Ah, behold the cryptocurrency-an enigmatic creature, lingering about the illustrious $100K threshold, as if it were some noble ghost haunting its own past glories, lost and without purpose for multiple days, and yet, oh dear reader, we sense no clear harbinger of an imminent rally in this melancholic narrative!

Bitcoin Stalls at $100K, Have We Reached a New Plateau? 🤔

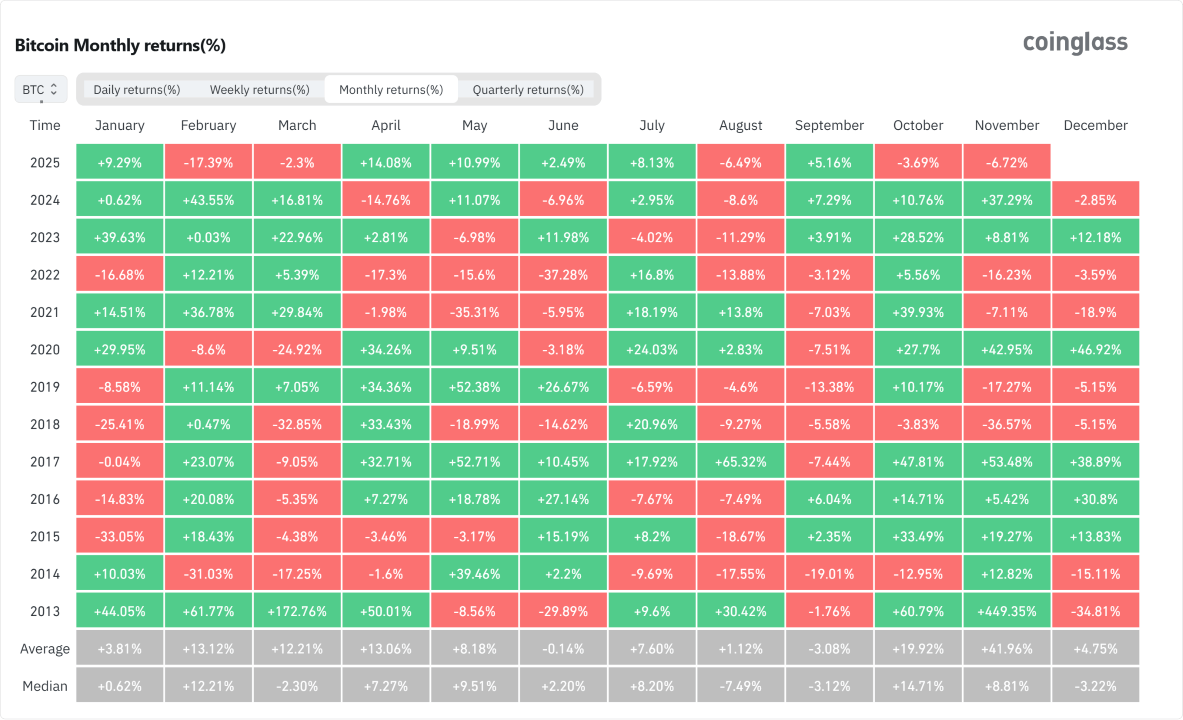

November, that most splendid month, of joy and revelry, has always been a good fortune for bitcoin. Historical data from Coinglass presents an assuring image, showing that our digital protagonist has bestowed positive monthly returns 66% of the time between 2013 and 2024-an era we naively considered marked by rational behavior! Yet, alas, this November has so cunningly chosen to deviate from tradition. BTC finds itself down a tragic 6.72%, ensnared by the dual forces of bad luck and the insatiable greed of its supporters-those who dream of riches while feasting on hopes of unattainable heights.

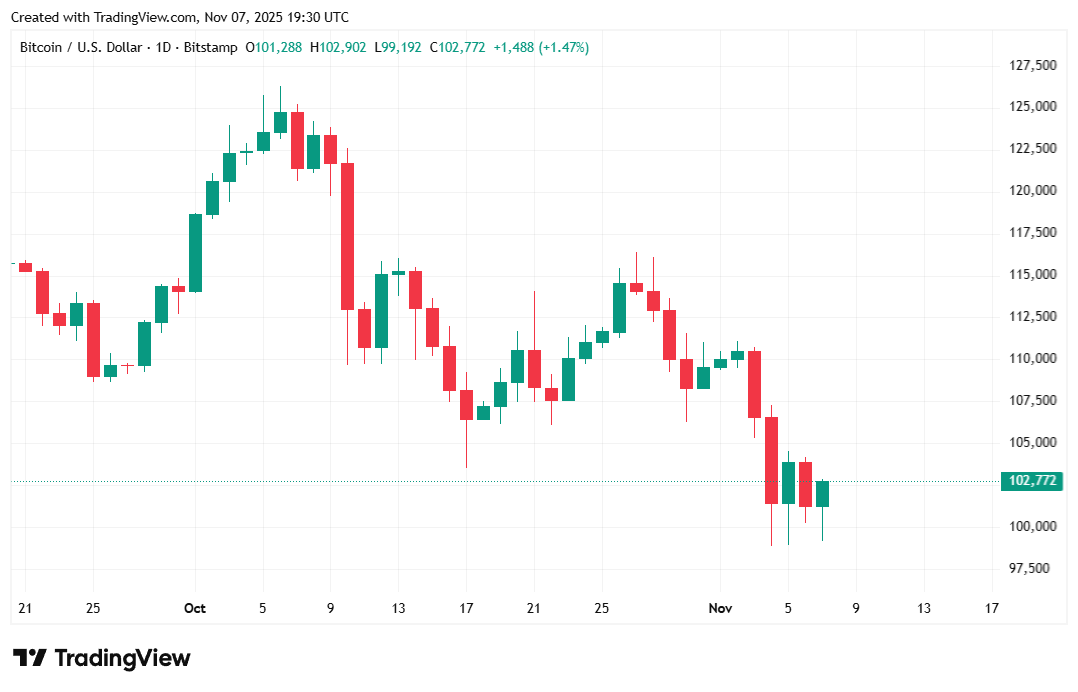

On the fateful day of October 6, the digital asset soared to heights not witnessed since its genesis, reaching an ostentatious $126K. Oh, the bullish traders! Clutching their leverages tightly, for they had grand visions swirling in their minds of a $200K year-end price as though it were an epiphany, a divine proclamation! Glassnode metrics reveal that 99.8% of all bitcoin basked in profitability at that moment-ah, but what is profit if it is not fleeting? Standard Chartered Bank’s prophecy, so confidently bestowed in the mellifluous summer’s whispers, suggested a rise of $135,000 by the end of Q3, and $200,000 by year’s end. A crown of thorns if ever there was one!

But everything, dear reader, met with the scorn of fortune on October 10, when a clearly agitated Donald Trump, perhaps misled by the winds of hubris or a sense of vengeful justice, lashed out at China, wailing accusations of their dastardly trade tactics, threatening the world with a “massive increase” in tariffs on Chinese wares. The cryptic, chaotic gallows of the market responded with fervor unmatched in history-over $19 billion in margin liquidated before our very eyes, as bitcoin tumbled below the now-decrepit $110K in a virtual cacophony. BTC sputtered, bobbing wretchedly upon tumultuous waves of emotional traders, yet never fully reclaiming its lost glory.

As if this spectacle were not enough, the stocks, too, fell victim to a chaotic symphony-AI bubbles and labor market anxieties coupled with an ever-dreaded prolonged U.S. Federal government shutdown pushed bitcoin below that exalted $100K for the first time since June 2025. Here it lies, dear reader, trading sideways as the wise pundits rage fiercely-debaters of future price, like philosophers arguing over the existence of souls in a darkened chamber!

One question arises from the echoing silence around $100K. Could it be, perchance, the new normal? Ah, most analysts shake their wise heads, conjuring prophecies that speak of future profits being revised downward, halting that euphoric march toward riches. Yet there remains a lingering hope for a rally in bitcoin’s future-“As a result of this market performance,” declared the sage Alex Thorn from Galaxy, “we are revising our bullish bitcoin target from $185,000 to a peculiarly modest $120,000.”

Meanwhile, in the kingdom of finance, Coindesk reported on Thursday that JPMorgan, ever the oracle, predicts a BTC price “as high as $170,000 within the next six to 12 months,” invoking comparisons to the ever-stable gold. “The message from recent stabilization is that deleveraging in perpetual futures is likely behind us,” they proclaimed, suggesting, with a hint of ironic levity, that the chaotic scene in October was merely an anomaly, a momentary digression before our beloved cryptocurrency returns to its upward march.

Overview of Market Metrics

Bitcoin took a slight breath of 1.2% on Friday afternoon, trading at the now pitiful sum of $102,879.05, while still reflecting a weed-infested garden where the weekly performance had withered down by 6.24%, according to the Capulus of Coinmarket. The digital asset oscillated distressingly between $99,257.06 and $102,912.61.

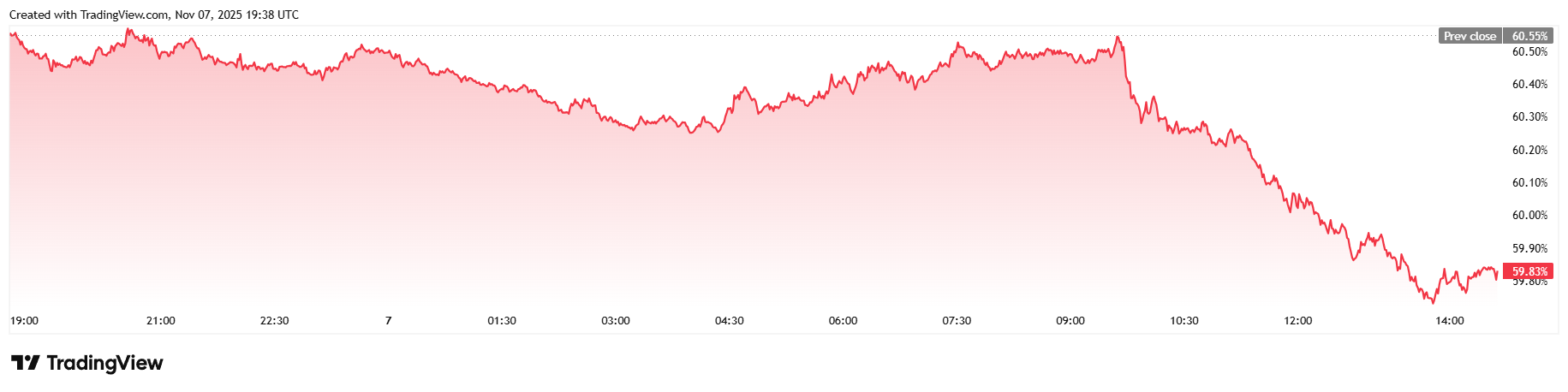

A surge in twenty-four-hour trading volume rose like a phoenix, jumping 47.42% to $91.15 billion, while market capitalization inched upward to the ludicrous total of $2.05 trillion. Alas, however, bitcoin dominance took a sizable fall from grace, shedding 1.2% to arrive at the currently precarious 59.80%.

The total value of bitcoin futures open interest, that elusive dream, climbed to $71.30 billion, ascending by 5%. Liquidations, too, finally relented on Friday, dropping down to a modest $148.37 million within these 24 hours. The distribution of losses was approached with tender intentions, albeit with the longs suffering grievously-a lamentable $84.86 million vanished into the ether, while the short sellers experienced a light-hearted loss of $63.52 million in liquidated margin.

FAQ ⚡

- Why is bitcoin stuck around $100K?

A cocktail of global uncertainty, an AI tempest, and the unending saga of U.S. government shutdown has kept prices trapped in a hollow melancholy. - What caused the earlier crash from $126K?

Ah, the fateful tariff threats from Trump against China on October 10, conjuring an unprecedented liquidation of $19 billion, undoing months of plodding gains. - Are analysts still bullish on bitcoin?

Though Galaxy has gently trimmed its target to $120K, JPMorgan remains optimistic, foreseeing BTC soaring to heights as lofty as $170K in the coming year. - Is $100K the new normal?

Most experts shake their heads, sifting through probabilities and viewing this sideways promenade as nothing more than a pause before our hero readies itself for the next rally, once the sinister macro pressures have dissipated.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

2025-11-08 00:14