The analyst, who prefers to dress his anxiety in italics and boldface (warned with the air of a man declining a third martini), declared that Bitcoin is loitering-possibly loitering with intent-near a threshold famous among financial ancients as the harbinger of apocalyptic market melodrama. One might almost suspect the cryptocurrency of theatrical ambitions.

The Thirty-Five Ounce Gold Snub

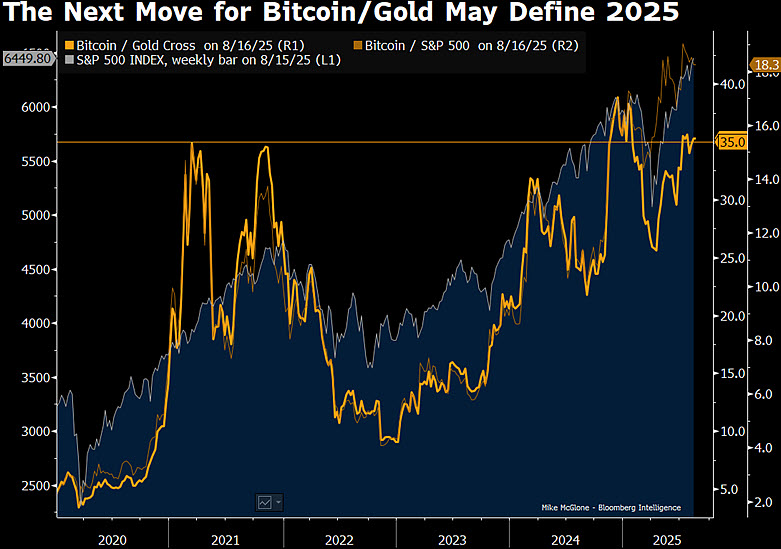

McGlone, a man whose calculator is certainly more polished than his optimism, has become enamored by the Bitcoin-to-gold ratio-presently perched around 35 ounces per solitary Bitcoin. This, we are told, is precisely the level reached in 2021, moments before Bitcoin decided to reenact Icarus, minus the sunblock. Should Bitcoin fail at this golden hurdle, he suggested investors would bolt for the safety of U.S. Treasuries, “the next big trade”-because there’s nothing like the thrill of earning 1.75% and a free lecture from your uncle at Thanksgiving.

“If Bitcoin slouches away from the vaunted 35 ounces of gold,” McGlone intoned, “prepare for bonds to rally and Treasury yields to swoon in synchrony, possibly toward 1.75%.” He likened this anticipated swoon to recent choreography witnessed in China’s markets-though one suspects the spectacle is more Swan Lake than Dragon Dance.

Which Crossroads? How Risky Can Risk Get?

Bitcoin, ever the muscular schoolboy eager to impress, has outperformed equities (BTC-to-S&P 500 ratio: approximately 18.3). Yet McGlone lectures that the ‘gold threshold’ carries far more weight for long-term wallet showboating. Should Bitcoin vault higher, it may swagger about as a high-beta peacock; if it flutters nervously or reverses, expect a broad recessionary sigh across markets-with crypto and equities alike reaching for smelling salts.

The Forecast Is… Unclear and Possibly Raining Bonds

The strategist, sounding every bit the Cassandra at a garden party, insists this gold-versus-Bitcoin duel is a microcosm of the world’s grand financial malaise: inflation drama 👻, central bank calamities, and geopolitical chicanery. If Bitcoin manages to leapfrog gold with style, investors may regain the confidence required to talk loudly at cocktail parties. If not, capital will gallop straight toward bonds and defensive assets, setting the mood for 2025: less Gatsby, more “Downton Abbey, after the inheritance tax.” 🍾📉

For those with grand investment ambitions: this tart commentary is for entertainment only. Coindoo.com disclaims any responsibility if-after skimming this-you decide to bet the family jewels on digital coins or ducats. Should you require actual advice, consult with someone whose credentials do not consist entirely of emojis, sarcasm, or literary references.

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Silver Rate Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Brent Oil Forecast

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- Bitcoin’s Wild Ride: Will It Hit $120K? 🚀

2025-08-18 06:32