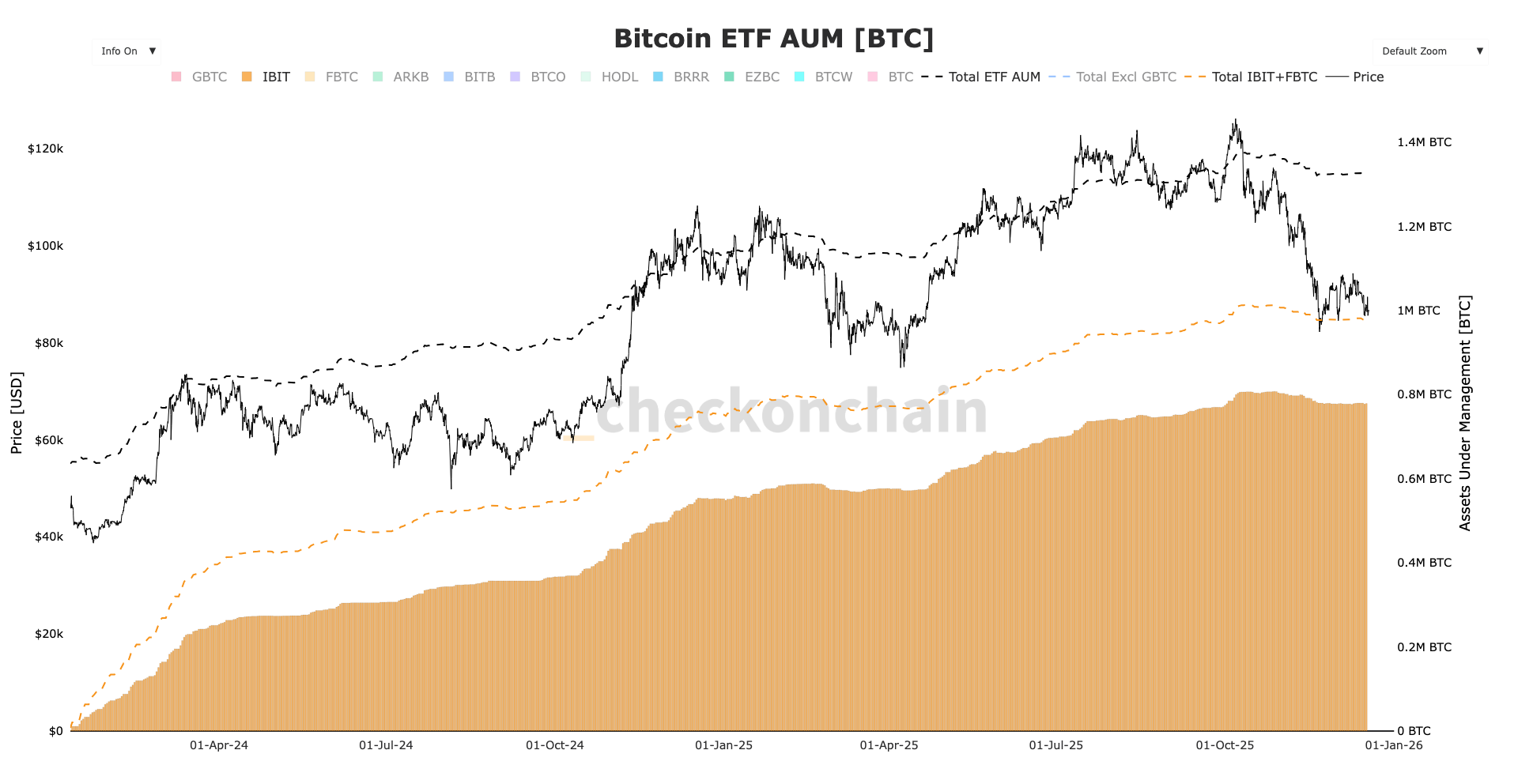

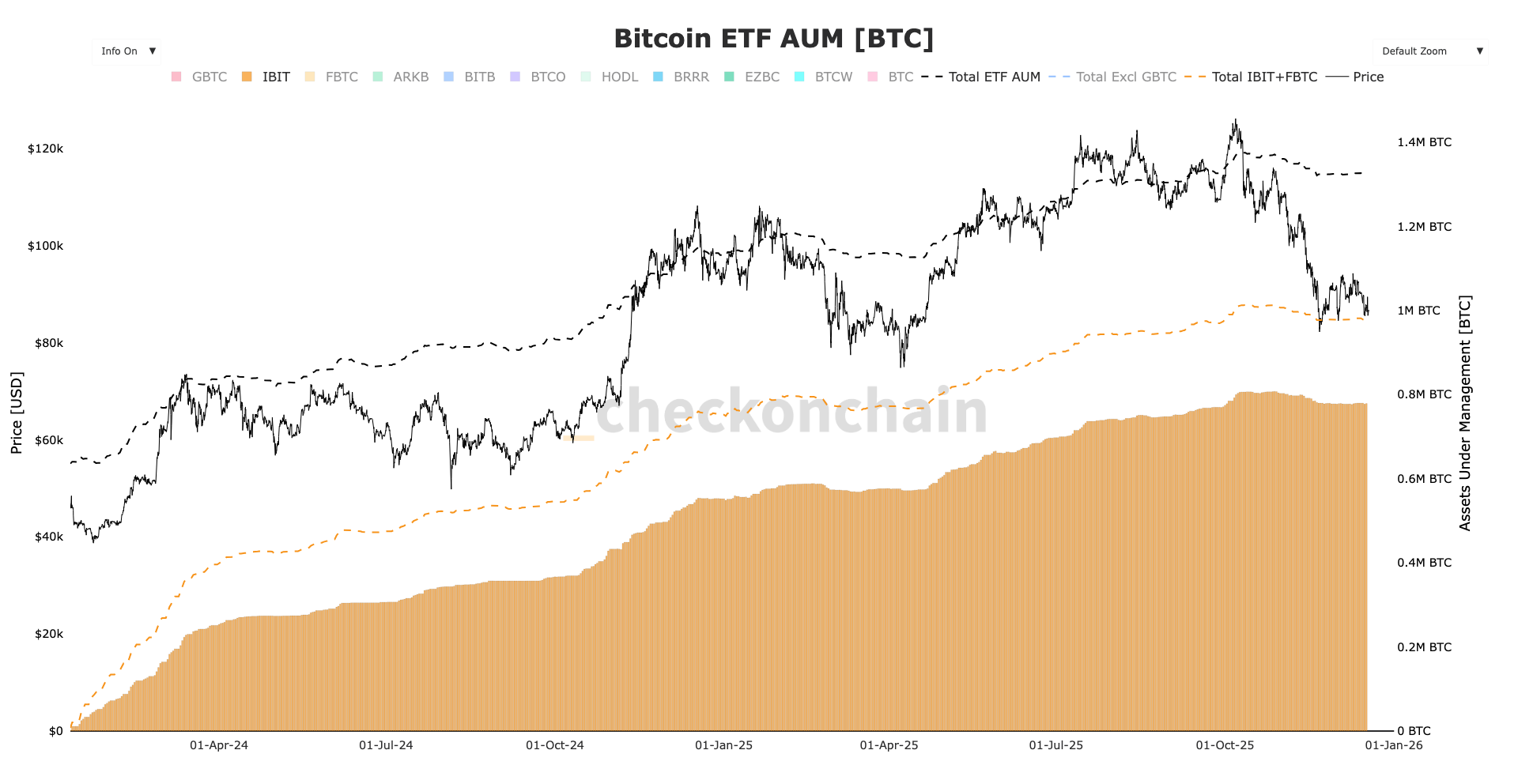

- Bitcoin’s October all-time high crumbled like a poorly-constructed soufflé (36% correction). Meanwhile, ETF holdings dropped a mere 3.6%, proving central bankers still play by the rules of their tiny dictionaries. 📊

- Bitcoin’s ETP flows outpaced gold’s by 2025. Because what market doesn’t need a little friendly one-upmanship?

\n

\n

\n

\n\n

So dear Discworld of finance, gold won the debasement trade narrative with the precision of a troll heisting a bank. Bitcoin? Well, it’s in recovery mode, languishing around $80k like a koala in a chemical spill. But fear not! Capital flows whisper a tale of resilient ETFs, despite the crypto’s plunge. Where were the prophets of profit? Probably praising decentralization from the back benches.

\n\n

Checkonchain’s data (a mystical oracle of blockchain clarity) reveals U.S. ETFs held 1.37M BTC in October and 1.32M BTC recently. Which is like saying the squirrel in the woods lost a nut-it’s not the end of the world, just slightly upsetting news for squirrels. BlackRock’s IBIT now dominates with 60% market share, which one might imagine as a particularly bossy troll taking over the bridge at Ankh-Morpork.

\n\n

Conclusion: Bit of a bounce for gold, bit of a wobble for Bitcoin. But as the Discworld’s postman Dave once said, “Never trust a surprises.” Unless they’re gold anomalies. Those are just trustworthy. 💎

\n

What to know about 2025? Gold, that glorious golden sandwich that warms the heart of every medieval wizard, surged 65%. Meanwhile, Bitcoin, the shiny new trinket everyone insisted was “going to the moon”, suffered a 7% slump. Spoiler: August was the turning point. Both assets had been frolicking in the realm of +30% gains until gold decided to throw a lavish party and Bitcoin spectacularly knocked over the punch bowl.

- Gold: 65% profit. Bitcoin: -7% profit. Gold: not just a currency, a cultural icon. 🏆

- Bitcoin’s October all-time high crumbled like a poorly-constructed soufflé (36% correction). Meanwhile, ETF holdings dropped a mere 3.6%, proving central bankers still play by the rules of their tiny dictionaries. 📊

- Bitcoin’s ETP flows outpaced gold’s by 2025. Because what market doesn’t need a little friendly one-upmanship?

So dear Discworld of finance, gold won the debasement trade narrative with the precision of a troll heisting a bank. Bitcoin? Well, it’s in recovery mode, languishing around $80k like a koala in a chemical spill. But fear not! Capital flows whisper a tale of resilient ETFs, despite the crypto’s plunge. Where were the prophets of profit? Probably praising decentralization from the back benches.

Checkonchain’s data (a mystical oracle of blockchain clarity) reveals U.S. ETFs held 1.37M BTC in October and 1.32M BTC recently. Which is like saying the squirrel in the woods lost a nut-it’s not the end of the world, just slightly upsetting news for squirrels. BlackRock’s IBIT now dominates with 60% market share, which one might imagine as a particularly bossy troll taking over the bridge at Ankh-Morpork.

Conclusion: Bit of a bounce for gold, bit of a wobble for Bitcoin. But as the Discworld’s postman Dave once said, “Never trust a surprises.” Unless they’re gold anomalies. Those are just trustworthy. 💎

Read More

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-12-20 16:27