Well folks, buckle up because we’re diving into some deep pockets of digital treasure, and trust me, it’s not for the faint of heart. 🚀 You see, Solana (or as the cool kids call it, SOL) is doing things that would make your grandma raise an eyebrow. At $199.50 per coin, it’s got volatility that makes a rollercoaster look like a kiddie ride – 4.3% in 24 hours, in case you’re keeping track.

Oh, and did I mention the market cap is a whopping $109.00 billion with a 24-hour trading volume of $13.72 billion? That’s right, we’re talking about some serious coin here. 💰

But wait-don’t get too comfy, because here’s where it gets juicy. Two treasury strategy firms, SOL Strategies and Solmate, are stepping in like knights in shining armor during a market crash, ready to scoop up discounted Solana at bargain prices. If you’re wondering if they’re on to something, well, they probably are. Who else buys big during a crash? Only the smart ones. 😉

SOL Strategies Pulls the Trigger on 88,433 SOL Tokens

First up, SOL Strategies Inc. made a move so smooth you’d think they were playing Monopoly. They scooped up 88,433 SOL tokens from their recently closed LIFE offering, paying a mere $193.93 per SOL. Now, that’s what I call a deal. 💸

But here’s the kicker-they got around 79,000 of those locked SOL tokens at a 15% discount, straight from the Solana Foundation. Why is that important? Because those tokens are locked up tighter than Fort Knox for 12 months, and guess what? They’re immediately staked and earning rewards. Talk about making your money work for you! 🏦

“We deployed the capital,” says Michael Hubbard, interim CEO of SOL Strategies. “Acquiring locked SOL at a 15% discount and staking it for rewards-DAT++ strategy in action, folks!”

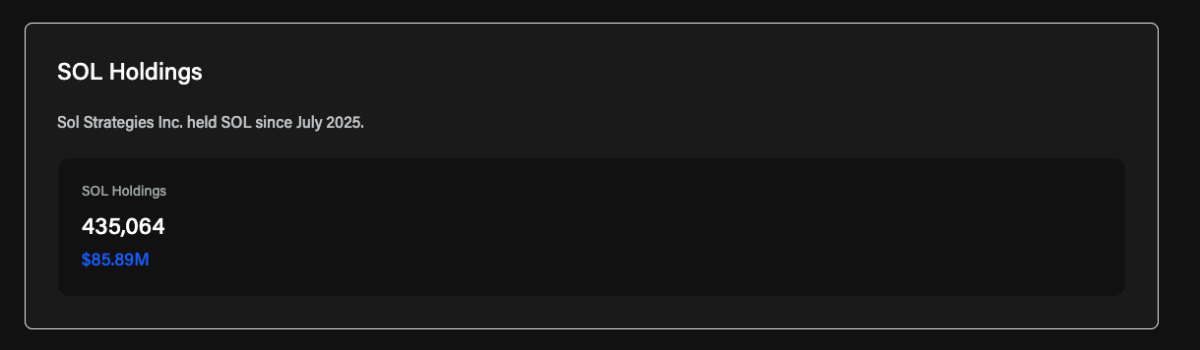

That’s right, after this purchase, SOL Strategies’ treasury now holds a grand total of 435,064 SOL, worth about $85.9 million. Not too shabby, eh? 👀

Cathie Wood and Solmate Join the Solana Party

And now, for the plot twist. Solmate Infrastructure, based in the luxurious land of Abu Dhabi, also got in on the action with a $50 million purchase of SOL, snagging it at a 15% discount, no less. That’s some next-level chess move. And don’t forget, Solmate’s right there leading the Solana charge in the Middle East. 🌍

And here’s the *real* kicker-Cathie Wood’s Ark Invest is now a shareholder in Solmate, owning a sweet 11.5% stake in the company. That’s right, the same Ark Invest that practically runs the fintech world. The plot thickens, my friends. 📈

“We bought the dip,” said Marco Santori, CEO of Solmate. “Our infrastructure-first strategy keeps us ahead of those ‘treasury companies’-we’re in the capital of capital, right where the money flows.”

Meanwhile, Ark Invest has been doubling down on Solmate, buying more shares like it’s a Black Friday sale. And guess what? They’re the first-ever US ETF to make an investment into a crypto infrastructure PIPE. Talk about breaking new ground. 💥

So what does all this mean? Well, these purchases from institutional heavyweights SOL Strategies and Solmate are more than just a couple of rich folks buying the dip. They’re making a bold statement: Solana is here for the long haul. 🚀

If this trend continues, retail investors might just start HODLing like their lives depend on it. And who knows, maybe, just maybe, Solana will come out the other side of this volatility stronger than ever. 🤔

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

2025-10-15 03:33