Markets

What to know:

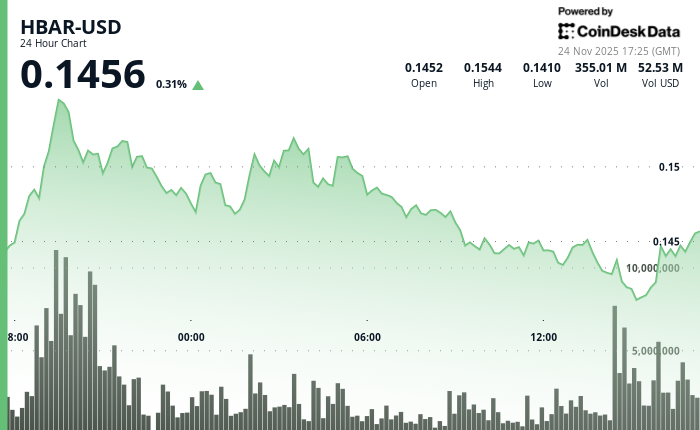

- HBAR, the crypto equivalent of a squirrel on espresso, climbed to $0.144 on 59% above-average volume. 🐿️☕

- Token lagged CD5 crypto index by 1.64%-because even squirrels have off days. 🥜

- Axelar integration connects Hedera to 60+ blockchains, because who doesn’t love a good blockchain party? 🎉

HBAR, the digital currency that’s as unpredictable as my nephew’s mood swings, climbed 2.38% to $0.144. Trading volume surged 59% above its weekly average, thanks to Axelar’s new integration-basically, it’s like giving a cat a laser pointer, but for blockchains. 🐱✨

Despite this flashy new toy, HBAR lagged the broader market, underperforming the CD5 index by 1.64%. Capital rotated into other digital assets, because apparently, HBAR wasn’t shiny enough this time. Intraday volatility was through the roof, with a $0.0146 range and a peak at $0.1555 before sellers said, “Enough with the fun,” and pushed the price into a descending channel. 📉

Support formed near $0.1410 as late-session buying stabilized the pullback-like a lifeguard rescuing a drowning squirrel. Short-term data showed a strong 60-minute reversal, pushing HBAR from $0.1413 to $0.1443 on robust volume. Bullish momentum? Sure, if you squint. Still, the broader trend remains as heavy as my holiday dinner plate, with persistent lower highs since September. 🍗

HBAR continues to trade below key EMAs, with the 20-day at $0.155 and higher-timeframe resistance at $0.174 and $0.189. The macro trend is bearish, tempering optimism around Axelar’s interoperability gains. Traders are watching whether expanding cross-chain liquidity can spark a sustained challenge of structural resistance-or if it’s just another crypto mirage. 🌵

Key Technical Levels Signal Mixed Outlook for HBAR

Support/Resistance: Immediate support holds at $0.1410 with resistance at $0.1450; major ceiling remains at 20-day EMA $0.155. Because even crypto needs a ceiling fan. 💨

Volume Analysis: 59% surge above weekly average validates price action; breakout volume of 6.8M confirms reversal attempt strength. Or maybe it’s just everyone panic-buying. 🛒

Chart Patterns: Descending channel dominates 24-hour structure while ascending pattern emerges in 60-minute timeframe, suggesting potential reversal. Or maybe it’s just crypto being crypto. 🤷♂️

Targets & Risk/Reward: Next resistance targets $0.1450-$0.1555 range; break below $0.1410 triggers $0.125 demand zone test. Because nothing says “fun” like a demand zone test. 🎢

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-11-24 20:56