Markets 🌪️

What to know: 🤔

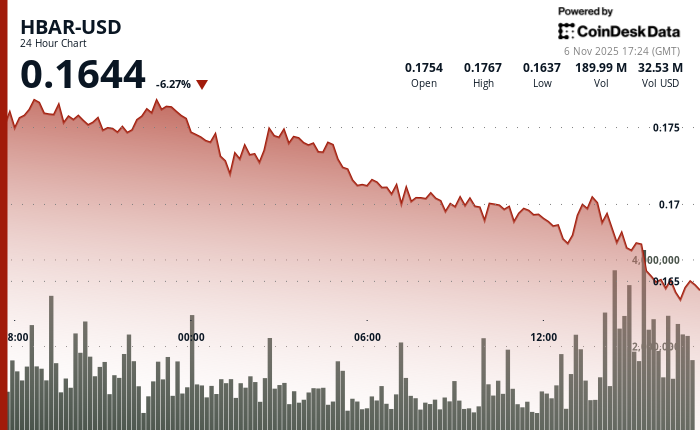

- HBAR took a nosedive from $0.1736 to $0.1691 in the past 24 hours, but like a stubborn mule, it found support at $0.1688 and decided to bounce back. 🪨💪

- Trading volume spiked 32% above average to 63.6M tokens, which is either a sign of renewed institutional interest or just a bunch of bots having a party. 🤖🎉

- A double-bottom pattern and higher lows suggest an early trend reversal, with targets set at $0.1720-$0.1730. Or, you know, it could just be the market trolling us again. 📈🤡

HBAR decided to take a 2.6% plunge in the past 24 hours, sliding from $0.1736 to $0.1691 because, well, why not? Sellers were in the driver’s seat during a session so technical it could’ve been written by a robot. 🤖📉 The move spanned a $0.0101 range-about 5.9% of trading value-with no fundamental catalyst in sight. Just the market doing market things, as usual. 🌪️💸

Trading volume surged as HBAR tested its $0.1688 support level, spiking 32% above the daily average to 63.6 million tokens. That burst of activity was followed by a sharp rebound, hinting at either renewed institutional buying interest or just a bunch of whales playing ping-pong. 🐳🏓 Resistance around $0.1770 kept earlier gains in check, while selling momentum fizzled out like a forgotten soda. 🥤💨

On the hourly chart, the token is showing early signs of a reversal from its recent downtrend. HBAR has started forming higher lows, moving from $0.1682 to $0.1690 before briefly testing resistance at $0.1706. A pullback to $0.1688 established a double-bottom pattern, which is either a bullish sign or just the market’s way of saying, “Gotcha!” 📉😂

Traders are now eyeing the $0.1720-$0.1730 zone as a near-term target. Sustained volume and buying pressure will be key to validating this breakout and overcoming the broader downtrend that’s been HBAR’s recent jam. 🎯💪 Or, you know, it could all go sideways. Because markets. 🤷♂️

Technical analysis 📊

Support/Resistance:

- Upside capped at $0.1770. 🛑

- Near-term resistance seen at $0.1720-$0.1730. 🚧

- Strong support holding at $0.1688. 🪨

Volume Analysis:

- 63.6M volume spike, 32% above average during support test. 📈

- Volume expansion continues through breakout attempts. 🚀

Chart Patterns:

- Double-bottom formation confirmed at $0.1688. 🦆🦆

- Sequence of higher lows emerging. 📈

- Downtrend structure showing early signs of failure. 🤞

Targets & Risk/Reward:

- Upside targets at $0.1720-$0.1730 zone. 🎯

- Stop-loss below $0.1682. 🚨

- Risk/reward 3:1 on a 5.9% range. 🎲

Read More

- Brent Oil Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- USD UAH PREDICTION

- Gold Rate Forecast

- EUR HKD PREDICTION

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Flipster’s Bold Leap: Zero-Spread Crypto Trading Unveiled! 🚀

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

2025-11-06 21:58